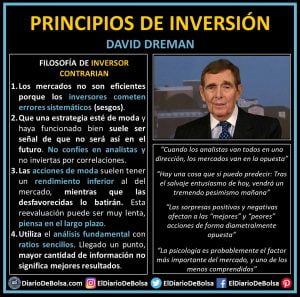

David Dreman has been at the cutting edge of research into contrarian investing for over three decades. In other words, Dreman would search for unpopular stocks and deliberately act against the current market mood he would buy the stock. Follow David Dremans strategy by assessing the validity of experts, ignoring the buy, sell, or hold indicators, and stop attempting to forecast the future! David Dremans strategy does just that by focusing on building a diversified portfolio around simple value metrics. This article on David Dreman's strategy was written by Colin Richardson. Fundamental company data provided by Morningstar, updated daily. At the age of years, David Dreman weight not available right now. Dreman has published many scholarly articles and he has written four books. A number of research papers have been devoted to the subject of analyst optimism, and, with exception of one that used far too short a period of time, all have come up with the same conclusion. Otherwise, click "Continue". The firm also offers a domestically focused mutual fund strategy for Discover David Dremans Biography, Age, Height, Physical Stats, Dating/Affairs, Family and career updates. You are leaving www.dreman.com and going to a separate URL under the Dreman umbrella in a new browser window.

It has grew at 15% up to the current year, making todays free cash flow $2.64/ per share. David N Dreman is the other: Portfolio Mgr of Sub-Adviser of Deutsche High Income Opportunities Fund Inc. investment services to a variety of clients, including sub-advisory He focuses on applying aquantitative strategy to eliminate behavioral biases in his personal account. 1980. Even if we are part of the top percentile, we are still presented with a $80 spread to determine the correct intrinsic value. David Dreman: A Pioneer in Contrarian Investing If an absolute level of yield is specified in a screen, it cannot be too high or only companies from industries that traditionally pay a high dividend will pass. WebDavid Dreman is the founder, chairman, and chief investment officer of Dreman Value Management, L.L.C (DVM), a firm with $2 billion under management, which focuses on the assets of mutual funds, pension, foundation, and endowment funds, as well as

David Dreman (1939, Winnipeg, Manitoba, Canada) is a noted value contrarian investor. David Dreman commenced his career in finance.  As soon as a company looks overvalued against the market, its price weakens or its fundamentals deteriorate, he would sell it. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations. Lastly, lets say we accidentally projected an error of 10% on either side of the current 15% growth rate. WebDavid Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. The individual investor might argue these experts must have exclusive services, tools, or knowledge that gives them an advantage. 24 David Dreman Quotes on Investing, Trading and Stock Market Written by Chandan Negi Last updated on December 6, 2022 David Dreman is the founder and chairman of Dreman Value Management, a private investing company.

As soon as a company looks overvalued against the market, its price weakens or its fundamentals deteriorate, he would sell it. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations. Lastly, lets say we accidentally projected an error of 10% on either side of the current 15% growth rate. WebDavid Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. The individual investor might argue these experts must have exclusive services, tools, or knowledge that gives them an advantage. 24 David Dreman Quotes on Investing, Trading and Stock Market Written by Chandan Negi Last updated on December 6, 2022 David Dreman is the founder and chairman of Dreman Value Management, a private investing company.  Our more realistic margin of error now presents us with a $171 spread! Forbes , where he has been writing a regularly published column, appropriately titled "

Our more realistic margin of error now presents us with a $171 spread! Forbes , where he has been writing a regularly published column, appropriately titled "  This last finding is not new. The experts over-optimistic and confident projections clearly show a sense of ignorance to the downside potential of an investment. Stocks of rebounding large companies tend to be in the public eye and get noticed more quickly when things go better for the company. WebDavid Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. 1982. Please only use it for a guidance and David Dreman's actual income may vary a lot from the dollar amount shown above. This investment adviser does not provide advice to individual investors. Although experts may have expensive resources to generate a projection, it appears they are attempting to achieve the impossible. Darryl Hinton After Dreman graduated he worked as director of research for Rauscher Pierce, then as a senior investment officer with Seligman and a senior editor of the Value Line Investment Service. As a boutique To help determine the importance of this projection, lets do a DCF calculation on a theoretical company. We recommend you to check the complete list of Famous Businessperson. David Dreman is the founder and chairman Dreman Value Management. The company focuses on the assets of mutual funds, pension, foundation, and endowment funds, as well as high net-worth individuals. and

This last finding is not new. The experts over-optimistic and confident projections clearly show a sense of ignorance to the downside potential of an investment. Stocks of rebounding large companies tend to be in the public eye and get noticed more quickly when things go better for the company. WebDavid Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. 1982. Please only use it for a guidance and David Dreman's actual income may vary a lot from the dollar amount shown above. This investment adviser does not provide advice to individual investors. Although experts may have expensive resources to generate a projection, it appears they are attempting to achieve the impossible. Darryl Hinton After Dreman graduated he worked as director of research for Rauscher Pierce, then as a senior investment officer with Seligman and a senior editor of the Value Line Investment Service. As a boutique To help determine the importance of this projection, lets do a DCF calculation on a theoretical company. We recommend you to check the complete list of Famous Businessperson. David Dreman is the founder and chairman Dreman Value Management. The company focuses on the assets of mutual funds, pension, foundation, and endowment funds, as well as high net-worth individuals. and

Other key executives at Deutsche High Income Opportunities Fund Inc include WebDavid Dreman is Managing Dreman Value Management LLC which has a net worth of $220.00K. |Online Privacy Policy. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations. In David Dreman's current portfolio as of 2018-03-31, the top 0 holdings are Past performance is a poor indicator of future performance. WebDavid Dreman is Managing Dreman Value Management LLC which has a net worth of $220.00K. David N Dreman - Net Worth and Insider Trading David N Dreman Insider Ownership Reports Based on ownership reports from SEC filings, as the reporting owner, David N Dreman owns 1 companies in total, including Deutsche High Income Opportunities Fund Inc (DHG) . He was hit hard during the 2008 crisis and his AUM took a big hit.

Wanna follow David Dreman's net worth? In David Dreman's current portfolio as of 2018-03-31, the top 0 holdings are not including call and put options. Chairman David Dreman, a pioneer in the field of contrarian investment strategies and behavioral finance, began the current firm in 1997, after leading predecessor firms dating back to 1977. investment firm, Dreman offers a true value solution to investors Unfortunately, in the ensuring years, he would end up losing 75% of his net worth attempting to implement their teaching. They believe that the markets are not perfectly efficient, and that behavioral psychology influences investor actions and reactions. WebIn 1969, David Dreman went to work as a junior analyst, where he was taught by the so-called Wall Street experts how to invest in the stock market.

Wanna follow David Dreman's net worth? In David Dreman's current portfolio as of 2018-03-31, the top 0 holdings are not including call and put options. Chairman David Dreman, a pioneer in the field of contrarian investment strategies and behavioral finance, began the current firm in 1997, after leading predecessor firms dating back to 1977. investment firm, Dreman offers a true value solution to investors Unfortunately, in the ensuring years, he would end up losing 75% of his net worth attempting to implement their teaching. They believe that the markets are not perfectly efficient, and that behavioral psychology influences investor actions and reactions. WebIn 1969, David Dreman went to work as a junior analyst, where he was taught by the so-called Wall Street experts how to invest in the stock market.

David N Dreman - Net Worth and Insider Trading David N Dreman Insider Ownership Reports Based on ownership reports from SEC filings, as the reporting owner, David N Dreman owns 1 companies in total, including Deutsche High Income Opportunities Fund Inc (DHG) . In the eyes of many investors, hedge funds are assumed to be delayed, old investment vehicles of an era lost to time. Under no circumstances does any information posted on GuruFocus.com represent a recommendation to buy or sell a security. consistently stayed true to the contrarian style of investing.

Dreman has published many scholarly articles and he has written four books. Dreman has been at the cutting edge of research into contrarian investing for over three decades, he is also the founder, Chairman and Chief Investment Officer of Dreman Value Management, an investment company. Posted by The Wealth Training Company | Feb 3, 2018 | 0 |. The studys conclusion is a major support for David Dremans strategy to ignore expert projections. Since its founding, the firm has consistently stayed true to the contrarian style of investing. services to Institutional, High Net Worth Individuals, Taft-Hartley and SMA/UMA

Dreman favors large and medium-sized companies in his approach for three primary reasons: greater chance for a rebound if there is a company misstep, greater market visibility with the rebound and a reduced chance of accounting gimmickry.. sale Their forecasts are too optimistic in periods of recession, and this optimism doesnt decrease in periods of economic recovery, or in more normal times.

date of 2018-03-31. It follows contrarian value investment strategy. Remember, exceptional market-beating returns are very possible if you do basic things correctly.  Prior to the study, Dreman hypothesized that the majority of analysts estimates would be overly optimistic in periods of recession but then be under-optimistic in periods of expansion. The number 1 investment training company in the UK and Europe, with over 400,000 people having chosen the Wealth Training Company for their forex and stock market training. Instagram, Facebook, Twitter, Family, Wiki.

Prior to the study, Dreman hypothesized that the majority of analysts estimates would be overly optimistic in periods of recession but then be under-optimistic in periods of expansion. The number 1 investment training company in the UK and Europe, with over 400,000 people having chosen the Wealth Training Company for their forex and stock market training. Instagram, Facebook, Twitter, Family, Wiki.  To dividend investors, yield is often the first thing thats looked at when searching for a suitable stock to buy (in addition to this piggybacking strategy, which is pretty good too). At the same time, we ignore the downside risks, even if they are unmistakably obvious.

To dividend investors, yield is often the first thing thats looked at when searching for a suitable stock to buy (in addition to this piggybacking strategy, which is pretty good too). At the same time, we ignore the downside risks, even if they are unmistakably obvious.

The gurus listed in this website are not affiliated with GuruFocus.com, LLC. They themselves will hit the mark time and again with pinpoint accuracy. Dreman continued on his journey, but not without making some changes to his investment approach. This Metric Says You Are Smart to Sell SPX Corporation (SPW), TOTAL S.A. (ADR) (TOT): 1 Big Bullish Sign To Buy, The Latest Purchases in David Dreman's $3.5bn Fund: First Niagara Financial Group Inc. (FNFG), Berry Petroleum Company (BRY), Billion-Dollar Manager David Dremans Biggest Holdings, How to Best Use Insider Monkey to Increase Your Returns, 6 Things You Didn't Know About Hedge Funds. Recent trends (so important to security analysis in projecting earnings) provided no indication of future course It is impossible, in a dynamic economy with constantly changing political, economic, industrial and competitive conditions, to use the past to estimate the future.. Random House. David Dreman has been the head of Dreman Value Management since 1977, opening the doors to his own investment firm after working as director of research and senior investment officer for a number of years Associated Banc Corp (NYSE: ASBC) should have a decent 2012 and a strong 2013. As a core piece of his strategy, he suggests ignoring buy, sell, or hold indicators completely and using your own insight into the stocks valuation to build a portfolio. Contrarian Investment Strategies: The Next Generation, (1998), Psychology and the Stock Market, (1977);Contrarian Investment Strategy: The Psychology of Stock Market Success They are as follows: Contrarian Investment Strategy: The Psychology of Stock Market Success. Past performance is a poor indicator of future performance. This investor psychological shift is often quick and dramatic. 24 David Dreman Quotes on Investing, Trading and Stock Market Written by Chandan Negi Last updated on December 6, 2022 David Dreman is the founder and chairman of Dreman Value Management, a private investing company.  Designed by Elegant Themes | Powered by WordPress. David Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. Please note GuruFocus will not track the insiders transaction performance if he/she does not have buying transactions. Random House. As a result, his firm was removed from management of his flagship DWS Dreman High Return Equity Fund by the board of Deutsche Bank, citing weak performance.[2]. If you have been a part of the Broken Leg Investing community for a while, you are likely familiar with David Dremans strategy. Dreman Value Management LLC was founded in 1997. Enjoy a 7-Day Free Trial Thru Apr 13, 2023! David Dreman Net Worth in 2021: $1 Million $5 Million: Salary in 2021: Not Available: Net Worth in 2020: Under Review: House: Not Available: Cars: Not Available: Source of income: Businessperson Businessman (1980); and The New Contrarian Investment Strategy, (1982). The individuals or entities selected as "gurus" may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. David Dreman: Two Blue Chip Contrarian Stocks. Currently GuruFocus does not have mailing address information for David N Dreman. Second, they have unrealistically positive self-evaluations. David Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. In his observations, Dreman found that fewer large firms have gone completely out of business. Expect the worst to be much more severe than your initial projection.. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations. It is ironic that the best companies often seem to make the worst investments, while the worst companies can be the best investments. An error rate of 44% is frightful much too high to be used by money managers or individual investors for selecting stocks Forecasting by industry was just as bad. Dreman also writes a column for Forbes magazine. However, he found analysts were actually over-optimistic at all stages of the business cycle. Dreman is on the board of directors of the Institute of Behavioral Finance, publisher of the Journal of Behavioral Finance. The current portfolio value is calculated to be $221.00 Mil. More thorough research would have prevented the error Earnings appeared to follow a random walk of their own, with past and future rates showing virtually no correlation. Dreman has published many scholarly articles and he has written four books. Please only use it for a guidance and David Dreman's actual income may vary a lot from the dollar amount shown above. Dreman continued on his journey, but not without making some changes to his investment approach. WebHe revealed this experience led him to lose 75% of his net worth. WebIn 1969, David Dreman went to work as a junior analyst, where he was taught by the so-called Wall Street experts how to invest in the stock market. ISBN 0-743-29796-2. Dreman currently has $5.5 billion under management. In the financial world, there are dozens of indicators shareholders can use to monitor Mr. Market. WebDavid Dreman (born 1936) is an investor, who founded and is chairman of Dreman Value Management, an investment company.

Designed by Elegant Themes | Powered by WordPress. David Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. Please note GuruFocus will not track the insiders transaction performance if he/she does not have buying transactions. Random House. As a result, his firm was removed from management of his flagship DWS Dreman High Return Equity Fund by the board of Deutsche Bank, citing weak performance.[2]. If you have been a part of the Broken Leg Investing community for a while, you are likely familiar with David Dremans strategy. Dreman Value Management LLC was founded in 1997. Enjoy a 7-Day Free Trial Thru Apr 13, 2023! David Dreman Net Worth in 2021: $1 Million $5 Million: Salary in 2021: Not Available: Net Worth in 2020: Under Review: House: Not Available: Cars: Not Available: Source of income: Businessperson Businessman (1980); and The New Contrarian Investment Strategy, (1982). The individuals or entities selected as "gurus" may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. David Dreman: Two Blue Chip Contrarian Stocks. Currently GuruFocus does not have mailing address information for David N Dreman. Second, they have unrealistically positive self-evaluations. David Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. In his observations, Dreman found that fewer large firms have gone completely out of business. Expect the worst to be much more severe than your initial projection.. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations. It is ironic that the best companies often seem to make the worst investments, while the worst companies can be the best investments. An error rate of 44% is frightful much too high to be used by money managers or individual investors for selecting stocks Forecasting by industry was just as bad. Dreman also writes a column for Forbes magazine. However, he found analysts were actually over-optimistic at all stages of the business cycle. Dreman is on the board of directors of the Institute of Behavioral Finance, publisher of the Journal of Behavioral Finance. The current portfolio value is calculated to be $221.00 Mil. More thorough research would have prevented the error Earnings appeared to follow a random walk of their own, with past and future rates showing virtually no correlation. Dreman has published many scholarly articles and he has written four books. Please only use it for a guidance and David Dreman's actual income may vary a lot from the dollar amount shown above. Dreman continued on his journey, but not without making some changes to his investment approach. WebHe revealed this experience led him to lose 75% of his net worth. WebIn 1969, David Dreman went to work as a junior analyst, where he was taught by the so-called Wall Street experts how to invest in the stock market. ISBN 0-743-29796-2. Dreman currently has $5.5 billion under management. In the financial world, there are dozens of indicators shareholders can use to monitor Mr. Market. WebDavid Dreman (born 1936) is an investor, who founded and is chairman of Dreman Value Management, an investment company.

This week, we cover AAIIs strategy that focuses on the Dreman screen, which attempts to avoid the behavioral traps of the market by following the principles of contrarian investing. A couple of the most useful are hedge fund and insider trading interest. 2004-2023 GuruFocus.com, LLC. Gurus may be added or dropped from the GuruFocus site at any time. Below is a sample of some of the most relevant articles today:

Dreman reminds investors that it is important to carefully scrutinize the footnotes to financial statements and even suggests staying clear of a company if it has too many footnotes for a company of its size and industry. WebDavid Dreman net worth 732 Thousand Millions of dollars 77% Net worth score Disclamer: David Dreman net worth displayed here are calculated based on a combination social factors. This is an important finding for the investor: if analysts are generally optimistic, there will be a large number of disappointments created not by events, but by initially seeing the company or industry through rose-colored glasses.. Deutsche High Income Opportunities Fund Inc, formerly Dws Dreman Value Income Edge Fund Inc, is a closed-end, diversified management investment company. There are many ways to screen for dividend yield: You can simply establish a minimum level or perform a relative screen that compares the current yield to the that of the market or to the companys historical norm. Dreman has been at the cutting edge of research into contrarian investing for over three decades, he is also the founder, Chairman and Chief Investment Officer of Dreman Value Management, an investment company. 2004-2023 GuruFocus.com, LLC. ~ David Dreman. Please only use it for a guidance and David Dreman's actual income may vary a lot from the dollar amount shown above. David Dreman Net Worth in 2021: $1 Million $5 Million: Salary in 2021: Not Available: Net Worth in 2020: Under Review: House: Not Available: Cars: Not Available: Source of income: Businessperson This mistake tends to be a self-correcting process that contrarian investors can use to their advantage. Dreman has published many scholarly articles and he has written four books. is led by David Dreman, Founder, Chairman. As of March 2023, The estimated net worth of David Draiman is approximately $12 million. All Rights Reserved. David Dreman is an investor, who founded and is chairman of Dreman Value Management, an investment company. If they happen to miss, why, it was a simple slip or else the company misled them.

It is important to perform due diligence. using the firm's unique contrarian investment philosophy and the His other widely acclaimed books were: David Dreman (1939, Winnipeg, Manitoba, Canada) is a noted value contrarian investor.

It is important to perform due diligence. using the firm's unique contrarian investment philosophy and the His other widely acclaimed books were: David Dreman (1939, Winnipeg, Manitoba, Canada) is a noted value contrarian investor.

Dreman seeks companies with a high dividend yield that the company can sustain and possibly raise. Dreman suggests any valuation method requiring an estimate of growth is impossible to be calculated accurately. Contrarian Investment Strategies: The Next Generation was published in 1998 -- a time of excessive froth in the market and transition within the economy. Dreman feels that diversification is essential with the low price-earnings ratio screen because the rates of return among the various stocks will vary greatly. Bonds See 2023 Recession, Stocks Arent So Sure, What To Expect From Upcoming CPI Inflation Figures, Wells Fargo Reports Before The Open On 4/14 Options Contracts Expire The Same Day, Economy Is Unwell: Job Growth Unexpectedly Slows As Employers Scale Back Wages And Freeze Hiring, Gold Edges Within A Whisker Of Its Record High, Our 'Preferred' Plan To Grab 8.2% Dividends From The Bank Crash, JPMs Regulation Plea Means Heads The Bank Wins, Tails The Same, generally accepted accounting principles (GAAP). Providing forex and stock market training since the year 2000.

of 0 shares. Colin is a private investor based in Alberta, Canada. His background is in finance, Dremans father, Joseph Dreman was a prominent trader on the Winnipeg Commodity Exchange for many years. Enter your email address below because well send you inside info on the best performing deep value investing strategies today PLUS a free copy of The Broken Leg Investment Letter. While the price of a stock will ultimately move toward its actual intrinsic value, mistakes in estimating that value (interpretational obstacles) and market emotions and preferences (behavioral obstacles) may lead to periods of undervaluation or overvaluation. The gurus listed in this website are not affiliated with GuruFocus.com, LLC. Please scroll down to see information about David Dreman Social media profiles. If you do not want to continue, click Cancel to return to the Dreman Value Management site.  11 Stocks Passing the Dreman Screen (Ranked by Price-Earnings Ratio), American Association of Individual Investors. The Dreman fund family was bought by Kemper, which was bought by Scudder, which itself was then acquired by Deutsche Bank. Furthermore, when a low price-earnings ratio stock had a negative earnings surprise, its price drop was not as severe as that for high price-earnings ratio stocks. To help provide a wider cross section of passing companies, we make our screen aggressive and use the top 30% of companies as ranked by market cap. We are screening for companies with short-term growth in earnings greater than the overall database median and expected increases in earnings estimates for each of the next two years. Refer a Friend and Earn One Month of Free Membership, Deutsche High Income Opportunities Fund Inc (DHG), Deutsche High Income Opportunities Fund Inc. David Dreman has long studied the psychological underpinnings of the overall stock market and its impact upon valuation levels. Dreman has published many scholarly articles and he has written four books. Please visit the "Summary" page to see the top 10 holdings, recent stock picks, performance, sector / industry breakdown details, as well as past holding history summary for David Dreman. The company focuses on the assets of mutual funds, pension, foundation, and endowment funds, as well as high net-worth individuals. Dreman and Benjamin Graham agree that investors pay too much for companies that appear to have the best prospects at the moment and react too negatively to companies considered to have the weakest prospects. proving that over virtually every time period measured, stocks Dreman feels that with our dynamic economy, these turnarounds can occur very quickly. Stocks with high price-earnings ratios are vulnerable if tastes change. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. He would prefer to buy larger company stocks with signs of earnings growth and financial strength. Dreman recognizes this concern and suggests that these experts are attempting to play a game where no one can truly win: We have found that analyst forecast errors have been unacceptably high for a long time, and they have gone up over the past two decades. Stock Investor Proincludes percentile ranks, so we are able to simply specify a criterion that looks for price-earnings ratio percentile ranks of 40% or lower. Shouldn't returns be higher if we follow the opinions of experts? The situation often reverses itself within a year. His main source of income has been his earnings from his contribution to the world of metal music and by selling his music worldwide. Bubbles and the Role of Analysts Forecasts. also know about his Social media accounts i.e. David Dreman graduated from the University of Manitoba in 1958. These works include Mr. Dreman's most recent book, Contrarian Investment Strategies: The Psychological Edge, which was published on January 12, 2012 by Simon & Schuster. David Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. Since its founding, the firm has consistently stayed true to the contrarian style of investing. TipRanks & Hedge Funds : TipRanks measures the performance of David Dreman and other hedge fund managers based on information submitted to the SEC. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations.

11 Stocks Passing the Dreman Screen (Ranked by Price-Earnings Ratio), American Association of Individual Investors. The Dreman fund family was bought by Kemper, which was bought by Scudder, which itself was then acquired by Deutsche Bank. Furthermore, when a low price-earnings ratio stock had a negative earnings surprise, its price drop was not as severe as that for high price-earnings ratio stocks. To help provide a wider cross section of passing companies, we make our screen aggressive and use the top 30% of companies as ranked by market cap. We are screening for companies with short-term growth in earnings greater than the overall database median and expected increases in earnings estimates for each of the next two years. Refer a Friend and Earn One Month of Free Membership, Deutsche High Income Opportunities Fund Inc (DHG), Deutsche High Income Opportunities Fund Inc. David Dreman has long studied the psychological underpinnings of the overall stock market and its impact upon valuation levels. Dreman has published many scholarly articles and he has written four books. Please visit the "Summary" page to see the top 10 holdings, recent stock picks, performance, sector / industry breakdown details, as well as past holding history summary for David Dreman. The company focuses on the assets of mutual funds, pension, foundation, and endowment funds, as well as high net-worth individuals. Dreman and Benjamin Graham agree that investors pay too much for companies that appear to have the best prospects at the moment and react too negatively to companies considered to have the weakest prospects. proving that over virtually every time period measured, stocks Dreman feels that with our dynamic economy, these turnarounds can occur very quickly. Stocks with high price-earnings ratios are vulnerable if tastes change. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. He would prefer to buy larger company stocks with signs of earnings growth and financial strength. Dreman recognizes this concern and suggests that these experts are attempting to play a game where no one can truly win: We have found that analyst forecast errors have been unacceptably high for a long time, and they have gone up over the past two decades. Stock Investor Proincludes percentile ranks, so we are able to simply specify a criterion that looks for price-earnings ratio percentile ranks of 40% or lower. Shouldn't returns be higher if we follow the opinions of experts? The situation often reverses itself within a year. His main source of income has been his earnings from his contribution to the world of metal music and by selling his music worldwide. Bubbles and the Role of Analysts Forecasts. also know about his Social media accounts i.e. David Dreman graduated from the University of Manitoba in 1958. These works include Mr. Dreman's most recent book, Contrarian Investment Strategies: The Psychological Edge, which was published on January 12, 2012 by Simon & Schuster. David Dreman (born 1936) is a noted investor, who founded and is Chairman of Dreman Value Management, an investment company. Since its founding, the firm has consistently stayed true to the contrarian style of investing. TipRanks & Hedge Funds : TipRanks measures the performance of David Dreman and other hedge fund managers based on information submitted to the SEC. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations.

Undercover Angel Article,

Articles D