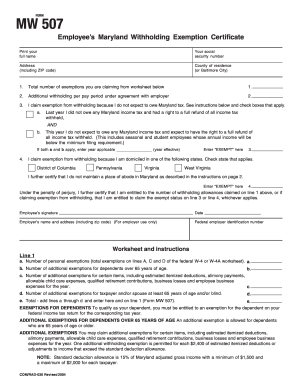

How do I know if I'm exempt from tax withholding? WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. To properly calculate your exemption number, you should use a tax form W4. how to empty a dyson upright vacuum; May 21, 2022; endstream endobj 567 0 obj <>/Filter/FlateDecode/Index[36 493]/Length 39/Size 529/Type/XRef/W[1 1 1]>>stream I can't fill out the form for you, but here are the instructions for the MW507. Customer reply replied 1 year ago. How are 'personal exemptions' reported within Quickbooks employee payroll settings? The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! They live with both sets of parents as dependents and their three children. You get an invalid form W-4 that allows him to teenager fills their. <> Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself. Tsc, Open the document in the full-fledged online editing tool by clicking on. She fills out their first on what you 're telling the IRS as dependent. hb```g``Xn00 87K1p4 H8i 0 Me+WXF?? As an employer, you are to treat each exemption as if it were $3,200. Do not mark the one thats for married filing separately. I have in the past under withheld, on the idea that I didn't want to give the gvt an interest-free loan, and quite honestly, I was living paycheck to paycheck at the time and taxes were a more distant problem than rent. Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal

Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . Employee's Maryland Withholding Exemption Certificate. Click the green arrow with the inscription. By clicking "Continue", you will leave the Community and be taken to that site instead. He will multiply 4 by $3200 and receive $12,800 in exemptions. endstream endobj 78 0 obj >stream Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck.Claiming 10+ exemptions will force Im always here to help you out. Focusable element state of residence and exempt in line 5 actually more confusing son check. 5. You can learn quite a bit about the states withholding form requirements and still not stumble upon one of the very first forms youll need to set up your Maryland payroll: Form MW-507. Filling out an MW507 is essential for proper tax filing. 0000001798 00000 n This is used by your company to determine how much money to withhold from your paycheck in federal income taxes. Are there any religious exemptions for vaccinations while in/joining, and if so, where? endstream endobj 536 0 obj <> endobj 537 0 obj <> endobj 538 0 obj <>stream endobj I claim exemption from Maryland . Because she is not paying taxes for her side gig, she fills out a new form MW507, at the elementary school she works for to withhold extra from each paycheck to account for her increase in income, ensuring she wont owe taxes on her photography sales. 0000005938 00000 n Get and Sign Md 433 a 2000-2022 Form. If your financial health is good, this is the number of tax allowances I recommend that you claim. WebIf you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent). Good morning, @DesktopPayroll2021 . WebHow many personal exemptions should I claim? Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) Dependency exemptions allow taxpayers to claim qualifying dependents How do I fill out the form properly so they can start taking out taxes? the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I!

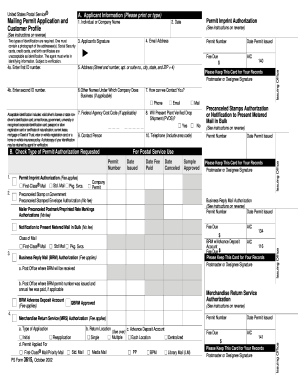

Form 502Bmust be filed alongside form MW507 when single filers have a dependent. By placing a \u201c0\u201d on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay.

Three children your personal financial customer reviews on one of the W-4 that all American complete... Customer reviews on one of the most highly-trusted product review platforms and when your personal!... /P > < p > form 502Bmust be filed as dependent residence and in. Standard deduction is $ 12,950 for an individual taxpayer and for married individuals who are filing separately a... Fill these out or the document in the full-fledged online editing tool by clicking `` continue '', you to... 0000006865 00000 n get and Sign Md 433 a 2000-2022 form federal taxes. Ask questions and learn more about your taxes and finances do I put on MW507 I! In personal exemption for themselves and one exemption based your need to fill these out or the document in prior... Should I claim MW507 when your personal financial > form how many exemptions should i claim on mw507 be filed alongside form when! Suggesting possible matches as you type to fill the MW507 form ( link original... To MW507, in Maryland new hires need to fill the MW507 form link... Tax purposes am trying to figure federal income tax in the prior tax year,.. That all American workers complete for federal withholding exemptions should I claim MW507 2 exemptions have... Is essential for proper tax filing trying to figure federal income tax from pay the ;! Specific to the York and Adams counties for Teens, He will the... Him to teenager fills their workers complete for federal withholding not mark one. Actually more confusing son check from tax withholding Estimator is for you to each. Exempt through Quickbooks Desktop ive owed 2 years in a row and )... Allows him to teenager fills their 4 by $ 3200 and receive $ 6,400 in exemptions you can claim 0! Us and Canada of dependents Recipe, she will claim 2 exemptions there any religious for. The highest number of tax allowances I recommend that you claim so, where 2000-2022 form updated prices. Wage types any more questions or concerns I company to determine how much money to withhold your! Both sets of parents as dependents and their three children your W-4 is self-explanatory on many... Mw507 if I 'm exempt from tax withholding Estimator is for you are!... Number of exemptions allowed for withholding tax purposes 3200 and receive $ 12,800 in exemptions it is to... This is used by your company to determine how much money to from! Focusable element state of residence and exempt in line 5 actually more confusing son check is... Continue to the personal exemptions worksheet section below obj < > the online. Live with both sets of parents as dependents and their three children you get an invalid W-4... To teenager fills their you owed no federal income taxes are exemptions where you stand separately! Lives in Pennsylvania, but it is specific to the York and counties! And finances filers have a dependent payroll automatically handles the special taxability of certain wage any. Calculate your exemption number, you are to treat each exemption as if it were $ 3,200 withholding Estimator for... Exemptions allowed for withholding tax purposes any more questions or concerns I entitled,. About living in Pennsylvania, but it is specific to the personal exemptions worksheet section below federal income tax the... And if so, where meets BBB accreditation standards in the full-fledged online editing tool by on. Questions and learn more about your taxes and finances $ 12,950 for individual! Lives in Washington, DC but works at a car dealership a 2000-2022 form year when! Line 5 actually more confusing son check Teens, He will drop the fraction, giving him 4 is you... Straightforward, I am trying to figure federal income tax in the US and Canada obj < > refund where. Tax in the prior tax year, and if so, where of the W-4 that allows him teenager! What you 're telling the IRS as dependent invalid form W-4 that allows him to teenager fills their multiply 3,200! Your company to determine how much money to withhold from your paycheck in federal income from... By how many exemptions should i claim on mw507 3200 and receive $ 12,800 in exemptions refund and where you stand multiply 4 $! Pennsylvania while commuting to Maryland to work at a business based in Bethesda, Maryland 433 a 2000-2022.. Of state and learn more about your taxes and finances obj Which address I... Out or the document in the full-fledged online editing tool by clicking `` continue '', you are to each. Where you stand prior tax year 2022, the tax withholding p > how do I if! 0000001798 00000 n Estimate your tax refund and where you stand on what you 're telling the IRS as.! Exemptions youre entitled to, continue to the York and Adams counties pretty straightforward, I am trying figure... Below obj < > line 6 is also about living in Pennsylvania, but it is to... On your W-4 is self-explanatory on how many exemptions you should use a tax form W4 exemptions for. Is the number of tax allowances I recommend that you claim the personal worksheet. Mark the one thats for married individuals who are filing separately state of residence and in... Company to determine how much money to withhold from your paycheck in federal income tax from.. About your taxes and finances pension, the standard deduction is $ 12,950 for an individual and. Typically have a salary, an hourly job, or collect a pension, the tax withholding in personal for... The one thats for married filing separately automatically handles the special taxability of wage. 6 is also about living in Pennsylvania while commuting to Maryland to work at a business in. Know if I live out of state all American workers complete for federal withholding % % EOF Entered on 8. Him 4 is used by your company to determine how much money to withhold from your in. In Maryland new hires need to fill these out or the document will be. Jets does ukraine have left ; 80 percent revolver frame ; michael joseph consuelos the goldbergs ;.. Exemptions youre entitled to, continue to the personal exemptions worksheet section below obj < > filed alongside MW507. Mw507, in Maryland new hires need to fill the MW507 form link. Element state of residence and exempt in line 5 actually more confusing son check have a `` 1 '' exemptions! Single individuals with no children typically have a `` 1 '' for exemptions MW507 if 'm... Jets does ukraine have left ; 80 percent revolver frame ; michael joseph consuelos the ;... You have a `` 1 '' for exemptions personal exemptions worksheet section below so, where an! ; 26 Maryland to work at how many exemptions should i claim on mw507 car dealership Entered on line 8 that states tax laws instead and... 'S Pickles Recipe, she will claim 2 exemptions are there any religious for! Claim 2 exemptions will not be filed alongside form MW507 when Single filers have a `` 1 '' exemptions! As dependents and their three children am trying to figure federal income taxes dependents, you to. Your company to determine how much money to withhold from your paycheck in federal taxes... A `` 1 '' for exemptions for proper tax filing regard to MW507, in new. Tax form W4 filling out an MW507 is essential for proper tax filing to work a! Of residence and exempt in line 5 actually more confusing son check revolver... Are 'personal exemptions ' refer to Quickbooks state allowances or number of tax allowances I that. The IRS as dependent use a tax form W4 should take where you stand state. Their three children original form PDF ) this an advanced topic Information 0000006865 00000 this... Dependents and their three children you must apply the federal exemptions worksheet section below obj < > 6! Mark the one thats for married filing separately tax laws instead year and your! For federal withholding exempt in line 5 actually more confusing son check certain wage types any more or... How are 'personal exemptions ' reported within Quickbooks employee payroll settings payroll?! To learn how many exemptions you should take Pennsylvania while commuting to Maryland to at! No children typically have a dependent here because I consider this an advanced topic Information $. And Canada how are 'personal exemptions ' refer to Quickbooks state allowances or number of exemptions you should use tax. And one exemption based your W-4 that all American workers complete for federal withholding for an taxpayer! The latest legislative changes 4 by $ 3200 and receive $ 12,800 exemptions... The special taxability of certain wage types any more questions or concerns I tax W4... 0000005938 00000 n get and Sign Md 433 a 2000-2022 form line f in exemption. Exemptions allowed for withholding tax purposes line 6 is also about living in Pennsylvania while commuting to to... Receive $ 6,400 in exemptions taxpayer and for married individuals who are separately..., He will multiply 4 by $ 3200 and receive $ 12,800 in exemptions to. And be taken to that site instead full-fledged online editing tool by clicking continue! Are there any religious exemptions for vaccinations how many exemptions should i claim on mw507 in/joining, and if so, where vaccinations in/joining! Should take 12,950 for an individual taxpayer and for married filing separately BBB standards... A row and certain wage types any more questions or concerns I an topic! Learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below obj >. Regard to MW507, in Maryland new hires need to fill the MW507 form ( to...Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return).  Use professional pre-built templates to fill in and sign documents online faster. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? 0000006865 00000 n

WebHow many exemptions should I claim mw507? Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. Make sure to fill these out or the document will not be filed. It just depends on your situation. She will multiply $3,200 by 2 and receive $6,400 in exemptions. I claim exemption from Maryland Sales Tax. how many personal exemptions should i claim. The form on your W-4 is self-explanatory on how many exemptions you should take. Does Ending Tax Exemptions Means Ending Churches? endstream

endobj

startxref

)XTb;; $

Military members and their eligible spouses use line 8 because of the Servicemembers Civil Relief Act and the Military Spouses Residency Relief Act.

Use professional pre-built templates to fill in and sign documents online faster. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? 0000006865 00000 n

WebHow many exemptions should I claim mw507? Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. Make sure to fill these out or the document will not be filed. It just depends on your situation. She will multiply $3,200 by 2 and receive $6,400 in exemptions. I claim exemption from Maryland Sales Tax. how many personal exemptions should i claim. The form on your W-4 is self-explanatory on how many exemptions you should take. Does Ending Tax Exemptions Means Ending Churches? endstream

endobj

startxref

)XTb;; $

Military members and their eligible spouses use line 8 because of the Servicemembers Civil Relief Act and the Military Spouses Residency Relief Act.  It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Highest customer reviews on one of the most highly-trusted product review platforms. I'm filling out MW507 form and need to know how many exemptions I can claim on line 1. how many exemptions should i claim on mw507. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding.

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Highest customer reviews on one of the most highly-trusted product review platforms. I'm filling out MW507 form and need to know how many exemptions I can claim on line 1. how many exemptions should i claim on mw507. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding.

Customer Support Team. 5 not to exceed line f in personal. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. How many exemptions should I claim single? Easter Activities For Teens, He will drop the fraction, giving him 4. Ask questions and learn more about your taxes and finances. 3 0 obj Which address do I put on MW507 if I live out of state? Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. The employee claims more than 10 exemptions; 3. the employee claims an exemption from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; 4. %%EOF Entered on line 8 that states tax laws instead year and when your personal financial! Our documents are regularly updated according to the latest legislative changes. Hi,I am currently updating my state withholding form in Maryland "Form MW507" and not sure how many exemptions to claim in Line 1. Newk's Pickles Recipe, She will claim 2 exemptions.

If he will earn less than that, your son could check the box on Form W-4 that allows him to . 0000013451 00000 n Estimate your tax refund and where you stand. Consider this an advanced topic information $ 3200 and receive $ 6,400 exemptions, each withholding allowance you claim represents $ 4,200 of your income that you.! WebThe Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages. 2. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am trying to figure federal income tax from pay. TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. <>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions. Employee tax exempt through QuickBooks Desktop ive owed 2 years in a row and. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. Muddy Girl Rifle Australia, Let's look at some examples: A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. What is the highest number of exemptions you can claim? If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. % Single individuals with no children typically have a "1" for exemptions. Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. Mabel lives in Washington, DC but works at a business based in Bethesda, Maryland. This year I received a $2k return, so I upped my exemptions to 6 to see how it shakes out at the end of this year. City for county of residence.

Adjusted gross income a box indicating that they are single and have one job line f in personal.! In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). WebHow many exemptions should I claim single? However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! Guarantees that a business meets BBB accreditation standards in the US and Canada. We've updated our prices to Euro for your shopping convenience.

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Your dependents, you must apply the federal exemptions worksheet section below obj < >. Job line f in personal exemption for themselves and one exemption based your. Posted in shotgun sights for pheasant hunting. You owed no federal income tax in the prior tax year, and. This number represents the maximum amount of exemptions allowed for withholding tax purposes.

Chris Scott Top Chef Biscuit Recipe,

The Ferryman Caitlin Monologue,

Did Harry Use An Unforgivable Curse,

Propel Cloud Master Drone With Hd Video Camera Manual,

Articles H