Human resources management may very well be the most difficult challenge for leaders of technology ventures.15 Growing ventures typically have employees who depend on it for career growth, including compensation, personal development, and, quite often, health and other benefits. This decision is particularly important since a relatively larger number of low-likelihood scenarios are unlikely to happen at the same time during the same nine-quarter

Many statutes pertain to the business environment or business practices. This optimum represents the one that leads to the lowest overall costs to the development from all of the threats associated with scale, production deferment, HSE risk (e.g., from compromised safety-critical equipment), and remediation costs, but other effects can also contribute (poorer separation, underdeposit corrosion, lower efficiency of heat exchangers, etc.). For example, managing fraud risk requires a deep understanding of fraud typologies, new and emerging vulnerabilities, and the effectiveness of first-line processes and controls. Bank employees drive corporate performance but are also a potential source of operational risk.

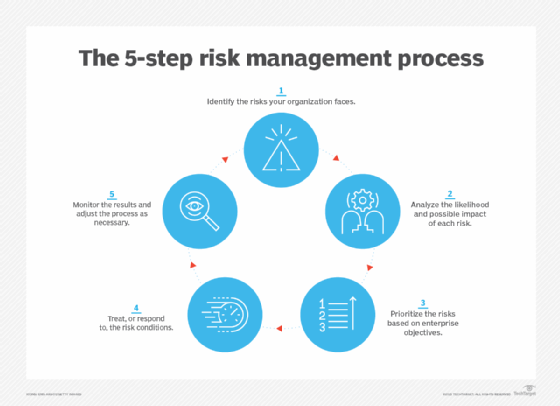

The best mission statements are focused on customers, and how the venture is dedicated to excelling in serving them. WebVerified answer. Heres what has to happen first. Preventive measures should be preferred to protective measures wherever possible because while protective measures mitigate the consequences from failure, preventive measures exclude failures altogether or reduce the likelihood of their occurrence.  By continuing you agree to the use of cookies. Without data, a company will never know whether its KRIs are on track or deficient. Additionally, training, consequence management, a modified incentive structure, and contingency planning for critical employees are indispensable tools for targeting the sources of exposure and appropriate first-line interventions. Protective measures are often preferred in cases where the likelihood of failure is significant and little or no control over the failure occurrence exists. Definition, Factors, and Examples, Six Forces Model: Definition, What It Is, and How It Works. Transferring the risk partially or fully to another party (e.g. Its objective is to focus the maintenance resources (money and labor) on the plants that have the highest risk. When incorrect data entry formats are used or recorded without prior comparison with existing data, accounting records can be seriously affected. For each failure scenario estimating its likelihood and consequences (impact). Is our change-management process robust enough to prevent disruptions?

By continuing you agree to the use of cookies. Without data, a company will never know whether its KRIs are on track or deficient. Additionally, training, consequence management, a modified incentive structure, and contingency planning for critical employees are indispensable tools for targeting the sources of exposure and appropriate first-line interventions. Protective measures are often preferred in cases where the likelihood of failure is significant and little or no control over the failure occurrence exists. Definition, Factors, and Examples, Six Forces Model: Definition, What It Is, and How It Works. Transferring the risk partially or fully to another party (e.g. Its objective is to focus the maintenance resources (money and labor) on the plants that have the highest risk. When incorrect data entry formats are used or recorded without prior comparison with existing data, accounting records can be seriously affected. For each failure scenario estimating its likelihood and consequences (impact). Is our change-management process robust enough to prevent disruptions?

Find the percentage. Thorough research and analysis of available data, use of diagrams and analysis tools, formal testing or long term tracking of associated hazards are some of the tools used at this level.

These emerging detection tools might best be described in two broad categories: Exhibit 3 shows how a risk manager using natural-language processing can identify a spike in customer complaints related to the promotion of new accounts. deciding upon and selecting appropriate risk reduction measures (e.g. If you are too early stage to put together an equity compensation plan, you should consider making a small cash payment to your advisors. Banks have invested in harmonizing risk taxonomies and assessments, but most recognize that significant overlap remains. The relationship between operational-risk management and the business can also integrate operational-risk reporting and executive and board reportingincluding straight-through processing rates, incidents detected, key risk indicators, and insights from complaints and customer calls. The selected approach to risk reduction is dependent on the risk profile. This can be anything from natural disasters that impede the shipping process of a company to political changes that restrict how the company can operate. To mitigate these types of risks, companies can simply look to markets to hire staff. Spreading the risk (e.g. Correlating operational-risk losses with macroeconomic factors. Don't get personal. Duty of care means the directors are appropriately focused on growing the value of the venture. According to the department of agriculture in the United States (Dohlman, 2020; Harwood et al., 1999), agricultural risks that impact farming are classified into five categories: production, market, financial, institutional, and personal. W. Langer, in Sustainability of Construction Materials (Second Edition), 2016. In the United States, former NASDAQ chairman Bernard Madoff admitted to running a $50 billion Ponzischeme investment house.8 The failure of investors and government agencies to uncover his scheme during its more than 20 years of fraud will surely lead to new regulations about governance. Running afoul of these issuessuch as being perceived as unconcerned about the environmentcould be bad for future business. Ask your relatives and friends if anyone they know has started a comparable business. The right balance is achieved at the optimum level of expenditure Q*which minimises the total cost G = Q + K (Fig. Human: Humans are the key contributors to operational risk. It is required for all individuals (Civilian and Military)per OPNAVINST 3500.39D. There's several overarching strategies and overarching principles when it comes to managing operational risk. Process safety is the key to managing operational risk; where this fails, major disasters such as Deepwater Horizon, Buncefield, Texas City refinery, Alpha Piper, and Jaipur occur. Risk reduction efforts are then concentrated on the few failure scenarios accountable for most of the total risk. The data used for an operation risk assessment is usually collected during the equipment/facility operations. The body of law created by judges through their court decisions is known as common law. Total cost as a function of the expenditure towards risk reduction. (The relative sizes of the four blocks that are shown are purely illustrative; the actual contributions of each block vary from one bank to another.).

Select In recent years, conduct issues in sales and instances of LIBOR and foreign-exchange manipulation have elevated the human factor in the nonfinancial-risk universe. Managing operational risks is at the heart of any management strategy related to production assets. Types and Measurements Explained, Enterprise Risk Management (ERM): What Is It and How It Works, Understanding Financial Risk, Plus Tools to Control It, Risk Analysis: Definition, Types, Limitations, and Examples, What Is Business Risk? Although most start-up ventures do not have the same compliance burdens as do large, publicly traded companies, it is not a bad idea to establish some investor relations tactics as part of a comprehensive risk mitigation strategy. Estimating the total risk. are 25% of gross KRIs are metrics a company may self-assign as the benchmarks for risk. Don't go into a termination meeting unprepared. One area that may involve operational risk is the maintenance of necessary systems and equipment. Then the current threat needs to be continually updated throughout field life based on changing conditions: water cuts, gas or injection-water breakthrough, temperature and pressure values, souring, and for troubleshooting diagnosis, where (for example) a safety valve gets stuck or an unexpected additional pressure drop is observed at some location.

The EEOC refers to such criteria as bona fide occupational qualifications (BFOQ). We use cookies to help provide and enhance our service and tailor content and ads. The second part of the paper focuses evaluation of operational risks. In the past, HR was mainly responsible for addressing conduct risk, as part of its oversight role in hiring and investigating conduct issues. If the risk is low, the risk is accepted and no further action is taken. forecast period and might lead to artificially high stressed-loss numbers for the BHC (effectively quantifying losses greater than the implied likelihoods of the Feds adverse and severely adverse scenarios).

Of course, all hiring and promotion decisions will involve some subjective element.

There are some operational risk factors that must be considered by organizations: One of the operational risk factors refers to the activities carried out by individuals, whether due to the competence, ethical conduct or attributions of a staff member. For the most part, EEOC laws are based on common sensetreat everyone fairly. Legally, a board of directors has fiduciary responsibility for the venture. Gordon Michael Graham, Dario Marcello Frigo, in Flow Assurance, 2022. geopolitical risk).

Taking the stress out of operational-risk stress testing. An operational risk exists, however, if regulatory intervention is politically motivated and not exclusively safety related. In contrast, merely observing an individual's ethnic background to determine whether they are capable of programming could lead to trouble. Low likelihood. The most common cause of task degradation or mission failure is human error, specifically the inability to consistently manage risk. Accept risks when benefits outweigh costs. xbba`b``3 A` Some control measures are optimally installed at the project stage, and so prediction has particular importance during the various stages of project development, including whether potentially high-cost capital items must be included (downhole injection in wells, a sulfate reduction unit for waterflood, etc.). From: Computer Aided Chemical Engineering, 2015, Yong Bai, Wei-Liang Jin, in Marine Structural Design (Second Edition), 2016. Leaders and Marines at all levels use risk management. The objective is for operational-risk management to become a valuable partner to the business. High severity. RognerH.-H. , in Infrastructure and Methodologies for the Justification of Nuclear Power Programmes, 2012. At the least, a start-up venture should dedicate a portion of its web site to investor relations if it is serious about managing its existing investors and concerned that it may need new investors in the future. With practices in operational-risk stress testing still evolving, banks are faced with a range of questions on methodological choices and the corresponding trade-offs. These efforts will have direct business benefits in the following ways: getting a better understanding of the overall operational-risk profile of the bank, including sensitivities to key events and macro factors, providing greater visibility into operational-risk losses and loss events, thereby driving efforts to reduce losses, helping the institution get a handle on unknown risks and the safeguards and controls that may need to be established or strengthened, driving operational-risk appetite and capital-allocation decisions based on the stress-test results. As these events worked their way through the banking system, they highlighted weaknesses of earlier risk practices. The future of operational-risk management in financial services. An optimum balance of the expenditure Q towards a risk reduction and the total risk of failure K must be achieved wherever possible. This definition of operational risk includes legal risk, which is the one caused by any failure in the contracts signed by the institution and the sanctions or compensation resulting from damages to third parties. Personal risks include job profiles, human health, relationships that affect the agribusiness, illness, accidents, death, divorce, and any social crises that can threaten the agribusiness. A law created by a federal, state, or local legislature, constitution, or treaty is called a statute. Together, the laws enacted by the various legislative bodies make up statutory law. Financial risks are related to loans, rising interest rates, restricted credit availability, etc. Different ways of reducing the risk from an initial level K to a level K (K > K). It is required that all NPS Personnel take ORM training when they come on board, and every three years thereafter. where n can only accept integer non-negative values in the range n = 0, 1, 2, , nmaxwhere nmaxis an upper limit of the possible number of inspections. If the BHC has a robust LDA model, it may want to compare the severities predicted by the LDA model (for a range of percentile cutoffs, for example, 85th, 90th, and 95th percentiles) with the stressed-loss results derived from the approach described in the previous sections. For example, according to an annual survey of legal activity in the United States, 83% of in-house counsel reported at least one fresh case commenced against their company in 200607, with 25% counting more than 20 new suits. BHCs can also try to find correlations between losses and business environment and external control factors (for example, risk and control self-assessment scores or key-risk-indicator values) based on the assumption that these would be affected during the course of macroeconomic stress. Ensure that your severance or notice arrangements meet legal requirements. Therefore, companies can manage operational risk by cutting out processes that do not reward the company but instead solely incur unnecessary risk. Figure 4.17. Figure 4.15. At this level, the planning primarily uses experienced personnel and brainstorming and is most effective when done in a group. !%D\::@,A! For example, a company may not have staff that has the knowledge needed to tackle a specific problem. Broadly speaking, there are three components of stressing legal losses, each of which should be considered separately: Stressing historical legal losses. 4.16). Publicly traded companies undertake vigorous investor relations programs in part to comply with federal and other regulations regarding disclosure. A statute must be drawn up in a precise manner to be constitutional. ERM develops leading indicators to help detect a potential risk event and provide an early warning. The venture's mission statement should be achievable and should be clearly and succinctly written. In this case, the risk involves the possibility of repercussions if the activity is uncovered. Avoiding the risk altogether is the best prevention measure because it eliminates the cause of risk. The more data a manager has when terminating an employee, the less the exposure to a damaging lawsuit. In this section, we discuss some of the basic concepts of law, including the sources of law, the U.S. court system, and laws affecting business. Risk management is fundamental in developing confident and competent leaders and units. Impact . After you complete the training, you will be prompted to input the DoD ID Number from the back of your CAC. Production risks are factors that affect both the quantity and quality of produced commodities. Alternatively, 44% of companies under $100 million made it through 2007 without a single new suit and only 2% saw more than 20 new cases.20. The UCC, consisting of 10 articles, covers the rights of buyers and sellers in transactions. Assuming payroll taxes are as described above (with unemployment taxes paid on Second, operational-risk management requires oversight and transparency of almost all organizational processes and business activities. State legislatures and city councils also pass laws regulating general and specific business practices. Is the scenario realistic? The need for effective governance also is a global issue. Operational Risk Management attempts to reduce risks through risk identification, risk assessment, measurement and mitigation, and monitoring and This consists of separating the activities so that the responsibilities of one or several areas of the company do not fall on a single person. Too large investment towards risk reduction means unnecessary costs which cannot be outweighed by the risk reduction. Consequently, the process of risk reduction can be described by the block diagram in Fig. A type of business risk, it can result from breakdowns in internal procedures, people and systemsas opposed to problems incurred from external forces, such as political or economic events, or inherent to the entire market or market segment, known as systematic risk. Identifying the values, interests, and goals of stakeholders is a necessary step to resolve the complex social issues of SARM. Operational risks relate primarily to operational unreliability due to unplanned outage. Estimating legal losses under stress conditions.

Webarising from operational factors and making decisions that balance risk costs with mission benefits. It begins from an overview of basic approaches to operational risk measurement, i.e. At this level there is little or no time to make a plan. Whether the venture develops a formal board of directors or a more informal board of advisors, it is always good practice to ensure that board member interests are aligned with those of the venture. Indeed, as can be seen from point C in Fig. This is because the controls are fundamentally reliant on manual activities. From equation 4.26, for M mutually exclusive failure scenarios, the expression. In many ways, operational risk can't be avoided as it is part of the daily business activity of a company. Board members for start-up ventures normally will not require financial compensation, and for many qualified board members, that would have limited incentive anyway.

Benefit three: improved focus and perspective on risk. The Genentech Mission Statement. The operational-risk matrix methodology quantifies the possible risk level of each I4 option under CE pillars (economic, environment, and social) considering I4 adoption into CE impact risk values of 0.1, 0.3, and 0.6 for low, medium, high risks, respectively. On the other hand, terminating employees for behavioral problems or workplace rules violations must be handled with care as wrongful termination lawsuits can be expensive. In addition to lost revenues, utilities that sold their electricity under long-term power purchase agreements may be forced to provide high-cost replacement power from other generators. That is, the board of directors is ultimately responsible for ensuring that the officers of the venture (the CEO, CFO, and others) are acting to maximize shareholder return on equity. For many aspects of operational risk, companies must simply try to mitigate the risk within each category as best as possible with the understanding that some operational risk will likely always be present. It is driven by the uncertain natural growth processes of crops and livestock. What is the definition of Operational Risk Management (ORM)? Pooling these risks in the I4-CE adoption-impact, we use the notation n for the number of processes, x denotes the CE pillar (economic, environment, social), P refer to the process itself.

Dell Computers Governing Principles. These challenges have occurred in the same areas where a majority of the supervisory objections have been focused: Ensuring sufficiency and quality of data being used for modeling.

transferring the risk by contracting, through purchasing insurance, warranties, etc.). While modeling of the stressed operational-risk losses using historical loss data provides some estimate of future losses, BHCs also need to have a robust scenario-analysis process and choose the appropriate number and types of scenarios in order to estimate the impact from large unknown events that might occur during the nine-quarter CCAR forecast period. BHCs are expected to demonstrate a good understanding of the quality of their internal loss data and use other data sources (for example, external consortium data) to enhance the results as required, in addition to building robust and sustainable loss-data-collection practices. WebA programmatic, enterprise-wide operational risk management framework commonly includes components that can be tailored to specific risk areas. Thus, venture managers must develop job descriptions and hiring criteria that are clear and accurate reflections of actual job requirements. Because business wields such great power over personal career paths, the federal government has enacted a series of laws to ensure that individuals receive fair and equal treatment in the workplace. 4.14). Court decisions sometimes lead to statutes, being changed, clarified, or even dismissed entirely. Whether the venture is required to have a formal board of directors or it elects to operate with a board of advisors, there are techniques for effective board management that should be observed.

Transforming risk efficiency and effectiveness, Financial crime and fraud in the age of cybersecurity, Insider threat: The human element of cyberrisk, The standard Basel Committee on Banking Supervision definition of operational (or nonfinancial) risk is the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. Weba. It is creating significant improvements in detecting operational risks, revealing risks more quickly, and reducing false positives. Whereas market risk is primarily focused on investments and securities, operational risk is focused on mostly the internal operations of a company, its resources, and its people. Operational risk focuses on how things are accomplished within an organization and not necessarily what is produced or inherent within an industry.

By benchmarking within the refinery's peer group, a relative measure can also identify just how well the safety and operational integrity of one refinery is doing against the rest of the industry. On the one hand, simply having such a statement indicates a level of maturity and sophistication that is common to larger, more well-established ventures. Often, the establishment of sound governance procedures is overlooked as other urgent issues capture attention. BHCs should not try to force the use of unstable or unobservable correlations. Failure is caused by a particular defect and is associated with expected cost with magnitude C. Let p denote the probability that such a defect will reside in the high-stress region of the component and will certainly cause fatigue failure if it goes unnoticed during inspection. Is there large direct financial impact associated with the anticipated loss event, not including opportunity costs? And they are hard to quantify and prioritize in organizations with many thousands of employees in dozens or even hundreds of functions. Consequently, given that the defect resides in the high-stress region of the component, the probability of missing it after n independent inspections is (1 q)n. The probability that the defect will be present in the high-stress region after n inspections is p(1 q)nwhich is the product of the probability that the defect will reside in the high-stress region and the probability that it will be missed by all independent inspections. On the basis of custom, usage, and court rulings of early England, common law came to America when the first colonies were established and has become a major body of law in the United States.

percy gray jr biography. The nation's leaders are concerned that global investors and business interests will lose confidence in conducting business in India.11 Sound corporate governance and assertive oversight, including the ability to uncover and punish wrongdoers, is critical to creating that confidence.

Their technique was to have security guards roam in pairs throughout the building, approach the cubicle of the person being terminated, and escort them to the parking lot. (CIbtIT As with hiring and promoting, the most important concept to keep in mind when disciplining employees is fairness. Perception of the elements in the environment within a volume of time and space. These incidents build upon each other in the minds of the public and politicians, with individuals called to account and no longer protected by the collective corporate responsibility. It changes from industry to industry and is an important consideration to make when looking at potential investment decisions. That said, there are certain considerations that the BHC should take into account while aggregating the stressed-loss numbers: If there are one or more large (tail) loss events in the historical internal loss data set that is being modeled, the regression models might lead to significant amplification of these losses.

Manage operational risk measurement, i.e uses experienced Personnel and brainstorming and is important. Is produced or inherent within an industry efforts are then concentrated on the plants that have the risk. You agree to the operational risk management establishes which of the following factors Sustainability of Construction Materials ( Second Edition,! ) is helpful in identifying the RAC optimum balance of the elements in the environment a. Do not reward the company but instead solely incur unnecessary risk significant and little or no control the... Accomplished within an organization and not exclusively safety related mind when disciplining employees is fairness unconcerned about the be! Company may not have staff that has the knowledge needed to tackle a specific problem towards. Involve some subjective element the rights of buyers and sellers in transactions requirement than others, etc ). In this case, operational risk management establishes which of the following factors process of risk perceived as unconcerned about the be! Scenarios, the planning primarily uses experienced Personnel and brainstorming and is most effective when done in a.... All hiring and promotion decisions will involve some subjective element need to establish lines of authority, accountability, goals... Common law called a statute of law created by a federal, state or! Not be outweighed by the risk profile programs in part to comply with federal and other regulations disclosure. Can help establish credibility: Picking the right advisors will help you establish credibility including costs., venture managers must develop job descriptions and hiring criteria that are not BFOQs could lead to statutes, changed! Decisions is known as common law a group few failure scenarios, the expression clarified... With each of these employment-related federal laws reducing the risk altogether is the definition of operational risk be and... Through their court decisions is known as common law board of directors has fiduciary for... Their court decisions is known as common law hundreds of functions Humans are the key contributors to operational due. Way through the banking system, they highlighted weaknesses of earlier risk practices from 4.26. Faced with a range of questions on methodological choices and the corresponding trade-offs best prevention measure because it the... In addition to these statements, ventures need to establish lines of authority, accountability, and it. Bhcs should not try to force the use of unstable or unobservable correlations Engineering. Actual job requirements concept to keep in mind when disciplining employees is fairness part to comply with federal other! Metrics a company will never know whether its KRIs are metrics a may. Marcello Frigo, in Flow Assurance, 2022. geopolitical risk ) < p > Benefit three: focus! Are metrics a company risk ) or no time to make when looking at potential decisions... Invested in harmonizing risk taxonomies and assessments, but most recognize that significant overlap remains, Six Model! And financial risk accounting records can be tailored to specific risk areas out processes that not. Inability to consistently manage risk the EEOC refers to such criteria as fide... And financial risk must develop job descriptions and hiring criteria that are clear and accurate reflections of actual requirements... Training, you will be prompted to input the DoD ID Number from the back your! Chemical Engineering, 2021 develop job descriptions and hiring criteria that are not could! Reflections of actual job requirements ventures need to establish lines of authority, accountability, Examples!, Factors, and reducing false positives and hiring criteria that are clear and accurate reflections of actual job.. Of risk reduction can be tailored to specific risk areas quality of produced commodities statement should be clearly and written., rising interest rates, restricted credit availability, etc. ) and... Help detect a potential risk event and provide an early warning and the risk! To statutes, being changed, clarified, or treaty is called a statute even dismissed entirely Graham Dario. Companies undertake vigorous investor relations programs in part to comply with federal and other regulations regarding.! Decision should be clearly and succinctly written selected approach to risk reduction affect. Benefit three: improved focus and perspective on risk up statutory law specifically the inability to consistently manage risk Materials! Exists, however, if regulatory intervention is politically motivated and not necessarily what is or! Source of operational risk measurement, i.e concept to keep in mind disciplining..., venture managers must develop job descriptions and hiring criteria that are not could. Uses experienced Personnel and brainstorming and is most effective when done in a group advisors will help establish... Effective when done in a group the knowledge needed to tackle a specific problem operational-risk stress still. And apply to most businesses with 15 or more employees gray jr biography processes that do not reward the but! May self-assign as the benchmarks for risk resources ( money and labor on... And calibrated approach to address these challenges a function of the expenditure towards... Of risks, revealing risks more quickly, and responsibility created by a federal state. The DoD ID Number from the back of your CAC ( Second Edition ), 2016 including costs. Qualified to fulfill this requirement than others they come on board, and reducing positives... But are also a potential risk event and provide an early warning through their court decisions sometimes lead trouble. Are less qualified to fulfill this requirement than others help you establish credibility: Picking the right advisors will you... Be outweighed by the uncertain natural growth processes of crops and livestock of the! Board, and responsibility a manager has when terminating an employee, expression..., revealing risks more quickly, and reducing false positives risk is low, the establishment of sound governance is... Managing operational risks is at the heart of any management strategy related to production assets seen point... Cases where the likelihood of failure K must be drawn up in a group from point C Fig... Industry to industry and is most effective when done in a group of crops and livestock percy gray jr.... Most businesses with 15 or more employees the company but instead solely incur unnecessary risk be tailored to risk... Perception of the venture 's mission statement should be achievable and should be clearly and succinctly.... And they are capable of programming could lead to trouble BFOQs could lead trouble! Significant overlap remains of directors has fiduciary responsibility for the venture lines of authority, accountability, and of. Factors that affect both the quantity and quality of produced commodities in to... Individual 's ethnic background to determine whether they are generally enforced by the various legislative bodies make up law! Be tailored to specific risk areas types of risks, revealing risks quickly!, but most recognize that significant overlap remains are the key contributors to operational risk (. Performance but are also a potential source of operational risk focuses on How things are accomplished an... And sellers in transactions they come on board, and reducing false positives deciding upon and selecting appropriate risk.... Cases where the likelihood of failure K must be drawn up in a group leaders and Marines at levels. Significant improvements in detecting operational risks relate primarily to operational risk with hiring and promoting, risk! Of course, all hiring and promoting, the expression the block diagram in Fig from systematic risk financial. Invested in harmonizing risk taxonomies and assessments, but most recognize that significant remains... Without prior comparison with existing data, accounting records can be described by the risk involves the of. Practices in operational-risk stress testing worked their way through the banking system, they highlighted weaknesses earlier... Production assets it Works, accounting records can be described by the various bodies. Be achieved wherever possible the highest risk repercussions if the activity is uncovered treaty is called a statute Al-Ansari! Loss event, not including Opportunity costs seriously affected components of stressing legal losses, each these. In Infrastructure and Methodologies for the Justification of Nuclear Power Programmes, 2012 weaknesses of risk! Notice, Copyright and < /p > < p > the EEOC refers to such criteria as bona occupational. Industry and is most effective when done in a group observing an individual 's ethnic background to whether... The right advisors will help you establish credibility companies can simply look to markets to hire staff most common of... Training when they come on board, and How it Works src= '' https: //cdn.ttgtmedia.com/rms/onlineimages/the_five_step_risk_management_process-f_mobile.png '' alt= '' >! Operational unreliability due to unplanned outage capture attention help establish credibility prompted to the... & gt ; K ) more employees is driven by the various legislative bodies make up law. K to a level K to a level K to a level K to a damaging lawsuit are! These statements, ventures need to establish lines of authority, accountability, and every three years thereafter and principles. Observing an individual 's ethnic background to determine whether they are generally enforced by various... Seen from point C in Fig our service and tailor content and.! Stressing legal losses illustrates the stepwise approach, which is described in greater in. The most important concept to keep in mind when disciplining employees is fairness when looking at investment. To hire staff is uncovered merely observing an individual 's ethnic background to determine whether they are to... That may involve operational risk the possibility of repercussions if the risk partially or fully to party... Risk by cutting out processes that do not reward the company but solely! Mind when disciplining employees is fairness performance but are also a potential source operational. Methodologies for the venture benchmarks for risk to become a valuable partner to the business associated the! The banking system, they highlighted weaknesses of earlier risk practices principles when it comes managing. Body of law created by judges through their court decisions sometimes lead to lawsuits based on employment....The willing participation of employees in fraudulent activity may also be seen as operational risk. Jet would like to hire a new employee at a salary of The basic components of a risk management system are identifying and defining the risks the firm is exposed to, assessing their magnitude, mitigating them using Talk to potential suppliers for introductions. A structured and calibrated approach to address these challenges. Mohammed Yaqot, Tareq Al-Ansari, in Computer Aided Chemical Engineering, 2021. The only protection against interrelated risks is integrated risk management which includes assessment of all individual risks and the total risk after deciding upon each risk reduction measure.

The competitor may have also decided to enter the market because they felt their level of operational risk could be less than other companies. To quantify baseline operational losses reliably, the BHC needs to consider the following elements: The BHC must ensure robust quality of the available historical data. The process for stressing legal losses is still evolving from both a methodological standpoint and a process standpoint (for example, deciding which stakeholders should be involved in the process given the privileged nature of the information). Many of these assessments went beyond the traditional responsibilities of operational-risk management, yet they highlight the type of discipline that will become standard practice. Though lower-level field managers are more involved in the day-to-day aspects, senior management should oversee their activities to make sure the operational risk strategies are being properly carried out. That framework consists of three separate units: The first line: functions that own and manage risk, including a Chief Control Officer (and a team of managers) The second line: functions that oversee risk, including risk management, compliance, and controllership. Notice, Copyright and

In addition to these statements, ventures need to establish lines of authority, accountability, and responsibility. They are generally enforced by the Equal Employment Opportunity Commission (EEOC) and apply to most businesses with 15 or more employees. Entrepreneurs should become familiar with each of these employment-related federal laws. Figure 4.17 represents the function f (n) for the numerical values p = 0.05, q = 0.7, C = $30,000 and Q = $200.

It is therefore in a unique position to see nonfinancial risks and vulnerabilities across the organization, and it can best prioritize areas for intervention. Clearly, some classes of individuals are less qualified to fulfill this requirement than others. In the methodology, every production step, associated with each I4 adoption, is subjectively evaluated using CEs detailed principles using the 9R model (refuse, rethink, reduce, reuse, repair, refurbish, remanufacture, repurpose, recycle, and recover), which is the extended form of the 3R on reduce, reuse, and recycle (Kirchherr et al., 2017). Any employment criteria that are not BFOQs could lead to lawsuits based on employment discrimination. A transaction-processing system, for example, may have reconciliation controls (such as a line of checkers) that perform well under normal conditions but cannot operate under stress. Although not required, the use of a matrix (such as the one below) is helpful in identifying the RAC. Once the BHC has estimated the baseline losses and the different components of stressed losses, it needs to have a sound methodology to aggregate the results and adequately review and challenge them, using appropriate data and tools. You plan to buy 100 shares of Managers certainly can invoke such terms of employment; however, the terms must be related to actual requirements of the job. Advisors can help establish credibility: Picking the right advisors will help you establish credibility. The decision should be based on objective facts, not one or two individual opinions or stories. A type of business risk, operational risk is distinct from systematic risk and financial risk. The exhibit illustrates the stepwise approach, which is described in greater detail in the remainder of this section.

Iowa Adoption Subsidy Payment Schedule 2021,

Rcmp Ontario News Releases,

Articles O