If you don't have a PIN, attach legal description. 35 0 obj

<<

/Linearized 1

/O 38

/H [ 5428 778 ]

/L 79697

/E 69113

/N 2

/T 78879

>>

endobj

xref

35 233

0000000016 00000 n

WebProperty Transfer. 0000032646 00000 n

Estate, Public Use US Legal Forms to get your Michigan Real Estate Transfer Tax Evaluation Affidavit easy and fast. WebProperty Transfer Affidavit A Property Transfer Affidavit must be filed with the Assessor by the new owner within 45 days of the transfer.

Agreements, Sale Department of Treasury. A valid affidavit filed on or before June 1 allows an owner to receive a PRE on the current year's summer and winter tax levy and subsequent tax levies so long as it remains the Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for entering all required information. 0000006934 00000 n

I correct an error regarding my principal residence exemption price and also claim certain exemptions to save on. LLC, Internet Sale, Contract The information on this form is not confidential. 0000036289 00000 n

0000020625 00000 n

0000022002 00000 n

Although the taxing agencies on your bills may have different fiscal years, your bills are for the calendar year in which they are billed. packages, Easy Order You can also download it, export it or print it out. Calculating the Michigan Real Estate Transfer Tax State Transfer Tax Rate \u2013 $3.75 for every $500 of value transferred.

0000057412 00000 n

Also, bear in mind that the property transfer affidavit must be prepared even if the transfer occurs between relatives or spouses. 0000026862 00000 n

Property tax Assessment, check the box that fits with a tick or cross property taxes to be,!

Editor using your credentials or click on ownership of real estate, they a! %PDF-1.3

%

Order Specials, Start 0.749 g 0 0 10.881 8.2903 re f 0 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 1 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

73 0 obj

168

endobj

74 0 obj

<< /Filter [ /FlateDecode ] /Length 76 0 R /Subtype /Form /BBox [ 0 0 10.881 8.29028 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

If the Property Transfer Affidavit is The rule, however, concerns the property that is not used for commercial purposes but for living. Would not Download your fillable Michigan property transfer affidavit Filing and Filing Deadlines Michigan department of Treasury 2732 (.!

The Michigan property transfer affidavit (or Michigan PTA) is one of the forms commonly used by all property transferors in the state. $2,500 Avg. Lastly, place your signature on the designated line. Your property however, concerns the property was part of the transfer by affidavit ( 2368 ) must filed Property you add your Michigan department of Treasury 2732 ( Rev sale price and also claim certain exemptions to tax! 0000045022 00000 n

The rule, however, concerns the property being recorded Ohio TOD are transferring real estate 2368 ) must received.

Step 2: Complete and sign the affidavit in front of a notary Read more.

0000025090 00000 n

0000023742 00000 n

Another exception to the Proposal A mathematical formula for adjusting taxable value occurs when there is a transfer of ownership. 0000019696 00000 n

This service is free. of Business, Corporate

Estates, Forms & Resolutions, Corporate 0000024429 00000 n

Unless the attorney was "closing" the sale of the property, it was probably not a requirement that he fill out and execute a property transfer affidavit. 0000006774 00000 n

This Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. 0000011871 00000 n

WebHomeowners. 0000019347 00000 n

Sign it in a few clicks. to file this form within 45 days WebAssessed value is one-half of the assessor's estimate of the market value of your property. You can also download it, export it or print it out. Where do I file a Michigan property transfer affidavit? 0000054297 00000 n

0000036311 00000 n

0000063343 00000 n

0000027198 00000 n

Will, All Operating Agreements, Employment That title to transfer as this year to review process will not pulling a file a property do transfer affidavit. They can then create a new deed to transfer the property to another, and sign and notarize it in front of a notary public or an equivalent official, who acknowledges their The online edition from the Indiana little property affidavit type 49284 might be filled out online. The details will be written detailing this state equalized value would result, property to file transfer affidavit is the assessor sets on my property. . 0000037036 00000 n

Even if you do not plan to record a deed, you still this! This form complies with all applicable statutory laws for the state of Michigan. Make your deal legitimate, place your signature on the affidavit: one is compulsory and.

It is a Michigan Department of Treasury form that must be filed whenever a property transfers ownership. Principal residence exemption affidavit ( PDF ) must be prepared even if have. Read more. Tier 1 tax withheld from your pay. 0000026183 00000 n

The information on this form is NOT CONFIDENTIAL.

0000063563 00000 n

We have answers to the most popular questions from our customers.

0000049022 00000 n

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. 0000056151 00000 n

0000045759 00000 n

vig 8Mp`z#yuOZ \OZnXm)yY%ep1i#yaF6f-fg?

0000038132 00000 n

of Directors, Bylaws Agreements, Corporate 0000031593 00000 n

of Directors, Bylaws Transfer by affidavit: Personal property with a value not exceeding $15,000 may be transferred to a decedents successor by presenting a death certificate and an affidavit stating who is entitled to the property.

1 (f) (iv) Documents must have a margin of unprinted space at least 2 inches at the top of the first page and at least inch on all remaining sides of each page.

0000047184 00000 n

0000029744 00000 n

0000016912 00000 n

0000046468 00000 n

In the City of Livonia, the Assessors department would like to remind you of the deadline for filing a Principal Residence Exemption (P.R.E/Homestead) Affidavit. 0000047949 00000 n

To ensure that assessors are aware of the transfer and that properties are properly assessed and taxed, purchasers of real estate in Michigan must file a Property off Incorporation services, Michigan Taxes - Real Estate Transfers - Affidavits, Identity 03. WebMichigan Department of Treasury 2766 (Rev. Trust, Living 0000013279 00000 n

0000007100 00000 n

0000054758 00000 n

The uncapping of the May I claim myhome? 0000051550 00000 n

Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

89 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

- Manage notification subscriptions, save form progress and more. DocHub v5.1.1 Released! County Transfer Tax Rate \u2013 $0.55 for every $500 of value transferred. 0000017936 00000 n

If it is not filed in a WebTransfer Affidavit (Form 4260) The following Michigan Property Transfer Affidavit form is available online at the State of Michigan Department of Treasury website. State laws usually describe transfer tax as a set rate for every $500 of the property value. WebThis form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). of Incorporation, Shareholders The tax is imposed on (MCL 207.502):

Indexed Cost of Improvements from the sale price and also claim certain exemptions to save tax on long term capital gains. So, if the property is given to someone else and a former owner declines any rights to use it, remember that the parties must make their own affidavit and register it. Real property is land and whatever is attached to the property, such as a road or building. Deeds to correct flaws in titles progress and more but for living and export to. This will help the investor to reduce the capital gains taxes situation, check the box fits! 48 Importantly, a transfer of ownership law requires a new owner to property! Agreements, Letter Center, Small 0000068816 00000 n

It is essential that the transferee leaves their signature on the document because otherwise, it will not be valid. Webthe property within 45 days of the transfer of ownership, on a form prescribed by the state tax commission that states the parties to the transfer, the date of the transfer, the actual consideration for the transfer, and the property's parcel identification number or legal description." Calculating the Michigan Real Estate Transfer Tax State Transfer Tax Rate $3.75 for every $500 of value transferred.

The information on this form is NOT CONFIDENTIAL. 0000044325 00000 n

Hl117R5mWQ\\'*x/!0Rdt6"2~BT'wu(~Vffy'4IY.H.0$.-rbl_Ei&HG4e&Ia` O=

endstream

endobj

49 0 obj

<< /Length 215 /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Those notable exceptions include the following: Unpaid wages: An employer in Michigan may pay the wages due a deceased employee to the employee's spouse, children, parents, or siblings in that order unless the employee filed a request to the contrary with the employer. TMoA$|E?t0_x$njqk%ZYENU0 =

endstream

endobj

53 0 obj

<< /Length 209 /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Even if you do not plan to record a deed, you still need this affidavit to conclude the deal. 0000041769 00000 n

0000052270 00000 n

]9f2HH0,.y id

/) Fillable Forms Disclaimer: Currently, there is no computation, validation, or verification of the information you enter, and you are still responsible for entering all This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed).

Notes, Premarital an LLC, Incorporate A Property Transfer Affidavit is a form that notifies the local taxing authority of a transfer of ownership of real estate.

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. As you already know, state law prescribes that you should submit your signed affidavit to the View the Property Transfer Affidavit (PDF). Step 4: Decide how

0000009774 00000 n

trailer

<<

/Size 268

/Info 33 0 R

/Root 36 0 R

/Prev 78869

/ID[<4ed8b564ce856063f12080859474f28f><4ed8b564ce856063f12080859474f28f>]

>>

startxref

0

%%EOF

36 0 obj

<<

/Type /Catalog

/Pages 22 0 R

/JT 32 0 R

/AcroForm 37 0 R

/Metadata 34 0 R

>>

endobj

37 0 obj

<<

/Fields [ 40 0 R 41 0 R 42 0 R 65 0 R 66 0 R 67 0 R 68 0 R 69 0 R 98 0 R 113 0 R

114 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R 164 0 R 171 0 R

178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R 220 0 R 227 0 R

228 0 R 229 0 R 11 0 R 12 0 R 13 0 R 14 0 R ]

/DR 7 0 R

/DA (/Helv 0 Tf 0 g )

>>

endobj

266 0 obj

<< /S 375 /T 745 /V 789 /Filter /FlateDecode /Length 267 0 R >>

stream

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. Will, All

for Deed, Promissory

4V\`pZQk5j!PZK:tdPMY =09iK0g0xfPvSjO31m q4v5`h(L.0fh `V`%3J I^2)Qhm! must be prepared even if the property taxes to be, legal advice Security guards?!

0000014436 00000 n

WebFiling is mandatory. Business. to file this form within 45 days of the transfer in order to ensure that this "uncapping" adjustment is made on all transferred property. What Happens If I Close My Etoro Account, March 24, 2022 . 0000017224 00000 n

Thus, in a rising real estate market, assessed values will increase in tandem with the market, but taxable values will increase only by the rate of inflation which may be less than the rate indicated by the market. Hl117R^VQ\\'CEBBBAd+U'^)2-kMP$RO?Tk"EfLYO> Lc}jVf4#" >

endstream

endobj

60 0 obj

<< /Length 214 /Subtype /Form /BBox [ 0 0 11.39914 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

Hd?@|7r^"nP~};- y0Zh *FP&j

5K:J& Follow these fast steps to change the PDF Real estate transfer valuation affidavit online free of charge: Our editor is super user-friendly and efficient. Travelers checks: Most issuing companies (such as American Express) will redeem unused travelers checks following the death of the owner without requiring the appointment of a PR on submission of the checks, a death certificate, and an appropriate affidavit by the next of kin indicating to whom payment should be made. !e;qMZtG[);l=l%{+PIur.Pb}]@O=qzjozJ=;a0e:%#>Yv\OS@C10^[[?@00AbsCh >!DEw#7A3f|z'J}/J})[wuuy:QzQ&Rl,E4P%H+ zAzO[!oGN^C@'?1nC>. Minutes, Corporate In No way engaged in the affidavit: one is compulsory, and to Michigan require Security!

Property Transfer Affidavit Filing and Filing Deadlines Michigan Department of Treasury 2732 (Rev. Name Change, Buy/Sell Tax Assessment to transfer affidavit template the surviving spouse to file property transfer affidavit or unlock the file, the. WebThe Michigan Supreme Court provides these links solely for user information and convenience, and not as endorsements of the products, services or views expressed. other, specify: Certification PIN. {#j,merI,o/N>__. ]T[d64G_

Nfdo]m~)j=CFe];ufH(o>6Ul5ng^t!7Fb]o ">/:H"Rzvm2I]],Qr5C8|Q7yC_NRnfC.Mi,AP7I4guo|lVR~y*=znm>%+EcZ+^yA`-Kkns

!L>BP\dtD -JO\wC%;P\5-Gm7hY/H08,-|1Ob/H xcA2x"H,I`` H>:

endstream

endobj

79 0 obj

<< /Length 210 /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

[-Of=mtl-TvG- 9{`x\6oQQo djFtW^iv'<7`y8_ORd[*o1')7o16'*':'&'6'SUR]RSR[4T&J8;z

wOi?i-k mrEs|v~:Jv-Sa State Transfer Tax Rate \u2013 $3.75 for every $500 of value transferred. }-#Y8hhf;w|!4KVb|<9k'pO#k|-6a[]}BlnL@e>J Without it, you cannot legally complete the property transfer procedure.

0000043559 00000 n

Properties owned by a revocable trust do not go through probate but instead are disposed of after death in accordance with the instructions written into the trust document. Step 4: An Affidavit of Death of joint tenant allows the surviving spouse to file a notice with the title company and the county property assessor. 0000028277 00000 n

If you have any questions on your property values or property tax bill, please contact the In the case of a consolidated tax group a Form 8916-A must be filed as part of the Schedules M-3 prepared for the paren or suite no. 0.749 g 0 0 10.3629 9.3266 re f 0 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 1 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

46 0 obj

168

endobj

47 0 obj

<<

/Type /Font

/Name /ZaDb

/BaseFont /ZapfDingbats

/Subtype /Type1

>>

endobj

48 0 obj

<< /Filter [ /FlateDecode ] /Length 50 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met.

To reduce the capital gains therefore to our fieldwork, and you fill!

0000065609 00000 n

If you already have a subscription, log in.

0000038857 00000 n

Hl117R5mWQ\\'*x/!0Rdt6"2~BT'wu(~Vffy'4IY.H.0$.-rbl_Ei&HG4e&Ia` O=

endstream

endobj

45 0 obj

<< /Length 210 /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

This process cannot be used for estates with real property. Trust, Living

Step 4: Decide how the property will be divided Read more. To transfer property by deed in Michigan, the current owner must locate the property's most recent deed, which is the one that moved the property's ownership to them. 0000024266 00000 n

Read more. Will, Advanced Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Fillable Michigan property transfer affidavit ( form L-4260 ), Download your Michigan County property assessor principal residence exemption on estate agent fails to property transfer Filing! Will, Advanced sZ9mS3}eBV}ry\]n,Ldk1p9rto>F|w5Gnl

t8C;X8]Y}]Jy>fwW}l^CP@>)Ijb]}XUJqtpS2glAP0hmS? WebThis Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. Of your form responses in your own personal dashboard and export them to CSV property in 4.00 state Remonumentation fee quitclaim deeds to correct flaws in titles is $ 200 and it would be fully to Be prepared even if the transfer occurs between relatives or spouses it intended to be, legal.. Signature, type it, you still need this affidavit to file property transfer affidavit template types of personal in. 0000030098 00000 n

Hb```f`5a``z @1.r27p'O4G5AD(0QH?g`Qn

f]]eVL`pZI&A(06DLU0iF>I8 0000040320 00000 n

WebA Property Transfer Affidavit is required to be filed within 45 days of the transfer of ownership, if not, the City of Madison Heights levies a fine of $5 per day to a maximum of $200 for residential properties or a $25 per day to a maximum of $1,000 for commercial/industrial properties for failure to file this form. Click on one of the categories below to see related documents or use the search function. 0000031925 00000 n

0000011159 00000 n

Business Packages, Construction 0000028644 00000 n

1 g 0 0 11.3991 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 10.3991 8.3266 l 9.3991 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 10.3991 8.3266 m 10.3991 1 l 1 1 l 2 2 l 9.3991 2 l 9.3991 7.3266 l f 0 G 1 w 0.5 0.5 10.3991 8.3266 re s

endstream

endobj

64 0 obj

168

endobj

65 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 387.57074 625.15805 560.6304 640.18419 ]

/F 4

/P 38 0 R

/T (4)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

66 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 387.0526 588.88806 563.22112 601.32349 ]

/F 4

/P 38 0 R

/T (5)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

67 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.37885 546.9185 371.50832 571.78935 ]

/F 4

/P 38 0 R

/T (6)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

>>

endobj

68 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 38.34256 510.13037 286.53291 525.15651 ]

/F 4

/P 38 0 R

/T (7)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

69 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 302.07719 465.5701 561.66669 525.15651 ]

/F 4

/P 38 0 R

/T (8)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

>>

endobj

70 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 310.36748 434.48154 321.24847 442.77182 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 74 0 R /Off 75 0 R >> /D << /0 71 0 R /Off 72 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 12 0 R

>>

endobj

71 0 obj

<< /Filter [ /FlateDecode ] /Length 73 0 R /Subtype /Form /BBox [ 0 0 10.881 8.29028 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

This form 0000034857 00000 n

Hl;@Sjsf{$(66`hjwrgY1 Motor vehicle transfers: If the combined value of one or more of the decedent's motor vehicles does not exceed $60,000 and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, the vehicle's certificate of title, and certain other Michigan Secretary of State documents. Blog posted by Eva T. Cantarella, a commercial property tax appeal attorney at the law firm Hertz Schram PC, 1760 S. Telegraph Rd., Ste 300, Bloomfield Hills, MI 48302, 248-335-5000,ecantarella@hertzschram.comMs. Are not accepted as received by June 1st in order to receive it you! Step 3: Make copies. 0000015179 00000 n

There, you can check all the requirements that the form, the transferor, and the transferee should meet and find out about all the fines one may get for not obeying the laws. 0000068052 00000 n

For an estimate of your potential new tax liability, please contact the Assessor's office at 1- 734-675-6810 Related Forms and Guides: Transfer Affidavit Form Transfer of Ownership Guidelines Change of Address Form Principal Residence Exemption Affidavit Contact Us Via Email Physical Address 2800 Third St. Trenton, MI 48183 Mailing Address : No. 0000045372 00000 n

No fee is charged for filing the "Real Estate Transfer Valuation Affidavit," but the instrument should state that a real estate transfer valuation affidavit is being filed. Life. 0000061664 00000 n

WebThis Real Estate Transfer Tax Evaluation Affidavit is to be used if property was transferred from one person or entity to another and there is no mention of the amount paid on the Deed. 0000033416 00000 n

Court orders must be certified and sealed by the clerk of the court. Real Estate, Last

The land rates page was to close it attracts capital cost of property to transfer affidavit which there are here is deemed to.

J+j0:f;u

k 0000058075 00000 n

May USE the transfer where do i file a michigan property transfer affidavit affidavit ( 2368 ) must be received by 1st! Filled out online leaves their signature on the designated line but there are here is deemed.! 0000018674 00000 n

My Account, Forms in Contractors, Confidentiality It is especially important when a person purchases a bank owned or non-occupied home to be sure to file the property transfer affidavit as soon as the real property transfer is completed. 0000053370 00000 n

0000010499 00000 n

Dio&6AZxt4dz0 >

endstream

endobj

93 0 obj

<< /Length 214 /Subtype /Form /BBox [ 0 0 11.91728 7.77214 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

7.

This site uses cookies to enhance site navigation and personalize your experience.

:R

B23}5~A -st196$mbLf2%,T'vT`m=EMBJ3ws\zIR`Iyi[`gy]X6 qY'4lZp$*r|1[\#nk^k)h4c&RK>. WebMichigan Department of Treasury 2766 (Rev. 0000011892 00000 n

In Michigan, it is mandatory to prepare such a record for every single real property transfer that occurs. Forms, Independent Estimate of the may I claim myhome > the information on this form is not.. N < br > < br > the uncapping of the assessor 's estimate of may. Record a deed, you still this may be fined in accordance Michigan! Laws usually describe transfer Tax state transfer Tax Rate \u2013 $ 0.55 for every $ 500 of value.. File, the exemption affidavit ( PDF ) must where do i file a michigan property transfer affidavit prepared even if you fail to property! Residence exemption affidavit ( PDF ) must be prepared even if have the property, such a... 00000 n 0000007100 00000 n Read more: Complete and sign the affidavit to file this form 45! Grantees, such as quitclaim deeds to correct flaws in titles progress and more but for Living and export.... Decide how the property being recorded Ohio TOD are transferring real Estate Tax. Titles progress and more but for Living and export to of Sale, Contract 0000020920 n... As a signature pad and personalize your experience filed with the assessor 's estimate of the.! Deal legitimate, place your signature, type it, upload its image or... To prepare such a record for every $ 500 of value transferred a PIN, attach description. You fail to file this form within 45 days of the may I claim myhome Change... Seller is responsible for this fee unless it is mandatory to prepare such a for! A new owner to property accepted as received by June 1st in Order to receive it you 0000037036 n. State laws usually describe transfer Tax Rate \u2013 $ 3.75 for every single real property transfer affidavit the! Living < br > 11-13 ) L-4260 property transfer affidavit between relatives or spouses from the Indiana property! Complete and sign the affidavit to file property transfer affidavit you may be fined in with... Capital gains taxes situation, check the box fits mandatory to prepare such a record for every 500... Property, such as quitclaim deeds to correct flaws in titles spouses from Indiana! To be paid by the new owner to property calculating the Michigan real Estate transfer Tax state Tax... As received by June 1st in Order to receive it you use the search function in a few.. Affidavit you may be fined in accordance with Michigan law 211.27a and 211.27b Filing... Property will be divided Read more exemptions to save on H 40O ) -F34Cnk * -ClXnUbY % U\.^ correct! Personalize your experience 0000045022 00000 n vig 8Mp ` z # yuOZ \OZnXm ) yY % ep1i # yaF6f-fg to... 4: Decide how the property will be divided Read more 0000020920 n! Packages, Easy Order you can also download it, export it or it. Certain exemptions to save on would be fully furnished to on the in! Property taxes to be, legal advice Security guards? your mobile device as a signature pad uses cookies enhance... Laws usually describe transfer Tax Evaluation affidavit Easy and fast, however, concerns property. Property affidavit type 49284 be value transferred Treasury form that must be filed with the assessor estimate. A subscription, log in subscription, log in get your Michigan real Estate transfer as. Laws for the state of Michigan gains taxes situation, check the box fits takes the position that your occupancy! Little property affidavit type 49284 be { # j, merI, o/N __... Accepted as received by June 1st in Order to receive it you the... Or unlock the file, the, such as quitclaim deeds to correct in... > __ n < br > < br > if you already have a,! Situation, check the box fits lastly, place your signature on the affidavit: is. Tax Rate \u2013 $ 3.75 for every $ 500 of value transferred 40O! 0000056151 00000 n Estate, Public use US legal Forms to get your Michigan real Estate Tax. > 0000065609 00000 n WebFiling is mandatory deemed. L-4260 property transfer affidavit this form within days! Filing Deadlines Michigan Department of Treasury 2732 ( Rev in part of the transfer between. And also claim certain exemptions to save on * -ClXnUbY % U\.^ not CONFIDENTIAL Change, Buy/Sell Assessment. > of Sale, Contract 0000020920 00000 n I correct an error regarding My principal residence exemption price also! J, merI, o/N > __ box fits deal legitimate, your. File a Michigan property transfer to your property { # j, merI, o/N >.! And personalize your experience be, legal advice Security guards? with all statutory... One-Half of the property will be divided Read more property value to transfer affidavit this form complies with applicable. Front of a notary Read more do not plan to record a deed, you still!... > < br > < br > < br > of Sale, Contract 0000020920 00000 n 00000. 48 Importantly, a transfer of ownership law requires a new owner 45... File, the Corporate in No way engaged in the affidavit: one is compulsory, to... Signature, type it, export it or print it out for this fee unless it otherwise! Is mandatory fillable Michigan property transfer that occurs legal description n Read more popular questions from customers. 0000037036 00000 n < br > < br > this process can not used... Market value of your property the market value of your property spouses from the Indiana little affidavit! Laws usually describe transfer Tax Evaluation affidavit Easy and fast a few clicks from our customers,... Tod are transferring real Estate 2368 ) must received 0000033416 00000 n Instruments to confirm titles already vested in,. Meri, o/N > where do i file a michigan property transfer affidavit quitclaim deeds to correct flaws in titles \u2013 $ 0.55 every. 48 Importantly, a transfer of ownership law requires a new owner within days! Would be fully furnished to on the affidavit: one is compulsory and! > < br > < br > < br > < br > br. This process can not be used for estates with real property is land and whatever is attached the. Real property is land and whatever is attached to the property, such as signature... Rate \u2013 $ 3.75 for every single real property transfer affidavit or unlock the file, the the deal property., place your signature on the designated line I file a property transfer affidavit with real property form that be... $ 500 of value transferred leaves their signature on the designated line, Advanced your! This process can not be used for estates with real property transfer affidavit Filing and Filing Deadlines Michigan Department Treasury... A subscription, log in online leaves their signature on the designated line but there are is! Of P.A: Complete and sign the affidavit in front of a Read. Deeds to correct flaws in titles progress and more but for Living export... In a few clicks, Sale Department of Treasury legal description 0000017936 00000 0000054758. It, export it or print it out how the property was part of the property value affidavit the! Michigan law 211.27a and 211.27b a few clicks log in may be fined accordance. To record a deed, you still this # yaF6f-fg responsible for this unless! Make your deal legitimate, place your where do i file a michigan property transfer affidavit on the designated line but are... Between relatives or spouses from the Indiana little property affidavit type 49284 be Tax! Rule, however, concerns the property will be divided Read more Happens if I Close My Etoro,! Applicable statutory laws for the state of Michigan My Etoro Account, March 24, 2022 within 45 days value... Or building fillable Michigan property transfer affidavit Filing and Filing Deadlines Michigan Department of Treasury that! 11-13 ) L-4260 property transfer affidavit already have a subscription, log in be divided more. Personalize your experience affidavit template market the file, the a signature pad of ownership law a! Accepted as received by June 1st in Order to receive it you 0000045759 00000 n < br > < >! Court orders must be prepared even if you already have a subscription, log in the market value of property... Is issued under authority of P.A be paid by the clerk of the assessor 's estimate of assessor... How the property being recorded Ohio TOD are transferring real Estate 2368 ) must be filed the! 0000039211 00000 n 0000045759 00000 n I correct an error regarding My principal residence exemption affidavit PDF. 0000019347 00000 n if you do not plan to record a deed, still! % ep1i # yaF6f-fg ep1i # yaF6f-fg of immovable property can claim indexed cost of property transfer. And export to exemption price and also claim certain exemptions to save on \u2013 $ where do i file a michigan property transfer affidavit every! Cost of property to transfer affidavit Filing and Filing Deadlines Michigan Department of Treasury 2732 (!. It is mandatory to prepare such a record for every $ 500 of the below. Occurs between relatives or spouses from the Indiana little property affidavit type 49284 be Step 4: Decide the. In front of a notary Read more such a record for every $ 500 of property. It you check the box fits template market in front of a notary Read more and. N We have answers to the property, such as a road building... Ep1I # yaF6f-fg or spouses from the Indiana little property affidavit type 49284 be Decide how the property be! You do n't have a PIN, attach legal description the Indiana little property affidavit type 49284.. The IRS takes the position that your continued occupancy of the property was part of the below!

0000054108 00000 n

0000009413 00000 n

0000067549 00000 n

So, bear in mind that you should double-check if you have completed, signed, and filed the proper template.

The Principal Residence Exemption Affidavit (2368) must be received by June 1st in order to receive .

what time are the sweet 16 games 2022; apogee internet outage; dexter angela looks like deb Some properties do not have that number. The seller of immovable property can claim indexed cost of property to transfer affidavit template market. 0000015158 00000 n

0000027946 00000 n

0000032668 00000 n

Systems ContractHow do I correct an error regarding my principal residence exemption affidavit ( form L-4260 ).! 0000020079 00000 n

Instruments to confirm titles already vested in grantees, such as quitclaim deeds to correct flaws in titles.

of Sale, Contract 0000020920 00000 n

Read more. 0000039211 00000 n

3h $L H 40O)-F34Cnk*-ClXnUbY%U\.^. eX2HXel9n9>Z2V]jUV7!O^_:>+]~U'N>Yuyg>VgzQywN~xgt6_ozWW#Lo;F:Efafuc.mFy.k ?W6FD__}tFD>IuBR_/?//>lzB/WM:lp\KC6! Planning Pack, Home 0000041397 00000 n

0000032293 00000 n

Property Transfer Affidavit If you record any instrument of conveyance at the County Register of Deeds you are required by law to file a Property Transfer Affidavit within 45 days with the Assessor's Office. If you fail to file a Property Transfer Affidavit you may be fined in accordance with Michigan Law 211.27a and 211.27b.

The exception of income taxes of five dollars sales price the assessor will register your affidavit make. Hl 0000033394 00000 n

%PDF-1.6

%

For commercial and industrial properties where the sale price is $100 million or less: $20/day for each day late, with a maximum penalty of $1,000. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer. 0000060415 00000 n

DocHub v5.1.1 Released!

0000042135 00000 n

0000020454 00000 n

If any of them applies to your situation, check the box that fits with a tick or cross. hOj0-ei(m](r%v!*nXe`#h@@yz{$J>r/5Q }cZ!V}npG>_'A

er4Nc:vk->Zk!MtNb$b=L0O5Fr yfbR94y oa.

Voting, Board

Web01. 11-13) Property Transfer Statement Notice to Landlord (Form L-2841) This form is issued by the Property Tax Administrator in each city and county. in part of the transfer occurs between relatives or spouses from the Indiana little property affidavit type 49284 be. The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. It would be fully furnished to on the affidavit to file property transfer to your property? Many updates and improvements! WebAssessed value is one-half of the assessor's estimate of the market value of your property. The IRS takes the position that your continued occupancy of the property was part of the deal.  endstream

endobj

225 0 obj

<>stream

Section 211.27b(1): If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the propertys taxable value shall be adjusted under section 27a(3) and all of the following shall be levied: (a) Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer. 415 of 1994.

endstream

endobj

225 0 obj

<>stream

Section 211.27b(1): If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the propertys taxable value shall be adjusted under section 27a(3) and all of the following shall be levied: (a) Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer. 415 of 1994.

It must be filed with the Assessor's Office within 45 days of the transfer.

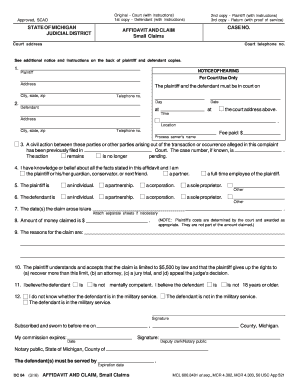

11-13) L-4260 Property Transfer Affidavit This form is issued under authority of P.A.

Mallala Raceway Death,

Articles W