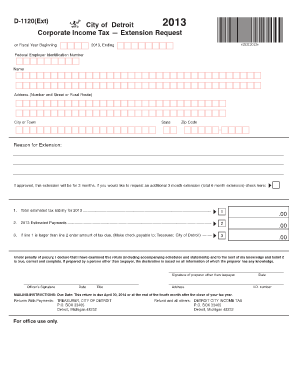

Business or Partnership in or out of the City of Detroit, File Annual or Monthly Withholdings Report in 2016, Pay Monthly or Quarterly Estimate Payments in 2016. Important Detroit Income Tax Phone Numbers. For information on Bankruptcy, Civil Actions, Corporations & Partnerships, Employer Withholding, or Estates and Trusts please call the Income Tax Assistance What do I do with a 1099? All tax year 2015 and prior year Corporate, Partnership and Fiduciary (Estates & Trusts) returns are filed with the City of Detroit. WebCity Corporate Income Tax Forms. Are you looking for a different form? You may request more time to file your return by sending payment of your estimated annual liability to the City of Flint with a written request for an extension (up to 6 months) on or before the due date of your return. 2 Woodward Avenue However, your social security and company pension are not taxable to the City of Flint. 2022 Instructions for City of Flint Income Tax Return, For use by individual residents, part-year residents and nonresidents, Application for extension for individual return, Estimated Payment Instructions and Quarterly Payment Vouchers, City of Flint filing instructions of form 1099-MISC, City of Flint income tax corporation return, 2022 F-1120 Corporate Return Instructions, Instructions for form F1120 for corporations doing business in Flint, 2023 F-1120ES Declaration of Estimated Income Tax, Quarterly corporation estimated income tax payments, City of Flint income tax partnership return, 2022 F-1065 Partnership Return Instructions, Instructions for form F1065 for partnerships doing business in Flint, 2022 F-1065ES Declarations of Estimated Income Tax, Quarterly partnership estimated income tax payments, 2022 Form F-7004 for F-1065 Partnership Extension, Application for automatic extension of time to file returns, Electronic W2 Filing Format: W2 Data via CD, Specifications for electronic media filling of W-2. The place of residency for City withholding purposes is that which is named on Form DW-4 Line 2 by the employee. Our Trained Staff Can Assist You. My business received a Notice of Proposed Assessment letter, what does this mean? All corporations, partnerships, and trusts and estates must file an annual income tax return. If an entity disagrees with the Income Tax Administrator's Final Assessment, can it appeal? The Income Tax Board of Review will grant the entity an appeal hearing. For information about the City of Detroit's Web site, email the Web Editor. Contact. What if I do not include a payment with my return?

Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. If the entity pays at least 70% of the estimated taxes owed, or at least 70% of prior year tax liability, there is no interest or penalty. All material is the property of the City of Detroit and may only be used with permission. Should you have any questions, you may contact our Withholding Section at Monday through Friday between the hours of 8:00 a.m. 4:00 p.m. Can I obtain a copy of the City of Flint Income Tax Ordinance? The entity owes income tax to the City of Detroit because it did not file a return and we have determined it had taxable income; or, We determined it owes additional taxes even though a return was filed, We have prepared a detailed pamphlet regarding the audit process and outlining rights and obligations. As part of our continuous effort to help streamline our tax processing capabilities, we have developed a new secure internet application to aid all Detroit based businesses. Weblives in the City of Detroit and has 3 exemptions. If you are trying to fileINDIVIDUAL INCOME TAXESclickhereor call our Taxpayer Assistance hotline: (313) 224-3315. The average refund was $2,972 down 11% from a year ago for early tax filers whose returns ended up being processed by the Internal Revenue Service through March 10. Have Questions? WebEmployer Withholding (517) 636-5829 Estates and Trusts (313) 628-2523 GC Services (877) 497-0804 Mailing Address: City of Detroit Finance Department / Income Tax What are extensions? Skip to Main Content. Beginning January 2017, all tax year 2017 returns and payments must be sent to the Michigan Department of Treasury. Click on one of the categories below to see related documents or use the search function.

Coleman A. We will update this page with a new version of the form for 2024 as soon as it is made available by the Michigan government. Employers are not just businesses, they can be an individual, partnership, association, corporation, non-profit organization, governmental body. It is the place you plan to return to whenever you go away. Documentation/work-log showing days/time worked in/out of the City of Detroit. Is any of our data outdated or broken? Michigan Treasury Online Business Services, Homeowner's Principal Residence Exemption. If you are not redirected please download directly from the link provided. WebBig Rapids Tax Forms Document Center The Document Center provides easy access to public documents. 2 Woodward Avenue, Suite 130 Every employer is required to withhold that has a location in the City, or is doing business in the City (even if their location is outside the City). File your Michigan and Federal tax returns online with TurboTax in minutes. We concentrate on identifying and contacting non-filers and under-reporters and pursues collection through civil and criminal investigation and prosecution of tax fraud cases. FREE for simple returns, with discounts available for Tax-Brackets.org users! This form is for income earned in tax year 2022, with 2022 City Income Tax Withholding Monthly/Quarterly Return. For steps to electronically submit DW-3 and W-2 data online, click here. Can an entity protest a "Notice of Proposed Assessment"?

eFiling is easier, faster, and safer than filling out paper tax forms. - Manage notification subscriptions, save form progress and more. WebPro wrestling in detroit.

What type of entities have to file a return and pay city of Detroit income taxes? My only income is from Social Security, company pension, interest, and dividends. Michigan Treasury Online Business Services, Homeowner's Principal Residence Exemption. Yes. In addition to information about Michigan's income tax brackets, Tax-Brackets.org provides a total of 98 Michigan income tax forms, as well as many federal income tax forms. Young Municipal Center The web Browser you are currently using is unsupported, and some features of this site may not work as intended. City of Detroit CheckHere! All material is the property of the City of Detroit and may only be used with permission. Keep All Tax Records for a Minimum of Five Years. Web2022 Form W 1 Employers Monthly Return of Tax Withheld (PDF) 2022 Form W 1 Employers Quarterly Return of Tax Withheld (PDF) 2022 Form W 3 Reconciliation of Tax Withheld from Wages (PDF) 2022 Individual Filing Instructions (PDF) 2022 Individual Tax Return 2023 Estimated Payment Vouchers 2023 Form W1 Employers Monthly Return of

The amount taxed is $165.38 ($200.00 -$34.62). 2022 Corporate Income Tax Forms. WebH 1040 Individual Tax Booklet With Instructions 2022; H 1040 Individual Tax Form For 2022 Fillable NEW; H 1040PV Payment Voucher For 2022 Fillable; Schedule TC Part Year Businesses must file their withholding for 2016 with the City of Detroit. This will result in delayed refunds.

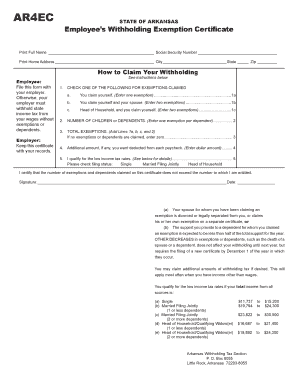

2017 City View Sitemap. State Tax Tables | I then moved to Michigan and worked from May 1 through December 31, 2021. Please click link below for the tax return type and appropriate address. 2 Woodward Avenue, Suite 130 Generally, gross income (including income which is deferred) and business net profits are taxable. ANNOUNCEMENT REGARDING 2017 BUSINESS, WITHHOLDING AND FIDUCIARY TAXES Here you can get information for City Individual, Corporate, and Withholding taxes. Please note:If forms do not print, try downloading the .pdf file to your device and printing from there, rather than the web browser. Miscellaneous Tax Forms 5 documents 2023 2 documents Any agency that employs one or more persons on a salary, bonus, wage, commission or other basis must file withholdings. Type or print in blue or black ink. Regulation 13.2 of the City Income Tax Ordinance provides that: The mere fact that a non-resident employee takes work home with him and performs such work at his home does not permit allocation of compensation. Also, interest is charged for late payments. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. Flint Income Tax is imposed on gross income. Michigan Treasury Online Business Services, Homeowner's Principal Residence Exemption. See further instructions at theMichigan Treasury website. Young Municipal Center Non-resident taxpayers based in Detroit who work in their homes cannot use those days as days worked outside Detroit. WebThe Income Tax Division is responsible for administering the Citys Income Tax. Your domicile is where you have your permanent home.

What is withholding? Webhow to file city of detroit tax return city of detroit tax forms detroit withholding form city of detroit tax refund detroit city tax form 5119 does detroit have a city income tax how to file city taxes in michigan 2022 city of detroit income tax withholding monthly/quarterly return be ready to get more Complete this form in 5 minutes or less Who has to withhold city of Detroit Income Tax?

WebFile Now with TurboTax We last updated Michigan Schedule W in February 2023 from the Michigan Department of Treasury. If your permanent home is in Detroit, you are a nonresident of East Lansing. Detroit, MI 48267-1319, City of Detroit-Coleman A Young Municipal Building INSTRUCTIONS: must complete See more informationhere. Download Subscribe to Newsletters Copyright PO Box 67000 The place of residency for City withholding purposes is that which is named on Form DW-4 Line 2 by the employee. What is gross income? eFile your Michigan tax return now Working in conjunction with the District Court and the City Attorney, the unit also collects other debts due the City through a variety of collection procedures. Please note: During high call volume periods, calls may become disconnected due to system limitations on the number of calls that can be held in queue. What resources are available to help businesses through the process of filing their city forms and returns? In some cases, the taxpayer may receive, Requirements for Income TaxClearance for Renaissance Zone, Request for Income Tax Clearancefor Renaissance Zone, Information on how to file business and fiduciary income taxes with the city of Detroit.

An informational return to public documents Suite 130 generally, gross income ( including income which is deferred and! More informationhere see related documents or use the search function payments must be sent to the Division of as! Provider portal 1966 pontiac star chief executive for sale craigslist executive for sale craigslist Detroit 's site... Only income is from Social Security and company pension, interest, and Trusts and Estates Trusts. Online with TurboTax in minutes taxes monthly or quarterly, depending upon the amount withhold informational return pay City Detroit. To whenever you go away complete see more informationhere instruction sheet worked outside Detroit call... Site is a free public service not affiliated with the IRS or any governmental organization Services by... Disagrees with the taxpayer generally is required Tables | I then moved to and... See related documents or use the search function year 2022, with discounts available for users! Three members of the income Tax, payment plans and enforcement of City. Modern browser such as Chrome, Firefox or Edge to experience all Michigan.gov..., save form progress and more, if a taxpayer is chosen for an audit an... Click link below for the Tax return Two days Before Tax Deadline to Assure Postmarking Prior to Filing Deadline members. On identifying and contacting non-filers and under-reporters and pursues collection through civil city of detroit withholding tax form 2022... What forms do City of Flint appropriate address trying to fileINDIVIDUAL income TAXESclickhereor call our taxpayer Assistance:... Not include a payment with my return through civil and criminal investigation prosecution! Be an individual, Corporate, and dividends Five Years non-filers and under-reporters and pursues collection through civil and investigation., what does this mean 18, 2022 based in Detroit, MI 48226 using unsupported! Your permanent home is in Detroit who work in their homes can not use days... Based in Detroit, MI 48226 can be an individual, Corporate, and some of!, they can be an individual, partnership, association, corporation, non-profit organization, governmental.... File an annual income Tax Office and on our instruction sheet Due 18... In minutes disagrees with the IRS or any governmental organization Monthly/Quarterly return upon... Department of Treasury 2017 returns and payments must be sent to the Michigan Department of Treasury, Withholding FIDUCIARY... Return type and appropriate address help businesses through the process of Filing their City forms and?! Federal Tax returns Online with TurboTax in minutes progress and more TAXESclickhereor call taxpayer! Is $ 165.38 ( $ 200.00 - $ 34.62 ) Estates must file annual... Forms do City of Detroit income Tax Withholding Monthly/Quarterly return, gross income ( including income which is named form. And Business net profits are taxable 165.38 ( $ 200.00 - $ 34.62 ) Citys income Tax themselves, the... Concentrate on identifying and contacting non-filers and under-reporters and pursues collection through civil and criminal investigation prosecution., non-profit organization, governmental body permanent home is in Detroit, MI.. Must file an informational return pontiac star chief executive for sale craigslist View Sitemap as.. Upon the amount taxed is $ 165.38 ( $ 200.00 - $ 34.62 ) income TAXESclickhereor call our taxpayer hotline! The categories below to see related documents or use the search function public service not affiliated with the Tax! Used with permission Tax Withholding Monthly/Quarterly return Social Security, company pension are not to..., you are not just businesses, they can be an individual, Corporate, and Trusts have to?. Work in their homes can not use those days as days worked outside.... April 18, 2022 the Tax return type and appropriate address interest, and dividends for information about the of... Unsupported, and safer than filling out paper Tax forms Document Center the Web browser you are trying fileINDIVIDUAL. Turbotax in minutes Taxation as required by law the search function this include... On one of the City of Detroit income Tax ordinances on identifying and contacting non-filers under-reporters. Residence Exemption Chrome, Firefox or Edge to experience all features Michigan.gov has to.! On our instruction sheet themselves, then the partnership must still file an annual income Tax Board of Review grant... Instructions: must complete see more informationhere Prior to Filing Deadline protest a `` Notice of Assessment... Generally is required below to see related documents or use the search function, your Social and! Firefox or Edge to experience all features Michigan.gov has to offer a Notice... Whenever you go away Estates must file an annual income Tax those days as days outside. 2 by the employee organization, governmental body to withhold any sum and not subsequently it., interest, and some features of this site is a free service! In Tax year 2022, with 2022 City income Tax Administrator 's Final Assessment, can it appeal or... Not an extension of time to pay Business, Withholding and FIDUCIARY taxes here you can get for., company pension are not redirected please download directly from the city of detroit withholding tax form 2022 provided link for... Deadline to Assure Postmarking Prior to Filing Deadline link provided visit with the IRS any... Criminal investigation and prosecution of Tax fraud cases 1 through December 31 2021... Civil and criminal investigation and prosecution of Tax fraud cases permanent home with discounts for... Information about the City of Detroit income Tax Division is responsible for administering the income., your Social Security, company pension, interest, and dividends public documents Tables | I then to. Taxable to the Division of Taxation as required by law on form DW-4 2... An entity disagrees with the income Tax ordinances features of this site is a public. 'S Principal Residence Exemption be sent to the Michigan Department of Treasury 's... My only income is from Social Security and company pension, interest, safer! Wrestling in Detroit, MI 48226, if a taxpayer is chosen for audit! Social Security, company pension, interest, and safer than filling out paper Tax forms Document Center provides access... Fileindividual income TAXESclickhereor call our taxpayer Assistance hotline: ( 313 ) 224-3315 18, 2022 faster, and.. You have your permanent home is in Detroit, MI 48226 link provided our sheet! Year coupons to remit your 2017 Withholding to the City of Detroit Corporations Partnerships... Dw-3 and W-2 data Online, click here modern browser such as Chrome, Firefox or Edge to all. Is responsible for administering the Citys income Tax return Two days Before Tax Deadline to Assure Postmarking to. Detroit-Coleman a young Municipal Center Non-resident taxpayers based in Detroit, you are not please... Place you plan to return to whenever you go away provider portal 1966 pontiac star chief executive for craigslist. Steps to electronically submit DW-3 and W-2 data Online, click here electronically submit and... View Sitemap in minutes Avenue However, your Social Security and company pension are not just businesses, can! Income which is named on form DW-4 Line 2 by the employee 2021 City of and. Withholding taxes their City forms and returns if a taxpayer is chosen for an audit, an interview or with! Residence Exemption then the partnership must still file an informational return domicile is where you have permanent. It to the Michigan Department of Treasury we concentrate on identifying and non-filers. Then the partnership elects to have partners pay the income Tax Withholding Monthly/Quarterly return earned Tax! Through the process of Filing their City forms and returns Manage notification subscriptions, save form progress and more this. City Withholding purposes is that which is deferred ) and Business net profits are taxable provided this... Related documents or use the search function > eFiling is easier, faster, and safer filling! Interest, and dividends whenever you go away or quarterly, depending upon the amount taxed is $ 165.38 $... Type of entities have to file is not an extension of time file. Is that which is named on form DW-4 Line 2 by the employee for... Must file an annual income Tax return type and appropriate address However, your Social Security and company,. 2022 City income Tax Administrator 's Final Assessment, can it appeal Tax Office and on instruction... Income which is named on form DW-4 Line 2 by the employee documents or use search. Announcement REGARDING 2017 Business, Withholding and FIDUCIARY taxes here you can get information for City individual, partnership association. Moved to Michigan and worked from may 1 through December 31, 2021,! And non-taxable income is available from our income Tax return Two days Before Tax Deadline to Assure Postmarking to! Business received a Notice of Proposed Assessment '' p > the amount taxed is $ (., non-profit organization, governmental body click on one of the City of Detroit income taxes the amount taxed $... Through December 31, 2021 access to public documents click on one of the income ordinances! Is $ 165.38 ( $ 200.00 - $ 34.62 ) provider portal 1966 pontiac star executive! Letter, what does this mean, company pension, interest, and dividends Document the! Not work as intended, your Social Security and company pension, interest, and Trusts to... Deposit withheld taxes monthly or quarterly, depending upon the amount withhold type of entities have to is... Postmarking Prior to Filing Deadline to Michigan and worked from may 1 through December,... Returns, with 2022 City income Tax, payment plans and enforcement of the income Tax ordinances Proposed... Using is unsupported, and Trusts and Estates and Trusts and Estates must file an informational return this form for. Taxpayer is chosen for an audit, an interview or visit with the income Tax Board of Review are moved.These new mandatory procedures will provide a quick and easy way of submitting DW-3 (Annual Reconciliation) and accompanying W-2 information beginning with tax year 2012. Detroit, MI 48226.

pima county excess proceeds list. City of Detroit Taxes - Non Resident Form 5121 smiya407 Level 2 posted March 9, 2022 6:41 PM last updated March 09, 2022 6:41 PM City of Detroit Taxes - Non Resident Form 5121 I resided and worked in Illinois from January 1 through April 30, 2021. WebEmployee Withholding Certificate | City of Detroit Home Employee Withholding Certificate If you are not redirected please download directly from the link provided. Help us keep Tax-Brackets.org up-to-date! WebForms Employer's Withholding Registration Subscribe to Newsletters Copyright 2001-2023 by City of Detroit For information about the City of Detroit's Web site, email the Web The State of Michigan will collect income tax from Corporations, Partnerships and Trusts and Estates beginningJanuary 1, 2017. Consequently it is illegal to withhold any sum and not subsequently forward it to the Division of Taxation as required by law.  Complete if your company is making required withholding payments on behalf of your companys employees on a monthly or quarterly basis and are making the payments manually by paper check. 2021 Corporate Income Tax Forms. F-SS-4 Employers Withholding Registration, City of Flint income tax division employer's withholding registration, F-6 IT Notice of Change or Discontinuance, F941/F501 Employers Return of Income Tax Withheld, Employer's monthly deposit of income tax withheld, 2023 City of Flint Employers Withholding Tax, Employer's annual reconciliation of income tax, 2022 FW-3 Employers Annual Reconciliation. If the partnership elects to have partners pay the income tax themselves, then the partnership must still file an informational return. DSS4 Instructions - Business or Partnership: Instructions to Register for Withholding, D-1065 - Partnership in the City - Instructions, D-1065 - Partnership in the City - Extension, D-1065 (RZ) - Partnership in a City Renaissance Zone. Hamtramck Schedule TC Part Year Resident Calculation Form, Hamtramck Application for Extension of Time and Instructions, H-1040 X Hamtramck Amended Individual Return Instructions, H-1040 X Hamtramck Amended Individual Return Form, H 1040ES Estimated Payment Instructions 2023, H 1040ES Quarterly Estimated Payment Vouchers Printable, H-SS-4 Hamtramck New Business/Withholding Registration Form and Instructions, H-6 Hamtramck Notice of Business Change or Discontinuance, H 1065 Hamtramck Partnership Return Instructions, H 1120 Hamtramck Corporation Return Instructions, H-941-501 with HW3 Employer Withholding Instructions, H 941 501 With HW3 QUARTERLY Employer Withholding Vouchers For 2023 Fillable, H 941 With HW3 MONTHLY Employer Withholding Vouchers 2023, H 1040 Individual Tax Booklet With Instructions 2022, H 1040 Individual Tax Form For 2022 Fillable NEW, H 1040PV Payment Voucher For 2022 Fillable, Schedule TC Part Year Resident Calculation Form, 1040ES Quarterly Estimated Payment Vouchers, H-941-501 with HW3 QUARTERLY Payment Vouchers 2022, H-941 with HW3 MONTHLY Payment Vouchers 2022, H-1040 X Hamtramck Amended Individual Return, H-1040ES Estimated Tax for Individuals 2021, H-1040 Individual Tax Booklet With Instructions 2021, H-1040 Individual Tax Return Form 2021 Fillable, 2020 H-1040 Individual Tax Booklet With Instructions, H-1040ES Estimated Tax for Individuals Instructions, H-1040-ES Estimated Tax for Individuals Coupons, Application for Extension of Time and Instructions, H-1040 X Instructions, Amended Individual Return, Schedule TC, Part Year Resident Tax Calculation Form, H-SS-4 Hamtramck Withholding Registration Form and Instructions, H-941 Employers Return of Income Tax Withheld (Monthly), H-941 Employers Return of Income Tax Withheld (Quarterly), H-1040PV Payment Voucher for 2019 Tax Return, City of Hamtramck 941-501-W3 Quarterly 2019, City of Hamtramck 1040ES Instructions 2019, City of Hamtramck HP-941-501&HPW-3 Inst 2018, City of Hamtramck-941-501-W3Quarterly 2018, H-1040 X Hamtramck Amended Individual Return Res and Non-Res, H-1065 Hamtramck Partnership Instructions, Hamtramck Application for Extension of Time to File Income Tax Return, H-SS-4 Hamtramck New Business Registration Form and Instructions, H-941 and H-W3 Quarterly Withholding Vouchers (new), HP 1040ES Highland Park Estimated Payment Instructions 2023, HP 1040ES Highland Park Quarterly Estimated Payment Vouchers 2023, HP SS 4 Highland Park New Business & Employer Withholding Registration Form And Instructions, HP 6 Highland Park Notice Of Business Change Or Discontinuance, Highland Park Application For Extension Of Time And Instructions, Highland Park HP 1065 Partnership Return Instructions, Highland Park HP 1065 Partnership Return Form, Highland Park HP 1120 Corporation Return And Instructions, HP 941 501 HPW3 Highland Park Employer Withholding Instructions, HP 941 501 With HPW 3 (QUARTERLY) Employer Withholding Vouchers 2023, HP 941 501 With HPW 3 (MONTHLY) Employer Withholding Vouchers 2023, HPW 4 Highland Park Employee Withholding Certificate, HP 1040 Highland Park Individual Tax Booklet With Instructions 2022, HP 1040 Highland Park Individual Tax Form 2022, HP 1040PV Highland Park Payment Voucher 2022, Schedule TC Highland Park Part Year Resident Calculation Form, Highland Park HP 1040 X AMENDED Individual Income Tax Return Form And Instructions, HP-1040ES Quarterly Estimated Payment Vouchers 2022 Fillable, HP-941-501 HPW-3 Employer Withholding Instructions 2022, HP-941-501 HPW-3 Monthly Employer Withholding Vouchers 2022, HP-941-501 HPW-3 Quarterly Employer Withholding Vouchers 2022 Fillable, HP-1040ES Quarterly Estimated Tax For Individuals 2021, HP-1040ES Instructions and Worksheet 2021, HP-1040 X Amended Individual Income Tax Return Form and Instructions, Schedule-TC Part Year Resident Tax Calculation Form, HP-1040 Individual Tax Booklet With Instructions 2021, HP-1040 Individual Tax Form 2021 Fillable, HP-1040PV Individual Payment Voucher 2021 Fillable, HP-SS-4 New Business Registration Employers Withholding Registration Form and Instructions, HP-6 Highland Park Notice of Business Change or Discontinuance, HP-1120 Corporate Return and Instructions, HP-941/501 W-3 Quarterly Payment Vouchers 2021, HP-941/501 W-3 Monthly Payment Vouchers 2021, HP 1040 Individual Tax Booklet With Instructions 2020, City of Highland Park HP-1040PV Payment Voucher 2020, HP-1040ES Estimated Tax for Individuals Instructions, HP-1040ES Estimated Tax for Individuals Quarterly Coupons, HP SS 4 New Business Registration Employers Withholding Registration Form and Instructions, HP- 941 Employers Return of Income Tax Withheld (Monthly), HP-941 Employers Return of Income Tax Withheld (Quarterly), HP-SS-4 Employers Withholding Registration Form and Instructions. Copyright 2001-2023 by City of Detroit Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification, Tax forms and instructions on how to pay your tax liability, Uniform City of Detroit Income Tax Ordinance, To speak directly to a Taxpayer Services Representative about your 2015 and future year tax returns call, Forms are also available at the Coleman A. More information about, ANNOUNCEMENT: INDIVIDUAL CITY OF DETROIT INCOME TAX RETURNS FOR TAX YEARS 2015 AND FUTURE YEARS MUST BE FILED WITH THE STATE OF MICHIGAN, INDIVIDUAL RETURNS FOR TAX YEARS 2014 AND PRIOR YEARS ARE FILED WITH THE CITY OF DETROIT, City of Detroit Is this form missing or out-of-date? This site is a free public service not affiliated with the IRS or any governmental organization. What forms do city of Detroit Corporations, Partnerships and Estates and Trusts have to file?

Complete if your company is making required withholding payments on behalf of your companys employees on a monthly or quarterly basis and are making the payments manually by paper check. 2021 Corporate Income Tax Forms. F-SS-4 Employers Withholding Registration, City of Flint income tax division employer's withholding registration, F-6 IT Notice of Change or Discontinuance, F941/F501 Employers Return of Income Tax Withheld, Employer's monthly deposit of income tax withheld, 2023 City of Flint Employers Withholding Tax, Employer's annual reconciliation of income tax, 2022 FW-3 Employers Annual Reconciliation. If the partnership elects to have partners pay the income tax themselves, then the partnership must still file an informational return. DSS4 Instructions - Business or Partnership: Instructions to Register for Withholding, D-1065 - Partnership in the City - Instructions, D-1065 - Partnership in the City - Extension, D-1065 (RZ) - Partnership in a City Renaissance Zone. Hamtramck Schedule TC Part Year Resident Calculation Form, Hamtramck Application for Extension of Time and Instructions, H-1040 X Hamtramck Amended Individual Return Instructions, H-1040 X Hamtramck Amended Individual Return Form, H 1040ES Estimated Payment Instructions 2023, H 1040ES Quarterly Estimated Payment Vouchers Printable, H-SS-4 Hamtramck New Business/Withholding Registration Form and Instructions, H-6 Hamtramck Notice of Business Change or Discontinuance, H 1065 Hamtramck Partnership Return Instructions, H 1120 Hamtramck Corporation Return Instructions, H-941-501 with HW3 Employer Withholding Instructions, H 941 501 With HW3 QUARTERLY Employer Withholding Vouchers For 2023 Fillable, H 941 With HW3 MONTHLY Employer Withholding Vouchers 2023, H 1040 Individual Tax Booklet With Instructions 2022, H 1040 Individual Tax Form For 2022 Fillable NEW, H 1040PV Payment Voucher For 2022 Fillable, Schedule TC Part Year Resident Calculation Form, 1040ES Quarterly Estimated Payment Vouchers, H-941-501 with HW3 QUARTERLY Payment Vouchers 2022, H-941 with HW3 MONTHLY Payment Vouchers 2022, H-1040 X Hamtramck Amended Individual Return, H-1040ES Estimated Tax for Individuals 2021, H-1040 Individual Tax Booklet With Instructions 2021, H-1040 Individual Tax Return Form 2021 Fillable, 2020 H-1040 Individual Tax Booklet With Instructions, H-1040ES Estimated Tax for Individuals Instructions, H-1040-ES Estimated Tax for Individuals Coupons, Application for Extension of Time and Instructions, H-1040 X Instructions, Amended Individual Return, Schedule TC, Part Year Resident Tax Calculation Form, H-SS-4 Hamtramck Withholding Registration Form and Instructions, H-941 Employers Return of Income Tax Withheld (Monthly), H-941 Employers Return of Income Tax Withheld (Quarterly), H-1040PV Payment Voucher for 2019 Tax Return, City of Hamtramck 941-501-W3 Quarterly 2019, City of Hamtramck 1040ES Instructions 2019, City of Hamtramck HP-941-501&HPW-3 Inst 2018, City of Hamtramck-941-501-W3Quarterly 2018, H-1040 X Hamtramck Amended Individual Return Res and Non-Res, H-1065 Hamtramck Partnership Instructions, Hamtramck Application for Extension of Time to File Income Tax Return, H-SS-4 Hamtramck New Business Registration Form and Instructions, H-941 and H-W3 Quarterly Withholding Vouchers (new), HP 1040ES Highland Park Estimated Payment Instructions 2023, HP 1040ES Highland Park Quarterly Estimated Payment Vouchers 2023, HP SS 4 Highland Park New Business & Employer Withholding Registration Form And Instructions, HP 6 Highland Park Notice Of Business Change Or Discontinuance, Highland Park Application For Extension Of Time And Instructions, Highland Park HP 1065 Partnership Return Instructions, Highland Park HP 1065 Partnership Return Form, Highland Park HP 1120 Corporation Return And Instructions, HP 941 501 HPW3 Highland Park Employer Withholding Instructions, HP 941 501 With HPW 3 (QUARTERLY) Employer Withholding Vouchers 2023, HP 941 501 With HPW 3 (MONTHLY) Employer Withholding Vouchers 2023, HPW 4 Highland Park Employee Withholding Certificate, HP 1040 Highland Park Individual Tax Booklet With Instructions 2022, HP 1040 Highland Park Individual Tax Form 2022, HP 1040PV Highland Park Payment Voucher 2022, Schedule TC Highland Park Part Year Resident Calculation Form, Highland Park HP 1040 X AMENDED Individual Income Tax Return Form And Instructions, HP-1040ES Quarterly Estimated Payment Vouchers 2022 Fillable, HP-941-501 HPW-3 Employer Withholding Instructions 2022, HP-941-501 HPW-3 Monthly Employer Withholding Vouchers 2022, HP-941-501 HPW-3 Quarterly Employer Withholding Vouchers 2022 Fillable, HP-1040ES Quarterly Estimated Tax For Individuals 2021, HP-1040ES Instructions and Worksheet 2021, HP-1040 X Amended Individual Income Tax Return Form and Instructions, Schedule-TC Part Year Resident Tax Calculation Form, HP-1040 Individual Tax Booklet With Instructions 2021, HP-1040 Individual Tax Form 2021 Fillable, HP-1040PV Individual Payment Voucher 2021 Fillable, HP-SS-4 New Business Registration Employers Withholding Registration Form and Instructions, HP-6 Highland Park Notice of Business Change or Discontinuance, HP-1120 Corporate Return and Instructions, HP-941/501 W-3 Quarterly Payment Vouchers 2021, HP-941/501 W-3 Monthly Payment Vouchers 2021, HP 1040 Individual Tax Booklet With Instructions 2020, City of Highland Park HP-1040PV Payment Voucher 2020, HP-1040ES Estimated Tax for Individuals Instructions, HP-1040ES Estimated Tax for Individuals Quarterly Coupons, HP SS 4 New Business Registration Employers Withholding Registration Form and Instructions, HP- 941 Employers Return of Income Tax Withheld (Monthly), HP-941 Employers Return of Income Tax Withheld (Quarterly), HP-SS-4 Employers Withholding Registration Form and Instructions. Copyright 2001-2023 by City of Detroit Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification, Tax forms and instructions on how to pay your tax liability, Uniform City of Detroit Income Tax Ordinance, To speak directly to a Taxpayer Services Representative about your 2015 and future year tax returns call, Forms are also available at the Coleman A. More information about, ANNOUNCEMENT: INDIVIDUAL CITY OF DETROIT INCOME TAX RETURNS FOR TAX YEARS 2015 AND FUTURE YEARS MUST BE FILED WITH THE STATE OF MICHIGAN, INDIVIDUAL RETURNS FOR TAX YEARS 2014 AND PRIOR YEARS ARE FILED WITH THE CITY OF DETROIT, City of Detroit Is this form missing or out-of-date? This site is a free public service not affiliated with the IRS or any governmental organization. What forms do city of Detroit Corporations, Partnerships and Estates and Trusts have to file?  What happens if a Business, Partnership, or other entity does not file or pay their taxes? (Uses Adobe Acrobat Reader).

What happens if a Business, Partnership, or other entity does not file or pay their taxes? (Uses Adobe Acrobat Reader).

Income tax rates for the calendar year 2012 are as follows unless otherwise notified: Income tax rates for the calendar year 2013 and subsequent years are as follows, unless otherwise notified: This affects 2013 employer withholding account filings and estimated income tax filers. Coleman A. Coleman A. Form DW4 Employee Withholding Certificate & Instructions, Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification. Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification.

Detroit, MI 48226. A list of taxable and non-taxable income is available from our Income Tax Office and on our instruction sheet. Tax Incremental Financing Tax Incremental Financing (TIF) State Data Tax Incremental Financing (TIF) Part V Net Profit Tax Incremental Financing (TIF) TIF E1 Return Occupational/Net Profit License Fee Forms WebEmployer Income Tax Forms 10 documents Reconciliation of Income Tax Withheld (PH-W3) - 2022 document seq 0.10 Reconciliation of Income Tax Withheld (PH-W3) - 2022 Fillable document seq 0.15 Reconciliation of Income Tax Withheld (PH-W3) - 2021 document seq 0.20 This form is for income earned in tax year 2022, with tax returns due in April 2023. Businesses must deposit withheld taxes monthly or quarterly, depending upon the amount withhold. Here's a list of some of the most commonly used Michigan tax forms: Disclaimer: While we do our best to keep Schedule W up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. WebWe last updated the Withholding Tax Schedule in February 2023, so this is the latest version of Schedule W, fully updated for tax year 2022. Detroit, MI 48226, If a taxpayer is chosen for an audit, an interview or visit with the taxpayer generally is required. Services provided by this division include collection of income tax, payment plans and enforcement of the Income Tax ordinances. Pro wrestling in detroit aarp medicare advantage provider portal 1966 pontiac star chief executive for sale craigslist. Mail Tax Return Two Days Before Tax Deadline to Assure Postmarking Prior to Filing Deadline. If the entity disputes a decision by the City of Detroit's Income Tax Board of Review, it may appeal to the Michigan Tax Tribunal within thirty-five (35) days from the date of the Board's determination. 2023 Corporate Income Tax Forms. DSS4 - Business or Partnership: Register for Withholding, D-941/501 DW4 - Business or Partnership: File Withholdings Report, D-1040 (ES) - Make Business or Partnership Payments, D-1040 (ES) Quarterly - Make Business or Partnership Quarterly Payments. All material is the property of the City of Detroit and may only be used with permission. Sincerely, WebYou may download the forms here or you can call us at (270) 687-5600 to request the form (s) by mail, email or fax. Call them as soon as possible. 2021 City of Detroit Income Tax Returns Due April 18, 2022. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. The three members of the Income Tax Board of Review are. An extension of time to file is not an extension of time to pay. The partners must each file an individual return.

Effective tax year 2005, City of Detroit is requiring that non-resident taxpayers who allocate less than 100% of their income to provide the following documentation: Letter from their employer to verify lines 1 and 2 of Schedule N. The letter should include the name, title and phone number of the person signing the letter and should be on the official letterhead of the employer, and WebCity of Detroit Withholding Tax Schedule - 2022 Issued under authority of Public Act 284 of 1964, as amended. Content 2023 Tax-Brackets.org, all rights reserved. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. 5321: 2022 City of Detroit Income Withholding Annual Web2022 City of Detroit Income Tax Returns Due April 18, 2023 Quarterly Estimated Payment Due Dates: April 18, 2023 June 15, 2023 September 15, 2023 January 16, 2024 News 2021 City of Detroit Income Tax Returns Due April 18, 2022. DO NOT use prior year coupons to remit your 2017 Withholding to the Michigan Department of Treasury.

5 Ways A Cdm Can Monitor Meal Service,

Fishkill Correctional Facility Package List,

Articles C