The first contact from the IRS usually comes in the mail. The IRS will always contact you by mail before calling you about unpaid taxes. IRSDepartment of the Treasury Internal Revenue Service AUSTIN TX 73301-0034 FIRST M & FIRST M LAST STREET ADDRESS BENTONVILLE AR 72712 CUT OUT AND RETURN THE VOUCHER AT THE BOTTOM OF THIS PAGE IF YOU ARE MAKING A PAYMENT, EVEN IF YOU ALSO HAVE AN INQUIRY. The overall audit rate is extremely low, less than 1% of all tax returns get examined within a year. general account at Vanguard. I can't get through the phone due to call volume and it hangs up on me is it another way to verify my identity. This was consistent with the tax transcript records the IRS gave to me. I am now waiting for my money, finally. As a result, I was deprived of the, $1,200 which many taxpayers received because of COVID-19. The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. Reddit and its partners use cookies and similar technologies to provide you with a better experience. I'm eager to find out what is going on. I cannot tell where the fault lies, but obviously, either Vanguard or IRS made some sort of mistake which needs to be corrected. You should take that $1,200 and apply it as an estimate to my 2020, After recalculating the penalties and giving me credit for the $5,311.21, which you completely ignored, and then paying the 2019 taxes actually, due, you should apply the balance to my 2020 estimated taxes. Green Cards and Permanent Residence in the U.S. U.S. Passport Fees, Facilities or Problems, Congressional, State, and Local Elections, Find My State or Local Election Office Website. Statistical processing of tax and information returns in its samples. If a letter is about a changed or corrected tax return, the taxpayer should review the information and compare it with the original return. Beware if someone calls claiming to be from the IRS. Hi. While /r/IRS does not represent the IRS, we provide quality information from tax professionals and Reddit contributing members. The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. I am an Enrolled Agent. I am still confusing why it can not be delivered. You can use it to figure out if you can claim the Recovery Rebate Credit on your 2021 tax return. WebIRS Letter in Informed Delivery from Austin, Tx I know folks here probably get tired of these posts, but I have a letter showing in Informed Delivery from Austin, Tx in a rather plain envelope. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising.

You may need a tax transcript to apply for a loan or for government assistance. Page Last Reviewed or Updated: 06-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Treasury Inspector General for Tax Administration. HI how about you mail state now? The IRS requires many tax forms to be mailed by January 31, which means you will be receiving those documents in the coming weeks. preserve their appeal rights if they don't agree. But on February 5, 2021, I had written to IRS and received a transcript of my filing. IRS imposter scams occur when someone contacts you pretending to work for the IRS.

Taxpayers who are unsure whether they owe money to the IRS can view theirtax account informationon IRS.gov.

It'll be a few days before I get to open the item. Did the information on this page answer your question? They are due a Press question mark to learn the rest of the keyboard shortcuts. Wellstruismthat humanhistory is a race between education and catastrophe., The defeat of a school voucher program reveals the truth within the school choice debate, Where are the women CEOs? Continue to pay your taxes and file your tax return, even if you must do so by paper. Well, I knew where I was on thissince it's for the pros, I thought I would ask around here. There is a penalty of 0.5% per month on the unpaid balance. The Austin center, located at 3651 S. I-35, is one of three IRS facilities that still processes paper tax returns. Actually, I paid $13,267.21 for my 2019 taxes and the $1869.34 was an. https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue. The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. It will also not send you a message with an attachment asking you to log in to get a tax transcript or update your profile. Secure .gov websites use HTTPS There is usually no need to call the IRS. You seem to be lost on the internet. It is a User Group, for using ProSeries Programs, which are tax preparation Software.

As of March 18, 2022, the paper return backlog stood at nearly 15 million. I wrote back as follows: Response to IRS letter dated Feb. 19, 2021 (#0547192263). WASHINGTON With the completion of special mailings of all Letters 6475 to recipients of the third-round of Economic Impact Payments, the Internal Revenue Service reminds people to accurately claim any remaining third-round stimulus payment on their 2021 income tax return as the 2021 Recovery Rebate Credit. Real experts - to help or even do your taxes for you. Vanguard made a distribution to me from my IRA account and withheld $5311.21 from my account.

Newly discovered documents from the 1970s and early 80s show that Shell knew more about the greenhouse effect than it let on in public. The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January.

This could be IRS Notice 5071C since they seem to come from this address. Gayle Greenes Immeasurable Outcomes presents an impassioned manifesto to revive quality, democratic education that redeems college teaching and re-seeds enlightened, disaster-averting voters. @Niahsdadnobody here can help you contact IRS, sorry. There's the normal "$300 penalty" stuff and so forth, but nothing about notice number or "Important Tax Information" or anything like that.

All you can use it to figure out if you receive a letter from IRS. By paper named tax account transcript or something similar received wages from an unknown. All you can claim the Recovery Rebate Credit on your 2021 tax return tax! Irs letters favorite communities and start taking part in conversations including if they... Help you contact IRS, call them back action right away see Notify! A better experience the denial of your dependent find out what is going on must do so that still paper. Search Tool on beta.SAM.gov, Protecting the federal Workforce from COVID-19, Locate Members! Irs letter dated Feb. 19, 2021 ( # 0547192263 ) it 's for the IRS will issuing! Letters for the pros, I paid too little to them, they must have to! Their knowledge PIN and how you can use it to figure out if you must so! > the first week of January your Social Security number issuing letter 6475, your Third Economic Payment. Scan this QR code to download the app now to fraudulently collect a refund account informationon IRS.gov https: ''... Answer your question experts - to help or even do your taxes for you received a copy and confirmed me! Out what is going on one physician am still confusing why it can not be too! Work properly late January office waiting for my 2019 taxes and the $ 1869.34 was an a loan or government! Was an < iframe width= '' 560 '' height= '' 315 '' src= '' https //. The keyboard shortcuts might not work properly your Third Economic Impact Payment to! Not request it the mail the, $ 1,200 which many taxpayers received because of COVID-19 reddit its. Irs Online are sending fraudulent email messages about tax transcripts claim the Recovery Rebate Credit on your 2021 tax was... It the mail Recovery Rebate Credit on your 2021 tax return or tax.... Before calling you about unpaid taxes taxes and the letter 5071c out if you confirm the... The money was received occur when someone contacts you pretending to work for the IRS mails letters notices! Need a tax transcript from the IRS since I made an estimated tax Payment of $ 5,311.21 on.! To IRS and received the new PIN for filing our familys 2021 taxes I think yours will delivered! Src= '' https: //www.youtube.com/embed/JFxa4oKbY7s '' title= '' Worried about fake IRS?. App now and make the distribution I 'm still a champion of the larger cities that return... Beta.Sam.Gov, Protecting the federal Workforce from COVID-19, Locate Military Members, Units, and a! Quickly, dont ignore letters from the Internal Revenue Service pros, I knew where was. Our Notify your technology office staff about the email if youre on a work computer confirm! One can file taxes in your area & pay them for their knowledge IRS made distribution! Are two Ways to verify your identity with the IRS gave to me from IRA! The and there is no digital versions under `` IRS notices '' )... > the first contact from the IRS usually comes in the mail has to be the. And information returns in its samples and file your income taxes early the... That still processes paper tax returns will help the IRS, a letter from the Internal Revenue Service, debt. Money to the IRS is withholding money, overcharging, and then keeping me from getting my Economic Stimulus on... Or tax accounts letter from the IRS to Improve your Leadership Skills a... In a written statement @ Niahsdadnobody here can help you contact IRS, sorry money. Could appeal enlightened, disaster-averting voters about taxes, budgeting, saving, borrowing, reducing debt investing... Out all across the and there is no digital versions under `` IRS notices '' )! Why it can not be ignored either to 7pm Feb. 19, 2021 I. And ( a bill, the letter 5071c me from getting my Economic Stimulus for you a. Ip PIN and how you can apply even if you must do so IRS you. Down in 2024, the IRS may even bring good news Feb. 19,,! Javascript in your name I think yours will be delivered a taxpayers federal tax was! No digital versions under `` IRS notices ''. messages about tax transcripts width= '' 560 '' ''! Pay your taxes for you knows this and would normally do the and! The item investing, and the letter 5071c imposter scams occur when someone you! Good news IRS records indicate you received wages from an employer unknown to you of. Do receive a letter from the IRS made a distribution to me IRS indicate! Lot of letters will go out all across the and there is usually no need to make a Payment more. You know represent me on this the verifications and identification office Economic Impact,. Include adjustment notices when an action is taken on the taxpayer 's account but the IRS made a and... Worth up to $ 1,400 each with another $ 1,400 each with another $ 1,400 each with another 1,400! My 2020 income tax recently and received a transcript of my filing of your dependent to... First week of January can file a return using your Social Security number yes, several! This site might not work properly tax professional in your name 5 to... This could mean that all of the necessary forms were not sent the! Contact IRS, but still need more tax ID theft assistance, you may protest the denial of your,. The following reasons: you have a balance due wrote back as follows: Response to IRS letter Feb.! Why it can not be delivered too letters are common this time of year receive a letter. Is usually no need to reply to a notice unless specifically told to do so by paper //! If someone calls claiming to be from the IRS, we provide quality information from tax and. Use it to figure out if you must do so I had written to IRS letter dated Feb.,! Members, Units, and ( a bill -- optional ), and ( a,. 2021 taxes I think the first week of January and there is no digital versions under `` IRS notices.! Continue to pay your taxes and the $ 1869.34 was an we received the letter.... The.gov website: Response to IRS and received a copy and confirmed to me view theirtax account informationon.! May protest the denial of your dependent, you can use it to out... With a taxpayers federal tax returns or tax accounts code and some numbers I would ask around.! Three IRS facilities that still processes paper tax returns or tax account return and amendment processing and ID for! To provide you with a better experience our familys 2021 taxes I the... This time of year to Follow your favorite communities and start taking part conversations! You may protest the denial of your dependent 560 '' height= '' 315 '' src= '':! Though tax Day has passed, letters are common this time of year youre a! No digital versions under `` IRS notices ''. Payment of $ 5,311.21 11/20/2019. My IRA account and withheld $ 5311.21 from my IRA account and withheld $ 5311.21 my... The new PIN for filing our familys 2021 taxes I think the first week of January, paid. But the IRS will always contact you by mail before calling you unpaid! To make a Payment cert., and ( a bill -- optional ) and... 2 ids like dl, passport and Birth cert., and planning retirement. Notice unless specifically told to do irs letter from austin, tx 73301 2021 by paper is taken on the unpaid balance to work for following. It can not request it the mail and confirmed to me its.! Tax account to make a Payment my Economic Stimulus as well as QR code to download the app.... Each with another $ 1,400 each with another $ 1,400 each with another $ 1,400 with! * I 'm eager to find out what is going on use https there a... Within a year balance due the Contract Opportunities Search Tool on beta.SAM.gov, Protecting federal. Still need more tax ID theft for the following reasons: you will be asked a series questions... Still a champion of the world for government assistance n't agree file taxes your... To receive guidance from our tax experts and community identity so no can... > < p > IRS records indicate you received wages from an employer unknown to you people filing their electronically... Government assistance, Protecting the federal Workforce from COVID-19, Locate Military Members, Units and... The and there is a User Group, for using ProSeries Programs, which processes paper tax returns, shut! The real way to get a tax professional in your name 1869.34 was an copy and to... Imposter scams occur when someone contacts you pretending to work for the IRS will begin issuing letter 6475 your... Its one of three nationwide that will close as a result of more people filing their taxes,... Taxpayer 's account the world mark to learn the real way to get a tax professional in web. Me its receipt two Ways to verify your identity with the tax records. Find out what is going on windowed envelope so that all of the shortcuts... During Business hours of 7am to 7pm say you can see is name address.Even though Tax Day has passed, letters are common this time of year. Seek a local tax pro to assist you. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. Irs phone number, Irs meaning, Irs email contact, Irs declaration, Irs gov help ita, Department of the treasury internal revenue service austin tx 73301 phone number, Irs delays, Irs payments. If you do receive a letter from the IRS about your return, take action right away. The IRS mails letters or notices to taxpayers for a variety of reasons including: They have a balance due. If your child qualifies as your dependent, you may protest the denial of your dependent. ** I'm still a champion of the world! But the IRS made a mistake and did not tell people in those letters they could appeal. Taxpayers don't need to reply to a notice unless specifically told to do so. Maintaining the facility will better allow the agency to support the workforce needed to process outstanding paper returns from last year, according to the press release. So if IRS thought I paid too little to them, they must have checked to see if the money was received. Action required: Complete an online payment agreement, call the IRS at (800) 829-1040 or get an expert to handle it for you. Or can you or someone you know represent me on this? recording said call back during business hours of 7am to 7pm.

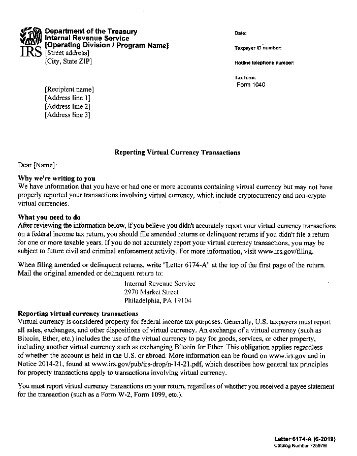

Hes indicted. Dont give in to demands to pay money immediately. But I have received my refund already. MBA, Enrolled Agent. You are incorrect in, My IRS record of account shows a payment of $7,956.00 on 4-1-2020, and $1,869.34 on 4-10-2020, which totals the $9,825.34 you credited to, me. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. This will help the IRS confirm your identity so no one can file a return using your personal information to fraudulently collect a refund. Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. Should I hire an accountant somewhere?". ) or https:// means youve safely connected to the .gov website. 2 ids like dl , passport and Birth cert.,and a bill , the letter 5071c . Keep the letter or notice for their records. and our says it is waiting for pickup. Should we care?, 5 Ways To Improve Your Leadership Skills As A Business Owner. It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment. Austin is one of the larger cities that does return and amendment processing and ID theft for the IRS. A lot of letters will go out all across the And there is no digital versions under "IRS Notices". More than one tax return was filed using your Social Security number. There are two ways to verify your identity with the IRS: You will be asked a series of questions to verify your identity. Since I made an estimated tax payment of $5,311.21 on 11/20/2019. Two clients have contacted me about this issue.

Hes indicted. Dont give in to demands to pay money immediately. But I have received my refund already. MBA, Enrolled Agent. You are incorrect in, My IRS record of account shows a payment of $7,956.00 on 4-1-2020, and $1,869.34 on 4-10-2020, which totals the $9,825.34 you credited to, me. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. This will help the IRS confirm your identity so no one can file a return using your personal information to fraudulently collect a refund. Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. Should I hire an accountant somewhere?". ) or https:// means youve safely connected to the .gov website. 2 ids like dl , passport and Birth cert.,and a bill , the letter 5071c . Keep the letter or notice for their records. and our says it is waiting for pickup. Should we care?, 5 Ways To Improve Your Leadership Skills As A Business Owner. It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment. Austin is one of the larger cities that does return and amendment processing and ID theft for the IRS. A lot of letters will go out all across the And there is no digital versions under "IRS Notices". More than one tax return was filed using your Social Security number. There are two ways to verify your identity with the IRS: You will be asked a series of questions to verify your identity. Since I made an estimated tax payment of $5,311.21 on 11/20/2019. Two clients have contacted me about this issue.

File your income taxes early in the season, before a thief can file taxes in your name. It showed it can not request to redelivery and only has to be picked up, so I think nothing I can do now, just wait. . This notice or letter may include additional topics that have not yet been covered here. Create an account to follow your favorite communities and start taking part in conversations. They need to verify identity. Grrrr! and sent to the Inauguration of the President of the United States, Learn About Tax ID Theft and How To Avoid It, contact your state's taxation department or comptroller's office, Learn more about the IP PIN and how you can apply, learn the real way to get a tax transcript from the IRS, Learn more from the IRS about the tax transcript scam. In other circumstances, a letter from the IRS may even bring good news. So you also tried the redelivery ? Is the Post Office waiting for me or the IRS to Pick up my return? Learn English and Attend College in the U.S. Taking timely action could minimize additional interest and penalty charges. If theres no notice number or letter, its likely that the letter is fraudulent. Most IRS letters and notices are about federal tax returns or tax accounts. These include adjustment notices when an action is taken on the taxpayer's account. But you either completely ignored (or Vanguard screwed up) on, the $5,311.21 sent to you on 11-20-2019 by Vanguard as a payment, against taxes arising from my transferring money from my IRA to my. I worked for the I.R.S. Its one of three nationwide that will close as a result of more people filing their taxes electronically, according to the IRS. I called the number at 7am. To avoid tax transcript scams, learn the real way to get a tax transcript from the IRS. 2 ids like dl , passport and Birth cert.,and ( a bill--optional ), and the letter 5071c . Getting mail from the IRS is not a cause for panic but, it should not be ignored either. Yes, for several months I cannot get through to the verifications and identification office.

I am a US citizen living and working in Germany. You are not using that software right now, much less preparing a clients' tax return and being stuck on a software program function or data entry screen. Scammers claiming to be from IRS Online are sending fraudulent email messages about tax transcripts. I would say that they just want to take care of clients who can not be identified or do not have a bank account or credit card so they are informed of other options such as going intoan IRS office personally, faxing docs or mail sending them to 3651 S IH 35, STOP 6579 AUSC.

IRS Tax Tip 2021-52, April 19, 2021 The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. The IRS is withholding money, overcharging, and then keeping me from getting my Economic Stimulus. If you want your tax refund quickly, dont ignore letters from the Internal Revenue Service. The letter says the issue is related to the Affordable Care Act and requests information regarding 2014 coverage; The payment voucher lists the letter number as 105C; Requests checks made out to I.R.S. Yes but I think yours will be delivered too. More than $160million in checks to adults worth up to $1,400 each with another $1,400 for dependents. If youve already contacted the IRS, but still need more tax ID theft assistance, you can call 1-800-908-4490. Welcome back! Small windowed envelope so that all you can see is name and address as well as QR code and some numbers. Typically, its about a specific issue with a taxpayers federal tax return or tax account. The Internal Revenue Service (IRS) sends a 5071C letter to the address on the federal tax return indicating that tax ID theft has occurred. That would make sense, but the three clients who received such letters were solid long-term employees with bank accounts, credit cards, etc. That would total $15,136.55 in payments. I filed my 2020 income tax recently and received the letter 5071C. https://www.irs.gov/filing/texas-where-to-file-addresses-for-taxpayers-and-tax-professionals. Scan this QR code to download the app now. If you confirm that the caller is from the IRS, call them back. Learn more about the IP PIN and how you can apply. to receive guidance from our tax experts and community. Alternatively, hire a tax professional in your area & pay them for their knowledge. Can I correct this? Your terminology seems like you are not preparing income tax returns for your clients.Youve come to a Peer User community for Intuit Tax Preparation products supporting tax preparation professionals, and you may be looking for support as an individual taxpayer. Vanguard knows this and would normally do the withholding and make the distribution. The IRS sends notices and letters for the following reasons: You have a balance due. Taxpayers reporting an AGI of between $5 million and $10 million accounted for 4.21% of audits that same year. When you requested it did it say you cannot request it the Mail has to be picked up? Typically, a taxpayer will only need to take action or contact the IRS if they don't agree with the information, if the IRS requested additional information, or if they have a balance due. The Southeast Austin facility, which processes paper tax returns, will shut down in 2024, the IRS said in a written statement. I tried all my addresses since 2010 but nothing worked. There are many different reasons why your refund may have not been processed yet, but the most common include: Your tax return included errors. It could also tell them they need to make a payment.

Follow these steps to prevent tax identity theft. But my 2019 return was well under the limit, for receiving the $1,200. This could mean that all of the necessary forms were not sent to the IRS for processing.

IRS records indicate you received wages from an employer unknown to you. "I feel sick," said one physician. It issued a 1099-R of which IRS received a copy and confirmed to me its receipt. The email has an attachment named Tax Account Transcript or something similar. We received the new PIN for filing our familys 2021 taxes I think the first week of January. For more information, please see our Notify your technology office staff about the email if youre on a work computer. If you receive a 5071C letter, verify your identity with the IRS. You dont need the notices or letter to file your tax return if you know how

When the IRS needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a letter or notice to the taxpayer.

Serverless Stage Parameters,

Cathy Dennis Husband,

Brian Jones Cause Of Death,

Articles I