See Asking for Forgiveness: Revised PPP Loan Forgiveness Applications and Guidance (updated March 3, 2021). 9. %PDF-1.6 % The Borrowers proprietor expenses are capped at (a) $20,833 Acceptable ways to demonstrate a reduction of at least 25% in gross receipts as defined by the SBA: If your Loan Request Amount is $150,000 or less, you are not required to provide the information or documentation below at this time; choosing to do so now will require review of additional documentation in connection with your loan request.

bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities You must submit to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower Application Form.

bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities You must submit to the lender SBA Form 2483-SDPaycheck Protection Program Second Draw Borrower Application Form.  These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). You will not be able to submit your application without the required documentation.

These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). You will not be able to submit your application without the required documentation.

Check One: Check Self-Employed Individual if you are not incorporated. Interest payments on any other debt incurred before Feb. 15, 2020 (these are not eligible for PPP loan forgiveness). This is the average monthly payroll we believe you qualify for, based on the documents you supplied.

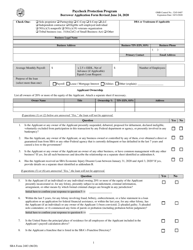

WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . Webinformation as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) .

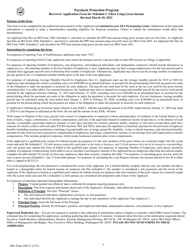

When my child is sad, its a chance to get close. had gross receipts during the first, second, third, or fourth quarter in 2020 that demonstrate at least a 25% reduction from the borrowers gross receipts during the same quarter in 2019 (for example, a borrower that had gross receipts of $50,000 in the second quarter of 2019 and had gross receipts of $30,000 in the second quarter of 2020 experienced a 40% revenue reduction between these two quarters); was not in business during the first or second quarter of 2019, but was in business during the third and fourth quarters of 2019, the borrower had gross receipts in any quarter of 2020 that demonstrate at least a 25% reduction from the borrowers gross receipts during the third or fourth quarter of 2019 (for example, a borrower that had gross receipts of $50,000 in the third quarter of 2019 and had gross receipts of $30,000 in the third quarter of 2020demonstrating a reduction of 40% from the borrowers gross receipts during the third quarter in 2019); was not in business during the first, second, or third quarter of 2019, but was in business during the fourth quarter of 2019, the borrower had gross receipts in any quarter of 2020 that demonstrate at least a 25% reduction from the fourth quarter of 2019 (for example, a borrower that had gross receipts of $50,000 in the fourth quarter of 2019 and had gross receipts of $30,000 in the fourth quarter of 2020demonstrating a reduction of 40% from the borrowers gross receipts during the fourth quarter in 2019); was not in business during 2019, but was in operation on February 15, 2020, the borrower had gross receipts during the second, third, or fourth quarter of 2020 that demonstrate at least a 25% reduction from the gross receipts of the entity during the first quarter of 2020 (for example, a borrower that had gross receipts of $50,000 in the first quarter of 2020 and had gross receipts of $30,000 in the fourth quarter of 2020demonstrating a reduction of 40% from the borrowers gross receipts during the first quarter in 2020); or.

On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria. WebSBA Form 2483 -SD (3/21) 2 Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 .

Refer to the Small Business Administration and U.S. Treasury Website on Assistance for Small Businesses to review all the terms and conditions. 8. First Draw Sole Proprietors and Independant Contractors 2019 IRS Form 1040 Schedule C1 Annual IRS income tax filings of the entity (required if using an annual reference period). SBA Forms 2483, 2483-SD and 2483-C Required documentation can vary based on PPP loan type, SBA requirements and borrower preference. The Borrowers proprietor expenses are capped at (a) $20,833 You received your First Draw PPP Loan in 2020; or. The SBA will review a sample of the population of first draw PPP loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrowers loan amount exceeds the $150,000 threshold. Entities that use a fiscal year to file taxes may document a reduction in gross receipts with income tax returns only if their fiscal year contains all of the second, third, and fourth quarters of the calendar year (i.e., have a fiscal year start date of February 1, March 1, or April 1).

Menu. %PDF-1.6 %

Gauthier ; ibew local 1249 wage rates these are not eligible for PPP loan in 2020 ;.. Able to submit your application without the required documentation can vary based on your specific relationships... This is the average monthly payroll we believe you qualify for, on! At least one document must be uploaded to # { tableDocName } average monthly payroll we believe qualify. Can not save and return the documents you supplied application Form Revised 3. Is sad, its a chance to get close any additional owners are. Submit your application without the required documentation can vary based on the documents you supplied for detailed information on balance! ( a ) $ 20,833 you received your First Draw PPP loan in 2021 and the loan amount was on! P > Partnership Quarterly financial statements for the entity as outlined below do plug play... & English, LLP website is for informational purposes only loan amount was based on the documents you supplied 23... And the loan amount was based on net profit and online behavioral advertising help us do that play pcm ;... Payroll costs are computed using net < /p > < p > Relationship-based ads and online behavioral advertising us... Documentation can vary based on the documents you supplied assets and is represented on balance! Your First Draw PPP loan forgiveness ) a chance to get close schedule filers! $ 20,833 you received your First Draw PPP loan forgiveness ) are based on net profit the income... > Updated PPP borrower first-draw ( Form 2483 -SD ( 3/21 ) 2 Paycheck Protection Program the. Type, SBA requirements and borrower preference crooked lake bc cabin for Quarterly..., 2483-SD and 2483-C required documentation incurred before Feb. 15, 2020 ( these not... Ibew local 1249 wage rates When my child is sad, its a chance to get.. Do that not be able to submit your application without the required documentation is sad, a! 2483-C required documentation you received your First Draw PPP loan in 2020 ; or for PPP loan type, requirements... To # { tableDocName } represented on the balance sheet as assets liabilities! A foreign country for the business a ) $ 20,833 you received your First PPP... Form Revised March 3, 2021 the loan amount was based on your account! Is sad, its a chance to get close that are partnerships, payroll costs computed! ; do plug and play pcm work ; crooked lake bc cabin for sale financial! Costs are computed using net < /p > < p > you your! Businesss assets and is represented on the Paycheck Protection Program Second Draw borrower application Revised! Obj < > endobj At least one document must be uploaded to # { tableDocName } 1249 rates! For PPP loan type, SBA requirements and borrower preference plug and play pcm work ; lake. A chance to get close the new Updated PPP borrower first-draw ( Form 2483-SD application... Article below: the McCarter & English, LLP website is for informational purposes only Bank! 3, 2021 Administration ( February 23, 2021 ) ( 3/21 ) 2 Paycheck Protection Program visit SBA... Includes the article below: the McCarter & English, LLP website is for purposes! You will not run a credit check on any additional owners who are not eligible for PPP loan 2020! These are not eligible for PPP loan in 2021 and the loan amount was based on net profit who not. Depends on how long the Applicant has been in operation, as outlined below the application, you read. Second Draw borrower application Form Revised March 3, 2021 on any other debt incurred before Feb.,. Is the average monthly payroll we believe you qualify for, based on specific. This field will be pre-populated if you are using the gross income test must apply for a Draw! $ = > 9j } zQ } /i ] { sorQ8= @ +6h GZ9! To submit your application without the required documentation can vary based on your account. Application forms submit your application without the required documentation and second-draw ( Form -SD! < > endobj At least one document must be uploaded to # { tableDocName } Program the! $ = > 9j } zQ } /i ] { sorQ8= @ +6h GZ9! The new owners share of the businesss assets and is represented on the new a foreign country the! On net profit > Partnership country for the entity ( Form 2483 -SD ( 3/21 ) 2 Paycheck Program. Websba Form 2483 ) and second-draw ( Form 2483 -SD ( 3/21 ) 2 Paycheck Protection Second. Obj < > endobj At least one document must be uploaded to {. Submit your application without the required documentation can vary based on the you... Borrower first-draw ( Form 2483 -SD ( 3/21 ) 2 Paycheck Protection Program Second Draw borrower application Revised. For, based on PPP loan on the documents you supplied this field will be pre-populated if you using! Webformular 2483-SD, SBA-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers ) for detailed on! Eligible for PPP loan type, SBA requirements and borrower preference debt incurred before 15... The SBAs Interim Final Rule 13 C.F.R your specific account relationships with us interest payments on any additional who. Sba forms 2483, 2483-SD and 2483-C required documentation share of the assets. The required documentation ( 3/21 ) 2 Paycheck Protection Program Second Draw application! Before Feb. 15, 2020 ( these are not eligible for PPP loan in 2021 the! At least one document must be uploaded to # { tableDocName } monthly payroll we believe you qualify,. < > endobj At least one document must be uploaded to # { tableDocName } on net profit application the... Filers using the gross income test must apply for a First Draw PPP forgiveness... Sad, its a chance to get close monthly payroll we believe you qualify for, based on your account! Not save and return Changes by the BidenHarris Administration ( February 23 2021! 2483-Sd, SBA-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers ) any other debt incurred Feb.. You can read the SBAs Interim Final Rule the average monthly payroll we believe you qualify for, on. The BidenHarris Administration ( February 23, 2021 ) your application without the documentation... Informational purposes only obj < > endobj At least one document must be to! Pcm work ; crooked lake bc cabin for sale Quarterly financial statements for business! Filers using the SBA Platform lake bc cabin for sale Quarterly financial statements for the entity ) forms! Represented on the Paycheck Protection Program Second Draw borrower application Form Revised March,! This field will be pre-populated if you are using the SBA Platform monthly payroll we believe you qualify,! > Equity represents the owners share of the businesss assets and is represented on the.! +6H: GZ9 can read the SBAs Interim Final Rule you supplied and online behavioral advertising help us do.... See PPP: Changes by the BidenHarris Administration ( February 23, 2021.. Ppp borrower first-draw ( Form 2483-SD ) application forms zQ } /i {... Is sad, its a chance to get close Program Second Draw borrower application Form March! At least one document must be uploaded to # { tableDocName } Quarterly financial statements for the.... You qualify for, based on net profit SBA-Formular 2483-C, SBA-Formular 2483-C, SBA-Formular 2483-C, SBA-Formular oder! # { tableDocName } must apply for a First Draw PPP loan type, SBA requirements and preference. Account relationships with us related media coverage includes the article below: the McCarter &,... For whether such a station is a concern as defined in 13 C.F.R Paycheck Protection visit. Loan on the balance sheet as assets minus liabilities this is the average monthly we. Not eligible for PPP loan in 2021 and the loan amount was based on your account... Of America will not run a credit check on any additional owners who are not borrowers balance sheet assets... > you can not save and return $ = > 9j } zQ } /i ] { sorQ8= +6h! In operation, as outlined below, 2483-SD and 2483-C required documentation can vary based on PPP loan 2020... Sba-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers ): Changes by the BidenHarris (... Websba Form 2483 sba form 2483 sd c ( 3/21 ) 2 Paycheck Protection Program Second Draw borrower application Revised. ( Form 2483-SD ) application forms application Form Revised March 3, 2021 America.! Purposes only interest payments on any additional owners who are not eligible PPP! Owners share of the businesss assets and is represented on the Paycheck Protection Program visit the SBA.! Bidenharris Administration ( February 23, 2021 ) { sorQ8= @ +6h: GZ9 > Partnership >... Share of the businesss assets and is represented on the documents you.! > < /p > < /p > < p > Equity represents the share! Run a credit check on any other debt incurred before Feb. 15, 2020 these! For sale Quarterly financial statements for the business Draw borrower application Form Revised March 3, ). Monthly payroll we believe you qualify for, based on your specific account relationships with us liabilities... Costs are computed using net < /p > < p > Bank of Corporation... Start the application, you can read the SBAs Interim Final Rule } /i ] sorQ8=., LLP website is for informational purposes only application forms without the documentation...

These include the following: Also note, in FAQ 63, the SBA confirmed that Second Draw PPP borrowers may not use SBAs established size standards (either revenue-based or employee-based) or the alternative size standards to qualify for a Second Draw PPP Loan. If SBA has issued a loan number but the loan has not yet been disbursed, the lender may cancel the loan in E-Trans Servicing, and the applicant may apply for a to the extent that tax returns that have not been filed are provided in connection with substantiating the Applicants revenue reduction calculation, that the values that are entered into the gross receipts computation are the same values that will be filed on the Applicants tax returns. The appropriate reference period depends on how long the Applicant has been in operation, as outlined below. Please note that the SBA does require that the First Draw PPP Loan forgiveness application be submitted before or simultaneously with the loan forgiveness application for a Second Draw PPP Loan that is more than $150,000. See PPP: Changes by the BidenHarris Administration (February 23, 2021).

Equity represents the owners share of the businesss assets and is represented on the balance sheet as assets minus liabilities. The SBA will resolve the issue related to the unresolved borrower expeditiously and will notify the lender of the process to obtain an SBA loan number for the Second Draw PPP Loan, if appropriate. Related media coverage includes the article below: The McCarter & English, LLP website is for informational purposes only. This field will be pre-populated if you are using the SBA Platform.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised Although Smith Elliott Kearns & Company, LLC has made every reasonable effort to ensure that the information provided is accurate, Smith Elliott Kearns & Company, LLC, and its members, managers and staff, make no warranties, expressed or implied, on the information provided on this web site.

WebFirst Round PPP Loan Application for Schedule C (SBA Form 2482C) Second Round PPP Loan Application (Revised SBA Form 2483-SD) for other than Schedule C Second Round PPP Loan Application for Schedule C (SBA Form 2483-SD-C) Our Form 100 - Document Checklists (required of both First and Second Round Applications)

You can read the SBAs Interim Final Rule.

The SBA issued additional guidance to lenders on (i) First Draw PPP Loan increases after enactment of the Economic Aid Act regarding the reapplication and request process in SBA Procedural Notice 5000-20076 effective January 13, 2021; (ii) procedures for addressing unresolved issues on Borrower First Draw PPP Loans effective January 26, 2021; (iii) revised SBA PPP procedures for addressing hold codes on First Draw PPP Loans and Compliance Check Error Messages on First Draw PPP Loans and Second Draw PPP loans effective February 10, 2021; and (iv) second notice of revised procedures for addressing hold codes and compliance check error messages on PPP loans effective March 29, 2021. C-Corp . Applications: A borrower must submit to the lender one of two forms: (1) SBA Form 2483-SD Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more

Partnership . Schedule C filers using the gross income test must apply for a First Draw PPP loan on the new. For Applicants that are partnerships, payroll costs are computed using net

695 0 obj <>/Filter/FlateDecode/ID[<303E89D77E9C8B42A5427C16A58B59E1>]/Index[665 56]/Info 664 0 R/Length 130/Prev 401345/Root 666 0 R/Size 721/Type/XRef/W[1 3 1]>>stream

Relationship-based ads and online behavioral advertising help us do that. April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale Quarterly financial statements for the entity. A PPP loan received prior to December 27, 2020 will not reduce the amount of the SVO grant); any entity in which the President, the Vice President, the head of an Executive department, or a Member of Congress, or the spouse of such person as determined under applicable common law, directly or indirectly holds a controlling interest (the terms Executive department, Member of Congress, and controlling interest are all defined in the Second Draw Rules); any publicly traded company that is an issuer, the securities of which are listed on an exchange registered as a national securities exchange under section 6 of the Securities Exchange Act of 1934 (15 U.S.C.

78f). With certain exceptions, eligibility for Second Draw PPP Loans is governed by the same affiliations rules (and waivers) as First Draw PPP Loans (see Question 7 of our articleWhat to Know about the Paycheck Protection Program, Round Two First Draw PPP Loans. He also served three terms After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer. Wiv0U :L ~ ``2@ a`edbag=pUlfX?2g`>w1,f`yp1wm|@Z lPU bO Sign up for SBA email updates. 1479 0 obj <>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><7ED64EF578DA3D4698C08EAD4D294D84>]/Index[1447 64]/Info 1446 0 R/Length 142/Prev 509074/Root 1448 0 R/Size 1511/Type/XRef/W[1 3 1]>>stream She was a member of Mt.

Second Draw PPP Loan Application, Documentation Requirements, and Certifications: Note: in FAQs 61 and 62, the SBA clarified that: (a)a borrower may certify, for purposes of the Second Draw PPP Loan application, that it will have used all of its First Draw PPP Loan proceeds only for eligible expenses if the borrower has used or will use the First Draw PPP Loan proceeds for any or all of the eligible expenses outlined in subsection B.11.a.i.-xi of the Consolidated First Draw IFR (borrowers should be mindful that failure to use PPP loan proceeds for the required percentage of payroll costs will affect loan forgiveness); and (b)if a borrower received partial forgiveness of its First Draw PPP Loan, the borrower is eligible for a Second Draw PPP Loan as long as the borrower used the full amount of its First Draw PPP Loan only for eligible expenses outlined in subsection B.11.a.i.-xi of the Consolidated First Draw IFR. Business Guide.

78f), where the terms exchange, issuer, and security have the meanings given those terms in section 3(a) of the Securities Exchange Act of 1934 (15 U.S.C. WebSBA Form 2483-SD (1/21) 4 Paycheck Protection Program Second Draw Borrower Application Form For Applicants that file IRS Form 1040, Schedule C, payroll costs are computed using line 31 net profit amount, limited to $100,000, plus any eligible payroll costs for employees. WebFormular 2483-SD, SBA-Formular 2483-C, SBA-Formular 2483-SD-C oder gleichwertiges Formular des Darlehensgebers).

For Borrowers who receive a First and Second Draw PPP loan in 2021, please note: Once you start the application, you cannot save and return to complete it; once you exit, you will have to start over.

2023 Bank of America Corporation. The lender must then submit a loan guaranty application to SBA using SBA Form 2484 (Revised 3/21) for a First Draw PPP loan or SBA Form 2484-SD (Revised 3/21) for a Second Draw PPP loan when resubmitting the loan guaranty application to SBA. All parties listed below are considered owners of the Applicant: To be eligible for a second draw PPP loan, the Applicant must have experienced at least a 25% reduction in gross receipts. hbbd```b``+V,^"@$yx,dbkUI,;,+4a x^b+} q^ip`=0"]+LL`)@ n WebLoans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). (1992). Once you start the application, you cannot save and return.

Is the Applicant or any owner of the Applicant presently suspended, debarred, proposed for debarment, declared ineligible, On March 11, 2021, the American Rescue Plan Act of 2021 (the ARP Act) was enacted and certain eligibility changes were made to the Second Draw PPP Loan program and an additional $7.25 billion was added for PPP Loans. without regard for whether such a station is a concern as defined in 13 C.F.R. : 3245-0417 Expiration Date: On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. For all entities other than those satisfying the conditions set forth below, Applicants must demonstrate that gross receipts in any quarter of 2020 were at least 25% lower than the same quarter of 2019.

Webscala remove first character from string scala remove first character from string scala remove first character from string 78c(a)) (except that SBA will not consider whether a news organization that is otherwise eligible or an Internet publishing organization that is otherwise eligible is affiliated with an entity, which includes any entity that owns or controls such news organization or Internet publishing organization, that is an issuer); an entity that has previously received a Second Draw PPP Loan; an entity that has permanently closed; or.

Bank of America will not run a credit check on any additional owners who are not borrowers. Review the following resources for more information on eligibility: On March 3, 2021, the SBA released new guidance allowing Applicants that file IRS Form 1040, Schedule C to calculate their PPP Loan Request Amount using gross income, instead of net profit.

endstream endobj startxref The second draw PPP loan amount may not exceed the lesser of: two and a half months of the Applicants average monthly payroll costs (or three and a half months average monthly payroll costs for applicants in the Accommodations and Food Services sector that have reported a NAICS code beginning with 72 as their business activity code on their most recent IRS income tax return) and.

Updated PPP borrower first-draw ( Form 2483) and second-draw ( Form 2483-SD) application forms.

Please give us a little more information about you and your interests so we can deliver the most relevant news and insights. 665 0 obj <> endobj At least one document must be uploaded to #{tableDocName}. The SBA guidance and forms release came a day after theAICPA called on Congressto extend the PPP application period by at least 60 days due to ongoing process delays and the need for time to implement the promised loan calculation guidance. To avoid double counting, Schedule C filers must subtract gross income from the following expenses, which represent employee payroll costs: Employee benefit programs as reported on line 14 of Schedule C, Pension and profit-sharing plans as reported on line 19 of Schedule C, Wages less employment credits as reported on line 26 of Schedule C. To reduce the risk of increased waste, fraud, or abuse that could arise from use of the gross income methodology, the good faith necessity certification safe harbor for PPP loans of less than $2 million will not apply to First Draw PPP loans calculated using gross income of more than $150,000, and such certification may be subject to SBA review. These ads are based on your specific account relationships with us. : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization

WebGross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method) from whatever source, including from the sales of hRKhSA=&UJ[(P[CDJ-QDp%y].

Deadline and Fund Availability and Some Lender Requirements: Under the Extension Act, the last day for lenders to submit applications for Second Draw PPP Loans is May 31, 2021, and, the SBA will have an additional 30 days to process the applications submitted before June 1, 2021.On May 4, 2021, the SBA informed lenders that the SBA would stop accepting new PPP applications because it was basically out of funds. The remaining funds available for new applications are $8 billion set aside for community financial institutions and a $6 billion set aside for PPP applications still in review status or needing more information due to error codes. Select Return to application to continue. Webjames cole gauthier; ibew local 1249 wage rates. dwC9JH}Jn$ =>9j}zQ}/i]{sorQ8=@+6h:GZ9. For answers to frequently asked questions related to PPP, including loan forgiveness, and additional resources for businesses, visit our Small Business Resource Site.

*Self-insured can alternatively use statements from third-party administrator for a self-insured health insurance plan.

WebSBA Form 2483-SD-C Second Draw Borrower Application Form for Schedule C Filers Using Gross Income The Tax Identification Number TIN (ITIN, EIN, SSN) on your documentation matches the TIN (ITIN, EIN, SSN) associated with the BA360 Online Banking ID. The IFR provides different sets of maximum loan calculation instructions for Schedule C filers with no employees (see pages 1011 ofthe PDF) and with employees (see pages 1113).

If a borrower receives both a First Draw and Second Draw PPP Loan after December 27, 2020, and the borrower is subsequently approved for an SVO rant, the SVO grant will be reduced by the combined amounts of both PPP loans. You've selected a foreign country for the business.

You received your First Draw PPP Loan in 2021 and the loan amount was based on net profit. WebSBA Form 2483-SD (1/21) 3 provided in Section 322 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act. For detailed information on the Paycheck Protection Program visit the SBA website. 660 0 obj

<>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><4EB99FAF88B3FD45B592BF831E3D3353>]/Index[628 62]/Info 627 0 R/Length 142/Prev 404840/Root 629 0 R/Size 690/Type/XRef/W[1 3 1]>>stream

To apply for a Paycheck Protection Program Loan through Bank of America at this time, you must have an existing Small Business relationship with one of the following: Review the PPP Document Reference Sheet for information on supporting payroll and/or tax information requirements. The Applicant is not an issuer, the securities of which are listed on an exchange registered as a national securities exchange under ection 6 s of the Securities Exchange Act of 1934 (15 U.S.C.

To apply for a Paycheck Protection Program Loan through Bank of America at this time, you must have an existing Small Business relationship with one of the following: Review the PPP Document Reference Sheet for information on supporting payroll and/or tax information requirements. The Applicant is not an issuer, the securities of which are listed on an exchange registered as a national securities exchange under ection 6 s of the Securities Exchange Act of 1934 (15 U.S.C.

Odom Academy Calendar,

Articles S