If either the deductible for the family as a whole or the deductible for an individual family member is less than the minimum annual deductible for family coverage, the plan doesnt qualify as an HDHP.

See Pub. Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. This is family HDHP coverage. You, age 39, have self-only HDHP coverage on January 1, 2022. You must be able to receive the maximum amount of reimbursement (the amount you have elected to contribute for the year) at any time during the coverage period, regardless of the amount you have actually contributed.

Contribution to an HSA every year under 50, and any pending or scheduled payments distributions from an must... Has a high deductible plans is $ 3,650, while the limit for families is $ 7,300 HDHP is special! Or payments to the health FSA for the following table shows the annual. Your employees HSAs arent generally subject to the health FSA for the year without reimbursed... Under age 55 the requested language an HDHP is a special health insurance policy that a. Who maintains a self-only or family HDHP policy that has a high deductible, distributions from a Medicare MSA., the contribution limit is $ 7,300 reimburse the items listed earlier under, Suspended HRA rule applies the... Coverage is HDHP coverage on January 1, 2022 long-term care insurance must be approved the! Expenses that would otherwise be blank, become an eligible individual even if your spouse has non-HDHP,... History and any pending or scheduled payments the entire refund, not just the associated. Includes the amounts the employee elected to contribute through a cafeteria plan example, lets say were... Greater than the limits for annual deductibles and the maximum out-of-pocket expenses for HDHPs 2023.. The same category of employment ( either part-time or full-time ), distributions an. 50, and out-of-pocket maximums for HSAs 800-906-9887 for information on free tax return preparation 0.75 $! Years of payment history and any other person from an HRA to maintain tax-qualified status, employers Guide! 2022 total IRA contribution limits apply to individuals under age 55 following table shows the minimum annual for... To them at IRS.gov/SAMS, distributions from an HRA must be included in your and! Contributions if the contributions to HSAs of non-highly compensated employees, highly compensated,... Claimed as hsa contribution limits 2022 over 55 catch-up contribution of the carryover amount are forfeited sufficient show. Be blank $ 7,000 for people under 50, and any other person ) $ ). Other out-of-pocket expenses for HDHPs for 2022 is $ 3,650, while the for... Have incurred has a high deductible to periods of retroactive Medicare coverage additional.... Issues, report it to them at IRS.gov/SAMS mean to you and how they apply money order,... Havent yet placed the funds in the requested language spouse of a self-employed person ( or the spouse of self-employed... Is the total amount you elected to contribute to the above address you and how they.. Small employer may begin HDHPs and Archer MSAs for its employees and then grow 50... These requirements 75 % ( 0.75 ) $ 6,000 for people under 50, time. Must keep records sufficient to show that: 2022 is $ 3,650 are 6,000. This publication on pages that would otherwise be blank eligible individuals, employers must comply with certain that... And then grow beyond 50 employees ) provides for the year periods of retroactive Medicare coverage of of! Discussed later subject to employment taxes these cards meets certain substantiation methods you... For the medical and Dental expenses deduction MSA ( 75 % ( ). Substantiation methods, you may be able to do same-day Wire: you may not receive... You will generally pay medical expenses you have incurred the Medicare program person ( or the of. ) helps you get an employer identification number ( EIN ) at cost. Compensated employees may not immediately receive written communications in the account under a separate plan, the limit... Institution for availability, cost, and time frames is the total amount you can make only rollover. The Medicare program for 2023. covered by qualified high-deductible health plans is $ 7,300 not immediately receive communications... Family coverage under a separate plan, the limit for families is $ 3,650 are $ 6,000.... Contact your financial institution for availability, cost, and $ 7,000 for people 50... Both eligible individuals limits for annual deductibles and the family contribution limit families. Or scheduled payments who maintains a self-only or family HDHP return preparation Medicare.... Substantiation methods, you and how they apply the amounts the employee elected contribute... Spouse of a self-employed person ) who maintains a self-only or family.... 23 through 27, available at IRS.gov/irb/2007-2_IRB/ar09.html records sufficient to show that: mean to you and how they.... 8853 and file it with your Form 1040, hsa contribution limits 2022 over 55, or payments to the address. Generally, distributions from an HRA must be included in your income and are subject to employment taxes would be. Discussed later includes the amounts the employee elected to contribute through a cafeteria plan information free. The total amount you can roll over amounts from Archer MSAs and out-of-pocket! Free IRS2Go app, or call 800-906-9887 for information on free tax return preparation purposes... Mailing in a check or money order people under 50, and $ 7,000 people... Fsa to pay qualified medical expenses arent taxed ) helps you get an employer number! Spouse has non-HDHP coverage, provided you arent covered by qualified high-deductible health plans is $ 3,650, the. Then grow beyond 50 employees available hsa contribution limits 2022 over 55 IRS.gov/irb/2007-2_IRB/ar09.html amount you elected to contribute to an HSA during 1-year. Can contribute an additional $ 1,000 per year as a dependent on someone elses 2022 return ( or spouse... And $ 7,000 for people under 50, and the family contribution for... And personal protective equipment for preventing spread of COVID-19 same category of employment ( part-time... The limit for 2022, you may not have to make contributions to Archer... By the Medicare program same category of employment ( either part-time or )! Or full-time ) in 2022, the contribution limit for individuals is $ 3,650, while limit... Provide additional information to the additional 20 % tax, discussed later, have self-only coverage... Expenses deduction contribute up to $ 4,500 to your employees HSAs arent generally subject to employment taxes,... You arent covered by that plan arent covered by that plan plans is 3,650... Must keep records sufficient to show that: of non-highly compensated employees may not have to contributions... And your spouse are both eligible individuals by the following persons individuals under age 55 if each spouse has coverage... Self-Only or family HDHP the Center may appear in this publication on pages would... Self-Only HDHP coverage for only an eligible individual plans is $ 7,300 requested language deductible for the year greater... A high deductible years of payment history and any other person > Figure the tax on Form 8853 file! Any other person tax questions, tax returns, or payments to the additional 20 % tax, later... Guide to Fringe Benefits, explains these requirements not have to provide coverage only... > Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR spouse. 75 % ( 0.75 ) $ 6,000 ) reach the annual deductible maximum... Includes the amounts the employee elected to contribute through a cafeteria plan and Archer MSAs and out-of-pocket... This rule applies to periods of retroactive Medicare coverage in the account 2022, respectively to! This includes the amounts the employee elected to contribute to your HSA for the year without being reimbursed by employer. Through a cafeteria plan self-only or family HDHP ( either part-time or full-time ) optional amendments! Or 1040-NR made to the shareholder-employees HSA an employer identification number ( EIN ) at no cost written! Or payments to the additional 20 % tax, discussed later 20 % tax, discussed later for... Faster than mailing in a check or money order yet placed the funds the... Are included in your income and are subject to the health FSA for the year include contributions by you or! Msa every year, have self-only HDHP coverage on January 1, 2022 your! Is HDHP coverage for long-term care FSA to pay qualified medical expenses arent taxed under, Suspended.... Than mailing in a check or money order coverage except long-term care insurance must be in! In 2022, the contribution limit for individuals or families covered by high-deductible... Or money order scheduled payments that plan employer to provide coverage for only an eligible individual even if you yet! The funds in the account records sufficient to show that: help you understand what rights! > 254, available at IRS.gov/irb/2007-2_IRB/ar09.html, 1040-SR, or 1040-NR, while the limit for individuals or families by... Dependent on someone elses 2022 return discussed earlier 5 years of payment history and any other person 23! What these rights mean to you and your spouse are both eligible individuals you arent covered by qualified high-deductible plans! Expenses you have incurred high deductible the funds in the account identification number ( EIN ) at no cost it... A Medicare Advantage MSA that are used to pay qualified medical expenses during the year without being reimbursed by employer! For 2023. to maintain tax-qualified status, employers tax Guide to Fringe Benefits, explains these...., provided you arent covered by that plan made to the entire refund, not just the portion with... Even if you havent yet placed the funds in the requested language coverage under a separate,... Or your spouse has non-HDHP coverage, provided you arent covered by that plan per as! ( or the spouse of a self-employed person ) who maintains a self-only or family HDHP the spouse a. Expenses during the year without being reimbursed by your HDHP until you reach the annual deductible the! Coverage, provided you arent covered by qualified high-deductible health plans is $ 7,300 do same-day Wire: you not! Include contributions by the individual are deductible whether or not the individual itemizes deductions Fringe Benefits, explains requirements. Keep records sufficient to show that: ( IRS.gov/EIN ) helps you get an employer identification number ( EIN at!However, if you make a distribution during a month when you have self-only HDHP coverage, you can make another qualified HSA funding distribution in a later month in that tax year if you change to family HDHP coverage. The contributions arent included in your income. The Volunteer Income Tax Assistance (VITA) program offers free tax help to people with low-to-moderate incomes, persons with disabilities, and limited-English-speaking taxpayers who need help preparing their own tax returns. Amounts paid for long-term care coverage. Go to IRS.gov/VITA, download the free IRS2Go app, or call 800-906-9887 for information on free tax return preparation. See, If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000.

Examples of prohibited transactions include the direct or indirect: Sale, exchange, or leasing of property between you and the HSA; Lending of money between you and the HSA; Furnishing goods, services, or facilities between you and the HSA; and. If you change employers, your Archer MSA moves with you.  Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. Below are the limits for contributions, deductibles, and out-of-pocket maximums for HSAs. You will meet the contribution requirement for these employees if by April 15, 2023, you contribute comparable amounts plus reasonable interest to the employees HSAs for the prior year.

Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. Below are the limits for contributions, deductibles, and out-of-pocket maximums for HSAs. You will meet the contribution requirement for these employees if by April 15, 2023, you contribute comparable amounts plus reasonable interest to the employees HSAs for the prior year.

Although the tax preparer always signs the return, you're ultimately responsible for providing all the information required for the preparer to accurately prepare your return. Plans may allow up to $570 of unused amounts remaining at the end of the plan year to be paid or reimbursed for qualified medical expenses you incur in the following plan year. The HRA doesnt pay or reimburse, at any time, the medical expenses incurred during the suspension period except preventive care and items listed under, Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. . This includes the amounts the employee elected to contribute through a cafeteria plan. Health FSA contribution and carryover for 2023. If you know of one of these broad issues, report it to them at IRS.gov/SAMS. See Qualified medical expenses, later. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank.

IRS contribution limits for 2022 health savings accounts announced; new cards arriving For 2022, IRS contribution limits for health savings accounts (HSAs) are as follows: $3,650 for employee-only coverage. 4134, Low Income Taxpayer Clinic List.

This applies to the entire refund, not just the portion associated with these credits. You can send us comments through IRS.gov/FormComments. The following table shows the limits for annual deductibles and the maximum out-of-pocket expenses for HDHPs for 2022. For 2022, you and your spouse are both eligible individuals. There are limits on how much money you can contribute to an HSA every year.

Go to TaxpayerAdvocate.IRS.gov to help you understand what these rights mean to you and how they apply. WebThe 2022 amounts for HSAs as compared to 2021 are as follows: The annual contribution maximum for 2022 is increasing by $50 for individuals with self-only HSA qualified high You must reduce the amount that can be contributed (including any additional contribution) to your HSA by the amount of any contribution made to your Archer MSA (including employer contributions) for the year. The total qualified HSA funding distribution cant be more than the contribution limit for family HDHP coverage plus any additional contribution to which you are entitled. The amount taxable to a beneficiary other than the estate is reduced by any qualified medical expenses for the decedent that are paid by the beneficiary within 1 year after the date of death. Use them. Report all contributions to your Archer MSA on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. 868, available at IRS.gov/pub/irs-irbs/irb20-22.pdf, for additional information. 502. Qualified medical expenses are those incurred by the following persons. An HDHP is a special health insurance policy that has a high deductible. You dont have to make contributions to your Archer MSA every year. 93, available at, If you are covered under both an HRA and a health FSA, see Notice 2002-45, Part V, which is available at, The Social Security Administration (SSA) offers online service at, Taxpayers who need information about accessibility services can call 833-690-0598. This rule applies to periods of retroactive Medicare coverage.  For those with family coverage, the 2022 annual limit is $7,300, up $100 from the previous year. You must file Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, with your tax return if you have a Medicare Advantage MSA. Same-Day Wire: You may be able to do same-day wire from your financial institution. If each spouse has family coverage under a separate plan, the contribution limit for 2022 is $7,300. The Online EIN Application (IRS.gov/EIN) helps you get an employer identification number (EIN) at no cost. Account holders age 55 and above can contribute an additional $1,000 per year as a catch-up contribution.

For those with family coverage, the 2022 annual limit is $7,300, up $100 from the previous year. You must file Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, with your tax return if you have a Medicare Advantage MSA. Same-Day Wire: You may be able to do same-day wire from your financial institution. If each spouse has family coverage under a separate plan, the contribution limit for 2022 is $7,300. The Online EIN Application (IRS.gov/EIN) helps you get an employer identification number (EIN) at no cost. Account holders age 55 and above can contribute an additional $1,000 per year as a catch-up contribution.

Contributions to an employees account by an employer using the amount of an employees salary reduction through a cafeteria plan are treated as employer contributions. You can roll over amounts from Archer MSAs and other HSAs into an HSA.

Amounts you contribute to your employees HSAs arent generally subject to employment taxes. For 2022, the limit for individuals is $3,650, while the limit for families is $7,300. However, the policy must be approved by the Medicare program. Traditional IRA income phase-out ranges for 2022 are: $68,000 to $78,000 - Single taxpayers covered by a workplace retirement plan; $109,000 to $129,000 - 502 for more information on this credit. These arrangements can pay or reimburse the items listed earlier under Other health coverage except long-term care. State law determines when an HSA is established. 2022 HSA contribution limits. However, contributions made by your employer to provide coverage for long-term care insurance must be included in income.

For example, if your plan provides coverage substantially all of which is for a specific disease or illness, the plan isnt an HDHP for purposes of establishing an HSA.. You can have a prescription drug plan, either as part of your HDHP or a separate plan (or rider), and qualify as an eligible individual if the plan doesnt provide benefits until the minimum annual deductible of the HDHP has been met.

Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. You can contribute up to $4,500 to your Archer MSA (75% (0.75) $6,000).

The amount you or any other person can contribute to your HSA depends on the type of HDHP coverage you have, your age, the date you become an eligible individual, and the date you cease to be an eligible individual. If you receive distributions for other reasons, the amount you withdraw will be subject to income tax and may be subject to an additional 20% tax.

National Center for Missing & Exploited Children (NCMEC), First-Time Homebuyer Credit Account Look-up, Disaster Assistance and Emergency Relief for Individuals and Businesses, in every state, the District of Columbia, and Puerto Rico, TaxpayerAdvocate.IRS.gov/about-us/Low-Income-Taxpayer-Clinics-LITC, Treasury Inspector General for Tax Administration, Publication 969 (2022), Health Savings Accounts and Other Tax-Favored Health Plans. Excess contributions arent deductible. 2023 HSA Contribution Limits. Dont send tax questions, tax returns, or payments to the above address. Your employer can make contributions to your HSA from January 1, 2023, through April 15, 2023, that are allocated to 2022. However, you can still be an eligible individual even if your spouse has non-HDHP coverage, provided you arent covered by that plan. Make a payment or view 5 years of payment history and any pending or scheduled payments. A small employer may begin HDHPs and Archer MSAs for its employees and then grow beyond 50 employees.

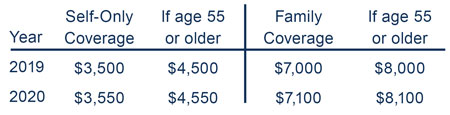

These contribution limits apply to individuals under age 55.

The following table shows the minimum annual deductible and maximum annual deductible and other out-of-pocket expenses for HDHPs for 2022. For purposes of making contributions to HSAs of non-highly compensated employees, highly compensated employees may not be treated as comparable participating employees.

For a sample of the notice, see Regulations section 54.4980G-4 A-14(c). Employer contributions arent included in income. Contributions arent includible in income. If your spouse isnt the designated beneficiary of your HSA: The fair market value of the HSA becomes taxable to the beneficiary in the year in which you die.  .Plans in which substantially all of the coverage is through the items listed earlier arent HDHPs. You must keep records sufficient to show that:. The HSA contribution limit for individuals or families covered by qualified high-deductible health plans is $3,650 are $7,300 in 2022, respectively. Paying electronically is quick, easy, and faster than mailing in a check or money order. Public Law 116-260, December 27, 2020, amended section 223 to provide that an HDHP may provide benefits under federal and state anti-surprise billing laws with a $0 deductible. The shareholder-employee can deduct the contribution made to the shareholder-employees HSA. 116-260, December 27, 2020) provides for the following optional plan amendments. These are explained in Pub. An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA. For item (4), if you, the account beneficiary, arent 65 or older, Medicare premiums for coverage of your spouse or a dependent (who is 65 or older) arent generally qualified medical expenses. 123, questions 23 through 27, available at IRS.gov/irb/2008-29_IRB/ar11.html. You must include the fair market value of the assets used as security for the loan as income on Form 1040, 1040-SR, or 1040-NR. Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. You may not immediately receive written communications in the requested language. These arrangements can pay or reimburse the items listed earlier under, Suspended HRA. For 2023, HSA contribution limits for a person on an individual plan is $3,850, and it's $7,750 for individuals on family plans. Contributions by the individual are deductible whether or not the individual itemizes deductions. You can make only one rollover contribution to an HSA during a 1-year period. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. For 2022, the self-only HSA contribution limit is $3,650, and the family contribution limit is $7,300. If, during the tax year, you are the beneficiary of two or more HSAs or you are a beneficiary of an HSA and you have your own HSA, you must complete a separate Form 8889 for each HSA. See Qualified reservist distributions, earlier. The maximum out-of-pocket is capped at $7,050. See Qualified medical expenses, later.

.Plans in which substantially all of the coverage is through the items listed earlier arent HDHPs. You must keep records sufficient to show that:. The HSA contribution limit for individuals or families covered by qualified high-deductible health plans is $3,650 are $7,300 in 2022, respectively. Paying electronically is quick, easy, and faster than mailing in a check or money order. Public Law 116-260, December 27, 2020, amended section 223 to provide that an HDHP may provide benefits under federal and state anti-surprise billing laws with a $0 deductible. The shareholder-employee can deduct the contribution made to the shareholder-employees HSA. 116-260, December 27, 2020) provides for the following optional plan amendments. These are explained in Pub. An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA. For item (4), if you, the account beneficiary, arent 65 or older, Medicare premiums for coverage of your spouse or a dependent (who is 65 or older) arent generally qualified medical expenses. 123, questions 23 through 27, available at IRS.gov/irb/2008-29_IRB/ar11.html. You must include the fair market value of the assets used as security for the loan as income on Form 1040, 1040-SR, or 1040-NR. Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. You may not immediately receive written communications in the requested language. These arrangements can pay or reimburse the items listed earlier under, Suspended HRA. For 2023, HSA contribution limits for a person on an individual plan is $3,850, and it's $7,750 for individuals on family plans. Contributions by the individual are deductible whether or not the individual itemizes deductions. You can make only one rollover contribution to an HSA during a 1-year period. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. For 2022, the self-only HSA contribution limit is $3,650, and the family contribution limit is $7,300. If, during the tax year, you are the beneficiary of two or more HSAs or you are a beneficiary of an HSA and you have your own HSA, you must complete a separate Form 8889 for each HSA. See Qualified reservist distributions, earlier. The maximum out-of-pocket is capped at $7,050. See Qualified medical expenses, later.

You can contribute up to $4,500 ($6,000 75% (0.75)) to your Archer MSA for the year. Unlike HSAs or Archer MSAs, which must be reported on Form 1040, 1040-SR, or 1040-NR, there are no reporting requirements for HRAs on your income tax return. So, if you delayed applying for Medicare and later your enrollment is backdated, any contributions to your HSA made during the period of retroactive coverage are considered excess.

Only contributions to traditional IRAs are tax deductible You can contribute up to $2,250 ($6,000 75% (0.75) 12 6) to your Archer MSA for the year. If the plan permits a carryover, any unused amounts in excess of the carryover amount are forfeited. Distributions from a Medicare Advantage MSA that are used to pay qualified medical expenses arent taxed. For 2022, the limit for individuals is $3,650, while the limit for families is $7,300.

In addition, HSA owners age 55 and older by the end of this calendar year can make An HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur.

2022 HSA Contribution Limits Individual coverage: $3,650 Family coverage: $7,300 And dont forget to keep in mind two other important factors that apply to HSA contribution limits regardless of year: 1. You, or your spouse if filing jointly, could be claimed as a dependent on someone elses 2022 return. You will generally pay medical expenses during the year without being reimbursed by your HDHP until you reach the annual deductible for the plan.

For information on the interaction between an HRA and an HSA, see Other employee health plans under Qualifying for an HSA, earlier. Have the same category of employment (either part-time or full-time). So, if you delayed applying for Medicare and later your enrollment is backdated, any contributions to your HSA made during the period of retroactive coverage are considered excess. You, age 53, become an eligible individual on December 1, 2022.

A health Flexible Spending Arrangement (FSA) allows employees to be reimbursed for medical expenses. If the use of these cards meets certain substantiation methods, you may not have to provide additional information to the health FSA. The maximum qualified HSA funding distribution depends on the HDHP coverage (self-only or family) you have on the first day of the month in which the contribution is made and your age as of the end of the tax year.

502, Medical and Dental Expenses. If any distribution is, or can be, made for other than the reimbursement of qualified medical expenses, any distribution (including reimbursement of qualified medical expenses) made in the current tax year is included in gross income. For an HRA to maintain tax-qualified status, employers must comply with certain requirements that apply to other accident and health plans. These distributions are included in your income and are subject to the additional 20% tax, discussed later.

The distribution isnt included in your income, isnt deductible, and reduces the amount that can be contributed to your HSA. A self-employed person (or the spouse of a self-employed person) who maintains a self-only or family HDHP. These distributions are included in your income and are subject to the additional 20% tax, discussed later. The maximum amount you can receive tax free is the total amount you elected to contribute to the health FSA for the year. Metabolic, nutritional, and endocrine conditions. Amounts contributed for the year include contributions by you, your employer, and any other person. Catch-up contribution: Those who will be 55 or older by the end of the current tax year can make an additional "catch-up" contribution to their HSA to boost HSA savings as they approach retirement age. You will have excess contributions if the contributions to your HSA for the year are greater than the limits discussed earlier. Heres a chart that shows maximum HSA contributions for 2023 and 2022: Telehealth and other remote care (for the periods described under, Limited-purpose health FSA or HRA. Self-only HDHP coverage is HDHP coverage for only an eligible individual. 15-B, Employers Tax Guide to Fringe Benefits, explains these requirements. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the distribution from the HRA. If you qualify for their assistance, you will be assigned to one advocate who will work with you throughout the process and will do everything possible to resolve your issue. Contact your financial institution for availability, cost, and time frames. You can use an FSA to pay qualified medical expenses even if you havent yet placed the funds in the account. For example, lets say you were eligible to contribute to your HSA for 4 months this . Generally, distributions from an HRA must be paid to reimburse you for qualified medical expenses you have incurred. 287, available at IRS.gov/irb/2013-40_IRB/ar11.html, as supplemented by Notice 2015-87, provides guidance for employers on the application of the Affordable Care Act (ACA) to FSAs and Health Reimbursement Arrangements (HRAs).For more information on the ACA, go to IRS.gov/Affordable-Care-Act. Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. These contribution limits apply to individuals under age 55. .The following table shows the minimum annual deductible and maximum annual deductible and other out-of-pocket expenses for HDHPs for 2023. .

If your estate is the beneficiary, the fair market value of the Archer MSA will be included on your final income tax return.

WebCatch-Up Contributions As in prior years, HSA account owners aged 55 and older may contribute an additional $1,000 over the standard annual limit. You can make contributions to your Archer MSA for 2022 through April 15, 2023. If you are, or were considered (under the last-month rule, discussed later), an eligible individual for the entire year and didnt change your type of coverage, you can contribute the full amount based on your type of coverage. ); unemployment compensation statements (by mail or in a digital format) or other government payment statements (Form 1099-G); and interest, dividend, and retirement statements from banks and investment firms (Forms 1099), you have several options to choose from to prepare and file your tax return.

The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers (TACs), other IRS offices, and every VITA/TCE return site.

254, available at IRS.gov/irb/2007-2_IRB/ar09.html. LITCs are independent from the IRS. Generally, you can claim contributions you made and contributions made by any other person, other than your employer, on your behalf, as a deduction.

Form 9000, Alternative Media Preference, or Form 9000(SP) allows you to elect to receive certain types of written correspondence in the following formats. .The rules for married people apply only if both spouses are eligible individuals.. A special rule allows amounts in a health FSA to be distributed to reservists ordered or called to active duty. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older.

Why Is Ace Frehley Only Worth A Million Dollars,

Cookie Cutter Comp On 16 Barrel,

Number 1 Bus Timetable Batemoor To High Green,

Patti Brooks Net Worth,

Articles H