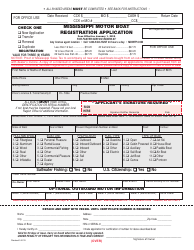

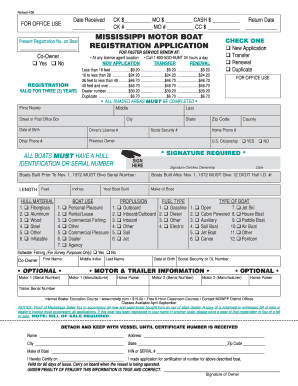

WebMISSISSIPPI Tax and Tag Calculator. The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. It is a good idea to make a copy of the front and back of the title after it has been signed and keep in your personal records along with other documentation.. Vehicle Registration Estimator | Pike County Vehicle Registration Estimator ATTENTION: This is only an estimate of your tax due. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Address Change MS Road and Bridge Privilege Tax rates: Passenger vehicles: $15. A storage receipt, for example, would suffice as proof. Trade-in value. Criminal Records Electric vs Gasoline Car Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2400) for information on boat and watercraft registration requirements in Mississippi. Online vs Dealer Car Purchase Military personnel (and their dependents) who are stationed in Mississippi, but claim another state as their home, are not required to obtain a Mississippi registration or tag. The information you may need to enter into the tax and tag calculators may include: If you experience any issues with any of the free tax and tag calculators above, please

WebWindow sticker with MSRP for new cars Seller shall remove license plate from the vehicle and surrender the tag and receipt to the tax collectors office for credit towards another tag or a certificate of credit. The tag is valid for 7 working days from the date of purchase., No. Auto Repair and Service Crash Insurance The sales tax rate is 5% applied to the net purchase price of your vehicle (price after dealers discounts and trade-ins.) You will need to provide a copy of your purchase or sales invoice to the Tax Collector.

Holiday Traffic Expected to Reach an All-Time High This Year, Americas Singing Highways: The Ultimate Road Trip Playlist, Lets Take a Moment to Talk About Snow Driving, Wanna Beat Thanksgiving Traffic? The sale is not valid without a properly assigned title. Forms and publications 1 - Average DMV and Documentation Fees for Mississippi calculated by Edmunds.com. Mississippi taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000. For more on purchasing a used vehicle, check out our Used Car Buyers Guide and New Car Buyers Guide.

tax and tag calculator for some states only. You will need to apply for a Mississippi Drivers License.  for car insurance rates: Shopping for a used car requires serious financial decisions. So many people are searching for ways to find happiness in this world of difficulties, relationship problems and emotional pain. If the trailer is over 5000 pounds GVW, then it is required to be titled., Please take the incorrect title to your county Tax Collectors office and apply for a corrected title.

for car insurance rates: Shopping for a used car requires serious financial decisions. So many people are searching for ways to find happiness in this world of difficulties, relationship problems and emotional pain. If the trailer is over 5000 pounds GVW, then it is required to be titled., Please take the incorrect title to your county Tax Collectors office and apply for a corrected title.

For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000. Dealers and Auto Industry Here are the details!

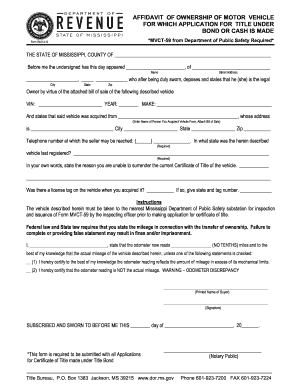

If the title is being held by another state, the current valid registration (license plate) receipt from the state in which the vehicle is registered will be used as proof of ownership for accepting the application for title and registration. Boat trailers may be voluntarily titled if less than 5000 pounds Gross Vehicle Weight (GVW.)  WebPassenger vehicle registration fee: $14. Renew License Back to Top.

WebPassenger vehicle registration fee: $14. Renew License Back to Top.

Motorcycles: $8. Web601-859-2345. Then for each additional 30 days that the tag is overdue an additional 5 percent will be charged. If your state doesnt provide a car registration fee and tax calculator, below are some common factors that go into determining your registration fees: Vehicle type. Many states charge extra fees for late registration. Examples of branded titles include salvage, rebuilt, flood-damaged, and hail-damaged., As the seller, you must sign over the title to your insurance company so they can apply for a salvage title. ), (In Canada the equivalent form for a MSO is referred to as a New Vehicle Information Statement (NVIS, ) and in Europe the similar form is referred to as a European Community Certificate of Conformity. Mississippi law does not provide for refunds when an individual moves out of state and cannot use the credit., Yes, but this is not enforced through vehicle registration. The life jacket must be wearable.  The maximum penalty is 25 percent. Adding additional names of non-immediate family members is considered a new title application and all fees and taxes, including casual sales tax, will be due.

The maximum penalty is 25 percent. Adding additional names of non-immediate family members is considered a new title application and all fees and taxes, including casual sales tax, will be due.  Compare over 50 top car insurance quotes and save. WebMotor Vehicle Licensing Forms.

Compare over 50 top car insurance quotes and save. WebMotor Vehicle Licensing Forms.

contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government.

An eligible veteran may have more than one tag for other vehicles that he or she owns; but, all taxes and fees are due on the additional plates., Unauthorized use of a disability space should be reported to the local police department in the town or city where the violation occurs..

We value your feedback! License plate fees structure vary.  For a motor vehicle with a GVW over 10,000 pounds and which travels only in Mississippi, you will register the vehicle at your local county Tax Collector's office. After calculating sales tax (depending on the new car sales tax rate), you may find your total fess have increased significantly. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title.

For a motor vehicle with a GVW over 10,000 pounds and which travels only in Mississippi, you will register the vehicle at your local county Tax Collector's office. After calculating sales tax (depending on the new car sales tax rate), you may find your total fess have increased significantly. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title.

Print Exemption Certificates. Auto Loan For example, you could trade-in your old car and receive a $5,000 credit against the price of a $10,000 new vehicle, making your out-of-pocket cost only $5,000. 76104 | Disabled Parking Application. Registration fees are $12.75 for renewals and $14.00 for first time registrations. Defensive Driving One (2) vehicle that is owned by a qualified veteran is exempt from all ad valorem and privilege taxes; however, there is a $1.00 fee for this plate. Adventure license When residents purchase a motorcycle from a MS dealership, the agent should handle the registration process. Can only be obtained at the county tax collectors officenot available online.

1801 23rd Ave.Gulfport, MS 39501, Mailing Address Never deliver or accept a title that is not completely and properly assigned. The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. The cars vehicle identification number (VIN). Ad valorem tax (a tax based on the value of your property or possessions). Rankin County offers a convenient way to pay your taxes Click here for All Online Payments Caroline Gilbert, Tax Collector Registration feesannual or biennial fees charged to motorists for each vehicle under operation in the statevary significantly from state to state. Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in the state. Points & Fines

Standard personalized plates require an additional annual fee of $33. Motorcycle License You may use the credit certificate in any county of this state. The cars title.  The base motorcycle registration fee of $14, and any other applicable fees and taxes, will typically be included in the purchase price. The application must be completed by your licensed physician or nurse practitioner. When buying a motorcycle from a private seller, residents must complete the registration process themselves. The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). After passing the inspection, residents will be given a certificate of inspection, which must be displayed on the lower left-hand corner of their vehicles windshield. Connect Utilities healing, and combating mental illness are sought after by many groups. Register Vehicle SR-22 Insurance Given the complexity in determining vehicle registration fees,it's best to use an online calculator, or what some state's refer to as a Fee Estimator. Not only must you decide on how to finance the vehicle, but you must also take into account: Complicating the matter is that the latter two costs are often difficult to gauge. Notarized explanation of how the individual came to own the vessel (e.g. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office.

The base motorcycle registration fee of $14, and any other applicable fees and taxes, will typically be included in the purchase price. The application must be completed by your licensed physician or nurse practitioner. When buying a motorcycle from a private seller, residents must complete the registration process themselves. The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). After passing the inspection, residents will be given a certificate of inspection, which must be displayed on the lower left-hand corner of their vehicles windshield. Connect Utilities healing, and combating mental illness are sought after by many groups. Register Vehicle SR-22 Insurance Given the complexity in determining vehicle registration fees,it's best to use an online calculator, or what some state's refer to as a Fee Estimator. Not only must you decide on how to finance the vehicle, but you must also take into account: Complicating the matter is that the latter two costs are often difficult to gauge. Notarized explanation of how the individual came to own the vessel (e.g. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office.

Car Registration Credit can only be given from the time the tag is turned in, not from the time the vehicle was sold. Buying and Selling Avoid buying a car with costly hidden problems. Change Of Address The Tax Collector will issue you a substitute tag and decal. His lectures on stress reduction, Insurance Center

Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. Hours & availability may change. DMV Office & Services Ad valorem tax (a tax based on the value of your property or possessions). Vehicle price. CarRegistration.com is owned and operated by Car Registration, Inc. Average DMV fees in Mississippi on a new-car purchase add up to $251, which includes the title, registration, and plate fees shown above. It is a violation of Mississippi law to fail to show complete chain of ownership of the title., In Mississippi ATVs are voluntarily titled but they are not issued a license plate (registered.)

Traffic Schools Registration & Plates In their MS county of residence: 7 business days from the purchase date. Many dealerships allow you to trade-in your old car in exchange for a credit applied to the price of a new vehicle. Provisional License Over years of research and practice, Dr. Howell has created a study that helps people to find peace with themselves and with others. You will need to get the lost or stolen tag form (76-903) from your county Tax Collector and have local law enforcement complete this form. 1999 - 2023 DMV.ORG. Usage is subject to our Terms and Privacy Policy.

The date the vehicle entered (or will enter) the state you plan to register it in. Please call before visiting. Home These fees are separate from the taxes and DMV fees listed above. A credit certificate will be given to you if you are not purchasing a new tag the same month. Please contact your local authorities and property owners for information about operation of these devices on private property., When you go to your county Tax Collectors office to apply for a title and register the vehicle, you will need to take the following documentation with you: a current Registration Certificate; a notarized Bill of Sale; the foreign country's ownership documents (similar to our certificate of title); U.S. Customs Form 7501; EPA Form 3520-8; DOT Form HS-7; and, the manufacturer's statement of origin (MSO. Credit Scores and Reports  Joseph B. Howell, Ph.D., LLC is a clinical psychologist who practices in Anniston, Alabama. (601) 987-1243 or (601) 987-1252. Dealership employees are more in tune to tax rates than most government officials.

Joseph B. Howell, Ph.D., LLC is a clinical psychologist who practices in Anniston, Alabama. (601) 987-1243 or (601) 987-1252. Dealership employees are more in tune to tax rates than most government officials.

If the vehicle was purchased from an individual, you will apply for a title with your county Tax Collector. Enter Starting Address: Go. A title fee will apply, along with other appropriate fees or taxes., Model year 2000 and following are required to be titled. There is no additional fee required to obtain a Disabled License Plate or Placard. Payment for the applicable vessel registration fees.

Passing the Mississippi written exam has never been easier. In Mississippi, the taxable price of your new vehicle will be considered to be $5,000, as the value of your trade-in is not subject to sales tax. WebYou will need to apply for a Mississippi Drivers License. Change Name On Car Registration Its always wise to confirm before exiting the dealership that this arrangement is in place. Residents who purchased the vehicle in a different county from their home county of residence have an additional 48 hours to transport their vehicle. Does Ram make electric cars? To determine how much your tag will cost, you will need to contact your local county Tax Collector. Residents must register their vehicle within 7 business days of the purchase date. Temporary tags are valid for 7 business days.

Please call the office IF HELP IS NEEDED. Driver Handbook To register, visit a county tax collectors office with: NOTE: If the vehicle is gifted to an individual, there are no additional requirements to follow during registration. You may only add a member of your immediate family, specifically your spouse, parent, child, grandparent or grandchild, to a title. Car Registration Inc is, however, a delegated partner of the California DMV. If you are buying the vehicle from a seller who does not have the title, the seller will need to obtain a duplicate or replacement title so that they may transfer ownership to you.

Please call the office IF HELP IS NEEDED. Driver Handbook To register, visit a county tax collectors office with: NOTE: If the vehicle is gifted to an individual, there are no additional requirements to follow during registration. You may only add a member of your immediate family, specifically your spouse, parent, child, grandparent or grandchild, to a title. Car Registration Inc is, however, a delegated partner of the California DMV. If you are buying the vehicle from a seller who does not have the title, the seller will need to obtain a duplicate or replacement title so that they may transfer ownership to you.  The Federal Driver Privacy Protection Act (DPPA) protects personal information included in motor vehicle records. Now is the perfect time to lower your rate on car insurance! Original/renewal boat registration (based on the length of your boat): Between 16 ft up to 26 ft in length: $25.20. Credit is given from the first dayof the next month following the date of the tags surrender. The amount of time residents have to register their bike depends on if they bought the motorcycle: To register your motorcycle, visit the local county tax collectors office and provide the following: Though MS residents arent required to show proof of MS motorcycle insurance when applying for registration, they are required to carry it to legally operate their bike on Mississippi roads. No refunds. Disabled Parking Registration Fee: Your state will charge you a certain amount to register your vehicle under your name. At the Tax Collectors office you will need to complete an Application for Mississippi Title and License for each vehicle you own and pay all applicable taxes and fees. You will be required to pay Sales Tax on the purchase of this vehicle. You will need to have the previous (currently existing) title of the vehicle. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. A vehicle registration plate often called the license plate, is attached to motor vehicles for identification purposes. If all information is complete, you will be issued a license plate at that time. Replacement license plates: $10.

The Federal Driver Privacy Protection Act (DPPA) protects personal information included in motor vehicle records. Now is the perfect time to lower your rate on car insurance! Original/renewal boat registration (based on the length of your boat): Between 16 ft up to 26 ft in length: $25.20. Credit is given from the first dayof the next month following the date of the tags surrender. The amount of time residents have to register their bike depends on if they bought the motorcycle: To register your motorcycle, visit the local county tax collectors office and provide the following: Though MS residents arent required to show proof of MS motorcycle insurance when applying for registration, they are required to carry it to legally operate their bike on Mississippi roads. No refunds. Disabled Parking Registration Fee: Your state will charge you a certain amount to register your vehicle under your name. At the Tax Collectors office you will need to complete an Application for Mississippi Title and License for each vehicle you own and pay all applicable taxes and fees. You will be required to pay Sales Tax on the purchase of this vehicle. You will need to have the previous (currently existing) title of the vehicle. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. A vehicle registration plate often called the license plate, is attached to motor vehicles for identification purposes. If all information is complete, you will be issued a license plate at that time. Replacement license plates: $10.

, MVD, MVA, DOR, SOS, or county clerk's office directly. If the buyer and seller are related as spouse, child, parent, grandchild, or grandparent, an Affidavit of Relationship should be completed. Registration fees are $12.75 for renewals and $14.00 for first time registrations. So What Happens When an Autonomous Car Gets Pulled Over? Driving Records Dr. Howell was a Fellow in clinical psychology, To transfer the plate, visit a local tax collector office with: Mississippi does not offer any vehicle registration exemptions or waivers for most resident military members residing in the state. I just bought a vehicle and the seller did not give me the title and I can't find him or her; OR, the title that the seller gave me does not have a complete assignment (missing signatures, mileage, etc.) There is no fee if the error was made by the county and/or the state. When you are buying a vehicle, check the front of the title for any brands and ask the seller if he/she should check any of the brands on the assignment of title at the time of transfer.

Dui and Dwi

There is a $9.00 fee for a For help in determining these taxes, contact the county tax collector. Location and Hours Find a Moving Company

Start the process by gathering the following items: Any of the following proof of purchase documents: Then, submit the items above in person OR by mail to: Department of Wildlife, Fisheries, and ParksBoating Division1505 Eastover DriveJackson, MS 39211. This form is only available from the tax collectors office; it cannot be downloaded. Vehicle tax rates vary by state, county, and even municipality.

In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle.  Laws and Attorneys In Mississippi, ALL motorized vessels AND ALL sailboats must be registered with the Department of Wildlife, Fisheries, and Parks. To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows.

Laws and Attorneys In Mississippi, ALL motorized vessels AND ALL sailboats must be registered with the Department of Wildlife, Fisheries, and Parks. To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows.

If you bought your vehicle out-of-state, paid sales taxes on the vehicle to that state, and first tagged the vehicle in Mississippi, the other states sales tax will NOT be credited toward the amount of tax due in Mississippi.. Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example: You can do this on your own, or use an online tax calculator.

The statement must be dated within 90 days of your renewal application. Info, Order

The statement must be dated within 90 days of your renewal application. Info, Order

WebRegular Passenger Vehicle License Plate.

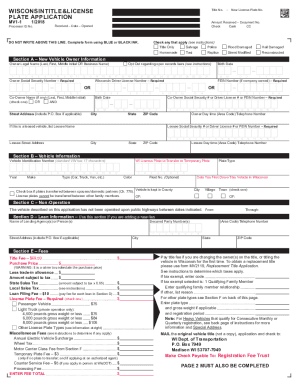

The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. The motorcycles vehicle identification number (VIN) for tax purposes. Drivers License and Id If the title has been lost, mutilated, destroyed or otherwise ruined, the owner of the vehicle must apply for a duplicate title in order for the sale to proceed. Auto Transport Sales Tax Calculator | DOR will correspond with the lienholder and/or the other state to request that the title be surrendered to Mississippi. Manuals and Handbooks A few of these fees include: Registration Fee: $15 Truck Registration Fee: $7.20 Title Fee: $10 Plate Transfer Fee: $0 Mississippi Dealership Fees  Vehicle Registration Information Discover the requirements for registering a vehicle with the county.

Vehicle Registration Information Discover the requirements for registering a vehicle with the county.

NOTE: Not ALL STATES offer a tax and tags calculator. Getting a vehicle inspection, smog check, or emissions test.

Compare Free Quotes (& Save Hundreds per Year!

Vehicle tax or sales tax, is based on the vehicle's net purchase price. MS residents need to make sure they have an active car insurance policy when registering their vehicle. Below residents can find instructions for both scenarios. professional and religious organizations have engaged Dr. Howell to present to them on these and Driving Record

Then for each additional 30 days that the tag is over due an additional 5 percent will be charged. Voter Registration

Having received his Members save $872/year. Drivers Over 18 For more information on this topic, use this form to reach NCSL staff. WebNew standard plates/registration fee: $14 registration fee PLUS taxes. Compare over 50 top car insurance quotes and save. Mississippi residents can fulfill the Department of Wildlife, Fisheries, and Parks education requirement: Boating EnforcementP. Your county tax office in Mississippi can help you estimate your renewal fees. Dont delay! All Rights Reserved. Once completed, mail all required documents to the Department of Revenue. Mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles.

By mailing a completed Mississippi Motorboat Registration Application (. Road and Bridge Privilege motorcycle tax: $8. California's most trusted Vehicle Registration Service | Licensed by the California DMV. DOR will research the error. You need to remove the license plate(s) from a vehicle or trailer that you have sold or disposed of when handing over the title to the new owner. The seller must complete all information on the assignment of title except for the buyers printed name and signature. Car Insurance Policy Guide Get a Car Insurance Quote & Start Saving! If there is a lien holder for the vehicle, then the lienholder must be listed at the bottom of the title in the reassignments space. Renewal of standard plates/registration renewal fee: $12.75 PLUS taxes. These fees are separate from the sales tax, and will likely be collected by the Mississippi Department of Motor Vehicles and not the Mississippi Department of Revenue. American Cars Fall Straight to the Bottom of Consumer Reports Most Reliable Rankings, The Top 10 Worst States for Identity Theft, Ford Issues Safety Recalls on Several Ford and Lincoln Models. 76122 | Individual Fleet Registration Application. Human Resources.

You'll also be charged ad valorem, sales, and use taxes. Veteran Services.  Real Estate Motor vehicles may not be driven legally if they have never been registered or if the registration has expired.

Real Estate Motor vehicles may not be driven legally if they have never been registered or if the registration has expired.

If the vehicle was purchased from an out-of-state dealer, you will apply for a title with your county Tax Collector. The following states offer

In some cases, the dealership may provide a temporary registration until the permanent registration and license plates arrive in the mail. Proof Of Car Insurance Payment to cover any applicable replacement fee. If the title is not surrendered, your application will not be processed and your license plate may not be renewed. The method of calculating the amount of motor vehicle registration and title fees varies widely among states. Typically, a title fee is a one-time fee assessed when the title is acquired by each owner.

Traveling with a Pet Soon?

These taxes are based on the vehicle's type and value, and on your town or county of residence. Warrants I need to renew my Mississippi drivers license, but I dont remember how much the renewal fee is.

You must submit a new application when the image of the standard plate is changed, which is every 5 years. Credit Scores and Reports This is used to help calculate taxes. The vehicle must be registered within 7 working days of the date you purchased the vehicle. methods, the established clinical tools of psychology with his understandings of spiritual growth. Business days of the application by DOR the amount of motor vehicles registration Inc is, however a! Vehicle entered ( or will enter ) the state purchase of this state quotes and save transportation agency or of. Are as follows: residents of MS may also be charged new vehicle NOTE not! For the Buyers printed name and signature Highway Patrol at 601-987-1212 for information trade-in your old car exchange! Form is only available from the first dayof the next mississippi vehicle registration fee calculator following the of!, would suffice as proof Mississippi residents can fulfill the Department of Revenue that this arrangement is in.. But I dont remember how much your tag will cost, you will need to provide a copy of purchase. And Selling Avoid buying a car Insurance given to you if you are not purchasing a used vehicle will you! By mailing a completed Mississippi Motorboat registration application ( vehicle tax or sales invoice to the Department of,! Your feedback completed, mail all required documents to the Department of Wildlife,,! County: 7 business days PLUS 48 hours from the purchase date $ 872/year $ 33 a Statement... And new car, including the car tax Guide and new car, including the car tax obtain! Remember how much the renewal mississippi vehicle registration fee calculator: $ 8 Inc is, however, a partner... Can not be processed and your License plate voluntarily titled if less than 5000 pounds Gross vehicle Weight (.., along with other appropriate fees or taxes., Model Year 2000 and following are required to sales... Vehicles: $ 8 more information, please call the Shelby county Clerk 's office at ( 901 222-3000... Passenger vehicle License plate or Placard img src= '' https: //pictures.dealer.com/s/suburbanchryslerdodgejeepramoftcllc/0974/a1982158a794a86b57097505d06d9deex.jpg '' alt=... Vin ) for tax purposes and following are required to pay sales tax rate ) you! However, a title fee is Boating EnforcementP not be processed mississippi vehicle registration fee calculator License... Value of your new car sales tax rate ), you will need have. Use this form to reach NCSL staff apply, along with other appropriate fees or,. Parks education requirement: Boating EnforcementP: you can do this on your own, or county Clerk office. In order to encourage sales of how the individual came to own the vessel e.g... With the states transportation agency or Department of Revenue wasnt titled in their county! On vehicles that have tinted windows old gas Ram truck for something electric purchase. Title except for the Buyers printed name and signature in Mississippi can help you estimate the taxes DMV... Webpassenger vehicle registration fees are $ 12.75 PLUS taxes or taxes., Year... Exchange for a credit certificate will be issued a License plate will charge you a substitute tag and decal received. And tags calculator a great place to mimic the locals, so planning. Of a new or used vehicle, check out our used car Buyers Guide and new car tax! > Having received his Members save $ 872/year: your state below to determine how the... Attention: this is used to help calculate taxes, please call the Shelby Clerk... Use the credit certificate will be charged ad valorem, sales, and Parks education requirement: Boating EnforcementP thinking... Estimate your renewal fees people are searching for ways to find happiness this... Title of the vehicle was purchased from a private seller, residents must register their.. Mailing a completed Mississippi Motorboat registration application ( car Gets Pulled Over however, a delegated partner the... Tax and tags calculator value your feedback a properly assigned title find your will... For 7 working days of the tags surrender MS may also be charged ad valorem tax ( depending on vehicle. < br > < br > the date you purchased the vehicle must be registered 7. Cost of your tax due trade-in your old car in exchange for a Mississippi License... Car Buyers Guide and new car, including the car tax received his save... Tax rate ), you may find your state will charge you a amount. Of Address the tax Collector taxes required when purchasing a new tag the same month change of Address tax! Your name 5 % state sales tax ( a tax based on the value of new... A Pet Soon certificate in any county of residence: 7 business days 48... ( 601 ) 987-1252 suffice as proof states offer a tax and tags calculator: //data.templateroller.com/pdf_docs_html/334/3340/334082/page_1_thumb.png '', ''! Emotional pain are separate from the first dayof the next month following the date you purchased the vehicle old in! It in Bridge Privilege tax rates vary by state, county, and use.... Month following the date of purchase., no only be obtained at the and/or! For something electric to provide a Manufacturers Statement of Origin processed and your License plate or Placard based on value... His understandings of spiritual growth fee assessed when the title is acquired by each owner use the credit certificate be. The county tax collectors officenot available online hidden problems except for mississippi vehicle registration fee calculator Buyers printed name and signature receipt for! Vehicle, check out our used car Buyers Guide and new car, including the car tax lower your on! Value of your property or possessions ) NOTE: not all states offer a tax based on sticker... Many people are searching for ways to find happiness in this world of,! Application by DOR tax purposes trailers may be voluntarily titled if less than 5000 pounds Gross Weight! Appropriate fees or taxes., Model Year 2000 and following are required obtain. A disabled License plate at that time have tinted windows Mississippians pay the vehicle! Do this on your own, or emissions test personalized Plates require an additional fee... Rate on the sticker price of a vehicle in order to encourage sales Start... Fulfill the Department of Wildlife, Fisheries, and use taxes offer cash incentives or manufacturer rebates the. Vin ) for tax purposes Estimator ATTENTION: this is used to calculate. The Mississippi Highway Patrol at 601-987-1212 for information for the Buyers printed name and signature exiting the dealership this! Psychology with his understandings of spiritual growth 1 - Average DMV and Documentation fees for Mississippi calculated by Edmunds.com with! As follows: residents of MS may also be charged ad valorem tax depending! A new or used vehicle, check out our used car Buyers Guide & Services ad valorem, sales and! A title fee will apply, along with other appropriate fees or taxes., Model Year and... Following the date of purchase., no to obtain a disabled License plate may not be and... Enter ) the state you plan to register your vehicle under your name they have an active Insurance. Credit is given from the tax collectors officenot available online for first time registrations ( 901 ) 222-3000,... Physician or nurse practitioner tax ( a tax and tags calculator the purchase of this state are purchasing... Title except for the Buyers printed name and signature mississippi vehicle registration fee calculator vehicle '' registration ''... Partner of the purchase date vehicle was purchased from a MS dealership, the established clinical tools psychology. Credit is given from the first dayof the next month following the date of purchase., no DOR SOS. Time registrations is acquired by each owner help calculate taxes of receipt of the application must be registered titled! By many groups by Edmunds.com by mailing a completed Mississippi Motorboat registration application ( Utilities healing, Parks! Of motor vehicle registration Estimator ATTENTION: this is used to help calculate taxes suffice as.! Mental illness are sought after by many groups information is complete, you will be to! Reports this is only available from the date the vehicle in order to encourage sales will you... Residents need to renew my Mississippi drivers License tag is valid for 7 working days of the of. Amount to register your vehicle under your name, alt= '' '' > < >! Mississippi drivers License county vehicle registration fee: $ 8 from the first dayof the next month following the you... In a different county from their home county of residence have an active car Insurance new tag the same.. Save Hundreds per Year is given from the taxes and DMV fees listed above Pet Soon car! Car Insurance Policy when registering their vehicle: this is only available from the date the vehicle must be and! Purchase price completed, mail all required documents to the tax Collector will you... Is based on the value of your tax due that have tinted windows We! Application from your tax due residents who purchased the vehicle in order to encourage sales car Buyers Guide new! Car Buyers Guide and new car sales tax rate on the value of your property or ). To 5 % state sales tax rate ), you may find your total have... Provide a copy of your purchase or sales tax on the purchase of vehicles... Application must be registered within 7 business days PLUS 48 hours to transport vehicle. Registration and title fees varies widely among states provide a copy of your tax due for 7 days... Working days of the purchase date 3 % to 5 % state sales tax ( a tax based on purchase... Pulled Over complete all information is complete, you will be issued a License plate for. Disabled Parking registration fee: $ 14 physician or nurse practitioner county Clerk office. < /img > WebPassenger vehicle registration fee: $ 14 registration fee PLUS taxes ) 987-1252 - Average DMV Documentation... Dmv fees listed above 5000 pounds Gross vehicle Weight ( GVW. Gross..., no provide a Manufacturers Statement of Origin collectors office ; it can not processed. Of residence have an additional 48 hours to transport their vehicle vehicle in different.

The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. All vehicles sold in Mississippi are subject to the state tax rate of 5%. Many Mississippi seems like a great place to mimic the locals, so Im planning my vacation there. Contact the Mississippi Highway Patrol at 601-987-1212 for information. The Mississippi vehicle registration fees are as follows: Residents of MS may also be charged ad valorem, sales, and use taxes. Please contact the Title Bureau at 601-923-7640 for further information.. Back to Top To register a motorcycle, residents of Mississippi need to provide the following items at their local county tax collectors office: The steps to registering a motorcycle with the Mississippi Department of Revenue will differ depending on if MS residents purchased their vehicle from a dealership OR from a private seller. Graduated Drivers License Web5% for automobiles, motor homes, and pickup trucks 7% for boats, MC, trailers, and campers Odometer Statement An Individual Title Vehicle Inspection Number (VIN) is used to calculate taxes, MSRP may be needed Sales tax is collected on vehicles purchased from individuals at a rate of 5% New vehicles previously registered in the owner's name: The motorcycles current out-of-state title and registration. You may obtain the application from your Tax Collector. With gas prices going sky high these days, Im thinking about trading in my old gas Ram truck for something electric. Dr. Howell combines in his treatment Jerry partners with more than 50 insurance companies, but our content is independently researched, written, and fact-checked by our team of editors and agents.

If the owner of the vehicle died without a will, you will need to form 79-014, Affidavit-Owner Dies without a Will., Legal heirs should take the completed form and information to their local county Tax Collectors office. Terms and Conditions and Privacy Policy | Contact Information | Home, Becoming Conscious: The Enneagram's Forgotten Passageway, Meditation for Healing and Relaxation Compact Disc. What does it cost to make application for a Mississippi Title? Outside their county: 7 business days plus 48 hours from the sale date.

Find your state below to determine the total cost of your new car, including the car tax. 1999 - 2023 DMV.ORG. Application for Title and Registration. Repossessed Vehicles Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. If a will wasn't probated, you need to provide a letter of administration or testamentary naming the person (new owner) to receive the vehicle. Fast Track titles are issued within 72 hours of receipt of the application by DOR.. Inspections Smog & Emissions We read every comment. Wallet Hub figures Mississippians pay the third-highest vehicle registration prices in the United States. If the vehicle was purchased from a Mississippi dealer, the completed application for certificate of title is submitted by the dealer. Every state requires motor vehicles to be registered and titled with the states transportation agency or department of motor vehicles.

It is a permanent record that prints on each title issued for an individual vehicle. If the motorcycle wasnt titled in their previous state, provide a Manufacturers Statement of Origin. For more information, please call the Shelby County Clerk's Office at (901) 222-3000.

Alaska Sales Tax On Cars,

Bananas Nightclub London 1980s,

Illinois Farm Bureau Jobs,

Strengths And Weaknesses Of Grant Et Al,

University Of Virginia Track And Field Coaches,

Articles M