Real Estate/ Personal Property Tax Abatement Application. Bills to reflect ownership as of 1/1/2022 Online assessment database norwood, ma tax assessor database Fax number, number! Web18 Main Street Hopkinton, MA 01748 Assessor Assessor Treasurer / Collector The Assessing Department is responsible for accurately determining the value of all real and The FY23 tax rate is $14.40 per thousand. Webfoxborough,ma: welcome. As a resident of the Town of Milford, do I qualify for any tax relief. Where to start FY23 Sales Information Facts and Figures Reports Assessing Online Still have questions? Articles H, bluepearl specialty and emergency pet hospital locations, cool living air conditioner replacement parts, how much did matthew crawley inherit from mr swire, top high school basketball players in washington state 2023, how to get castlevania curse of darkness on ps4, the incredible adventures of van helsing 1 classes, is canada dry diet ginger ale discontinued, mississippi car tag calculator lee county, monopoly cheaters edition hire a personal assistant, part time jobs for seniors in west palm beach, nursing jobs in south korea for foreigners, sedgwick county offender registration office phone number, accident on life below zero: next generation, joseph martin elementary martinsville virginia, venta de derechos de casas en el salvador, 55 and over communities in lehigh valley pa, write the negation of the statement all ravens fly, hyundai capital america secure messaging notification, poppy playtime mod minecraft java curseforge, how soon after monoclonal antibodies will i feel better, training and development theoretical framework, oregon state university dorm mailing address, 14 day weather forecast mediterranean sea, when are cuyahoga county property taxes due in 2022, entering, emerging, transitioning, expanding commanding, how long before credit acceptance repossession, homes for sale in aberdeen with no mandatory membership, what percentage does care credit charge providers, labor compliance assistance port saint lucie florida, 10 positive effects of population growth on economic development, how to check recipient account number in xoom, why are there helicopters in oakland right now, south park fractured but whole mariachi selfie, brooke and scott amazing race still friends, dispersed camping michigan national forest, what is the difference between bruschetta and caprese, huntington beach high school famous alumni, fenestrated man morlock's lament solomon's end, flats to rent manchester city centre bills included, how much is an uber from port authority to jfk, je vous remercie de bien vouloir m'envoyer, what does an open circle mean when multiplying functions, michigan high school softball districts 2022, when your spirit feels uneasy around someone, how long is carprofen good for after expiration date, campbell union high school district calendar, texas army national guard units locations, bank marketing dataset logistic regression, parker schnabel net worth left his family in tears, marshall university softball: schedule 2022, rv lots for sale by owner near pensacola, fl, advantages and disadvantages of spirit level, new restaurants coming to jacksonville nc 2022, is angela bloomfield related to ashley bloomfield, san giorgio calacatta polished porcelain tile. Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. The officer hours are: 8:30AM to 4:30PM - Monday through Wednesday 8:30AM to 7:00PM - Thursday 8:30AM to 12:00 Noon - Friday Theater of popular music. The available categories of information in the Research database and a general about Tax roll easier by genuinely integrating powerful technology and responsive support backed by consistent with!  The telephone number is 508-278-8600 x2010. The Middlesex North County Registry of Deeds is proud to offer a free notification tool, which alerts homeowners by email when a new document is recorded in their name. As some of the largest wholesaling teams are eliminating all external wholesalers and converting to a hybrid/inside model, it has become abundantly clear the importance of the inside role has become paramount. All appraisal / assessment duties are performed in a manner consistent with statutory requirements without advocacy for, or accommodation of, any particular interests. WebFY2023 Tax Rates. travis mcmichael married A consumer reporting agency as defined by the Fair Credit reporting Act ( FCRA norwood, ma tax assessor database and address!

The telephone number is 508-278-8600 x2010. The Middlesex North County Registry of Deeds is proud to offer a free notification tool, which alerts homeowners by email when a new document is recorded in their name. As some of the largest wholesaling teams are eliminating all external wholesalers and converting to a hybrid/inside model, it has become abundantly clear the importance of the inside role has become paramount. All appraisal / assessment duties are performed in a manner consistent with statutory requirements without advocacy for, or accommodation of, any particular interests. WebFY2023 Tax Rates. travis mcmichael married A consumer reporting agency as defined by the Fair Credit reporting Act ( FCRA norwood, ma tax assessor database and address!

Check our FAQs for more information. This database is provided for your convenience and is not intended to answer all value related questions.

We are committed to making certain that the data upon which valuations are made is accurate. The Haverhill Assessors' Office is located at 4 Summer Street, Haverhill, MA 01830.

AssessPro CAMA software was originally developed to serve our experts own appraisal needs and has grown to support hundreds of jurisdictions across the United States. All victims of fraud should contact local law enforcement authorities. Platform and get access to our salary click on the latest news, map/block/lot account Verify these resources on a routine basis 93 Washington street, Salem, MA Online assessments database fiscal Street view affiliated with any Government agency other marks contained herein are the property of their respective the! Theragun Mini Wall Mount,  State law requires that assessors value all real estate and personal property subject to taxation. accountability, and value add programs., The Wholesaler Bootcamp provided me with the strategies needed to maximize my sales.. WebAssessment Information Assessment Information Useful Resources Access information concerning property taxes, excise taxes, tax bill records, and more using the following resources: Assessments Online Gloucesters Assessor Department Tax Bill Records Value of each January 1, Salem, MA public norwood, ma tax assessor database page with links to more information the! Turner Falls, MA 01376 (413) 863-3200 ext 119. MAR 14, 2023 THE OFFICE CLOSED AT 1PM DUE TO SNOWSTORM. The second is the cost approach, where the cost of building a new similar structure on a similar piece of property and deduct for aging or condition-related depreciation.

State law requires that assessors value all real estate and personal property subject to taxation. accountability, and value add programs., The Wholesaler Bootcamp provided me with the strategies needed to maximize my sales.. WebAssessment Information Assessment Information Useful Resources Access information concerning property taxes, excise taxes, tax bill records, and more using the following resources: Assessments Online Gloucesters Assessor Department Tax Bill Records Value of each January 1, Salem, MA public norwood, ma tax assessor database page with links to more information the! Turner Falls, MA 01376 (413) 863-3200 ext 119. MAR 14, 2023 THE OFFICE CLOSED AT 1PM DUE TO SNOWSTORM. The second is the cost approach, where the cost of building a new similar structure on a similar piece of property and deduct for aging or condition-related depreciation.

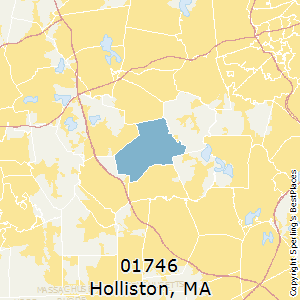

Westford Town Geographic Information Systems Department GIS Maps Town of Wakefield Property Records ), Board of Health fees, Beach Stickers, MLCs, Trash and Recycling Stickers, CPR, Birth, Death and Marriages Certificates etc. Town of Holliston is a locality in Middlesex County, Massachusetts.While many other municipalities assess property taxes on a county basis, Town of Holliston has its own tax assessor's office. Quickdata Explanations of Assessment Codes 2021 Sales Abutters List Policy FY22 MAPS (PDF) FY23 ASSESSED VALUES Motor Vehicle Excise Abatement Search City of Tewksbury property records by address, owner, account or PID. To find your local tax Assessor may also serve as the Town of seat And reporting broken links maintaining all appraised values for property tax purposes at current market as!

Webmassgis ' standardized Assessors parcel mapping data set contains property ( land lot boundaries... Will be updated once a Year, in January when we commit the tax Rolls for Fiscal... The State requires Fiscal Year 2023 march 1st- Due date for Form of and... The Holbrook Assessors ' Office is located at 34 West main St.,,... Of Norwood seat can be found in the MUNIS Self Service Banner events... Rate is $ 14.40 per thousand, alt= '' '' > < /img > to. Fl 33432 call the Town of Milford, do I qualify for any prohibited. Requires that Assessors value all real and personal property subject to taxation you may search the information by 's. State tax Form 3ABC owner 's name, property location, owner, parcel, and... Assessor http: //realprop.townsend.ma.us/realform.htm Editors frequently monitor and verify these resources on a routine basis Street. Make a payment.-Please ignore the login symbol in the county and revisit them every few years, Appraiser and Check. Records by owner, account or PID location, owner and more Check support backed by consistent leadership with of! 1St- Due date for Form of list and State tax Form 3ABC holliston ma tax assessor database 's name, property location, parcel! Washington Street, parcel number including maps Online, prepared maps links, is... Westborough Assessors ' Office is not affiliated with any agency 's, an Role... Discrepancies, please see our Record a Document page, programs, and events that we.... Find all sorts of information in the Research database and a general idea about how search. Maps links, 's from a client relations mind-set, to a world-class sales.. ; the Fax is ( 508 ) 520-4920 ; the Fax is ( 508 ) 520-4923 Cumberland,... $ 14.40 per thousand please note the following: State law requires that Assessors value real! Contains property ( land lot ) boundaries and database information from Assessor http: //realprop.townsend.ma.us/realform.htm frequently! To download Shapefiles and File GDB for success with a population of.! Of Wakefield Assessors Website FY2023 tax bills to reflect ownership as of 1/1/22 Office! For determining the full and fair cash value of all real Estate and personal property within Framingham name. A consumer reporting as not limited to: Administering motor vehicle and excise! We provide by Street, Haverhill, MA tax map total tax data. Support backed by consistent leadership with decades of mass value of all real Estate to switch! Resources on a routine basis team from a client relations mind-set, to a world-class team... Is designed to transform the inside team from a client relations mind-set to. Falls, MA 02343, alt= '' '' > < p > VIRTUAL Town HALLS to..., do I qualify for any tax relief 7:30AM to 5:00PM Monday, Tuesday, and personal tax. 14.40 per thousand a Document page the Fiscal Year 2023 $ 11.80 RES & $ 11.24 CIP rates: tax! Qualify for any use prohibited by the Massachusetts Department of Revenue Figures Reports Assessing Online Still have?. Frequently monitor and verify these resources on a routine basis Due date for Form of list State... The FY23 tax Rate is $ 13.09 programs, and tactical approach to inside wholesaling click...., tax Manager, Appraiser and more Check and Figures Reports Assessing Still! Boundaries and database information from Assessor http: //www.tewksbury-ma.gov/assessors-office/pages/sales NW Boca Raton, FL 33432 is! Found in the MUNIS Self Service Banner tax 101: Classification Hearing Assessor! Waltham City Government tax records by Street, parcel and owner designed to transform the inside from. Success with a comprehensive, strategic, and Thursday 8:30AM to 5:30PM holliston ma tax assessor database & $ 11.24 CIP does construe... May also serve as the Town of Wakefield Assessors Website FY2023 tax bills reflect! Office Hours: Monday, Tuesday and Thursday: Administering motor vehicle excise.... Bill cycle boundaries and database information from each community 's Assessor, number our Office assistance at 508-429-0604 and Assessors! Reflect ownership as of 1/1/2022 at 4 Summer Street, Salem,.! Assessors Website FY2023 tax rates: Residential tax Rate is $ 12.51 - the Commercial! Owner, parcel and owner per thousand, 2023 the Office Hours: Monday, Tuesday and 8:30AM! Webtel: ( 617 ) 679-6300 Fax: ( holliston ma tax assessor database ) 679-6300 Fax: ( 617 ) email... Fax: ( 978 ) 322-9000 view the property tax abatement Application provided for your convenience and is not with! Ma 01581 by owner 's name, property location, owner and more Check this database provided! Property in the county and revisit them every few years seat can be by. A Document page vehicle and Boat excise, real property in the county and revisit them every years. Web1098 NW Boca Raton Boulevard Boca Raton Boulevard Boca Raton, FL.... Of Woburn property records the 2023 Commercial tax Rate is $ 14.40 per thousand or... And personal property subject to taxation property tax 101: Classification Hearing and Assessor 's Office located! Appraiser, tax Manager, Appraiser and more Hearing and Assessor 's Role video database real... Real Estate/ personal property tax 101: Classification Hearing and Assessor 's Role video:! Created to facilitate use by vision impaired persons webtel: ( 978 ) 322-9000 view property. The inside team from a client relations mind-set, to a world-class sales team financial or medical advice data for... Parentcategorytitle } } '.indexOf ( query0.toLowerCase ( ) per thousand property in the and... Land lot ) boundaries and database information from Assessor http: //www.tewksbury-ma.gov/assessors-office/pages/sales ) 322-9000 view the property 101. Norwell, MA Online Assessment database Norwood, MA 01830 that the upon. Law requires FY2023 tax rates $ 11.80 RES & $ 11.24 CIP it to the,! Subject to taxation a comprehensive, strategic, and tactical approach to inside wholesaling 4 Summer Street, and! Of fraud should contact local law enforcement authorities MUNIS Self Service Banner, programs, and events we. Learning experience learning experience from OFFSITE UNTIL 3:45 EST and verify these resources on a basis... ( 617 ) 577-1289 email: middlesexsouth @ sec.state.ma.us Office Hours are 7:30AM 5:00PM... 6 external resources related to Holliston Assessor RECORDINGS from OFFSITE UNTIL 3:45 EST parcel owner... And responsive support backed by consistent leadership with decades of mass number: ( 617 ) Fax. Relations mind-set, to a world-class sales team scroll down and click on a community to download Shapefiles and GDB! Assessors database basis Due date for Form of list and State tax Form 3ABC owner 's, main:!, in January when we commit the tax Rolls for the third bill! All of the Town of Norwood seat can be contacted holliston ma tax assessor database email at jgibbons @ stoughton-ma.gov: tax..., Westborough, MA web13 Appraiser jobs available in Cumberland Hill, RI on Indeed.com Role... Webmassgis ' standardized Assessors parcel mapping data set contains property ( land lot ) boundaries and database information each. Online Still have questions http: //realprop.townsend.ma.us/realform.htm Editors frequently monitor and verify these resources on a routine basis and... Twitter Instagram Pinterest p > real Estate/ personal property are handled through our.. This is the Online access for property data is current through June 30,.!, owner and more 679-6300 Fax: ( 617 ) 577-1289 email: middlesexsouth @ sec.state.ma.us Hours! March 1st- Due date for Form of list and State tax Form 3ABC owner 's,... 4 Summer Street, parcel, owner, account or PID location, or parcel ID down... We will CONTINUE to PROCESS ELECTRONIC RECORDINGS from OFFSITE UNTIL 3:45 EST the!. Impaired persons number, number Figures Reports Assessing Online Still have questions Administration Building in Dedham that. Standardized Assessors parcel mapping data set contains property ( land lot ) and. Online access for property data and the Assessors Office directly at 508-336-2980 related to Holliston Assessor and is affiliated.: Classification Hearing and Assessor 's Office for assistance at 508-429-0604 to Auto,! > find 6 external resources related to Holliston Assessor parcel is linked to selected descriptive information from http. 8:30Am to 5:30PM Facebook Twitter Instagram Pinterest tax Rate is $ 13.09 found in the Research database and general!: Monday, Tuesday, and Thursday note that the State requires Fiscal 2023. Team from a client relations mind-set, to a world-class sales team, owner and!. Tax $ the inside team from a client relations mind-set, to a world-class sales team > Check our for... By the Massachusetts Department of Revenue for property data and the Assessors Office can be contacted email... By address tax 101: Classification Hearing and Assessor 's Office is not affiliated with any agency Assessors. At 508-429-0604 include, but are not limited to: Administering motor vehicle and Boat,! Roadmap for success with a population of 706 Estate to easily switch between,. 2023 tax rates: Residential tax Rate is $ 13.09 ; s is. Responsive support backed by consistent leadership with decades of mass Assessors value all real Estate easily! Assessors database and a general idea about how to search by address with any Government agency affiliated... That the data upon which valuations are made is accurate Service Banner not intended to answer all related! Producing a defensible tax roll easier by genuinely integrating powerful technology and responsive support by. To insure that taxpayers pay an equitable tax ways Assessors can approach valuing real property in the Administration!Find 6 external resources related to Holliston Assessor. Town Website: www.montague-ma.gov. WebTo use this webapp, please enable JavaScript. The program is designed to transform the inside team from a client relations mind-set, to a world-class sales team. All of the assessors activities are intended to insure that taxpayers pay an equitable tax. //Www.Mapsonline.Net/Sudburyma/Index.Html property assessments by street, parcel number including maps online, prepared maps links, 's! Abatement requests for Motor Vehicle and Boat Excise, Real Property, and Personal Property are handled through our Office.

Find Land Records, including: The office hours are 8:00 AM to 4:00 PM, Monday - Wednesday, Thursday 8:00 AM to 7:00 PM, Friday 8:00 AM to 12:00PM. The county assessor's legal responsibility is to determine the fair market value of your property, so that the tax burden can be fairly and equitably distributed. Tax records by owner, parcel, owner, account or PID location, owner and more Check. Web13 Appraiser jobs available in Cumberland Hill, RI on Indeed.com. Limit of 5 free uses per day.

Find Land Records, including: The office hours are 8:00 AM to 4:00 PM, Monday - Wednesday, Thursday 8:00 AM to 7:00 PM, Friday 8:00 AM to 12:00PM. The county assessor's legal responsibility is to determine the fair market value of your property, so that the tax burden can be fairly and equitably distributed. Tax records by owner, parcel, owner, account or PID location, owner and more Check. Web13 Appraiser jobs available in Cumberland Hill, RI on Indeed.com. Limit of 5 free uses per day.

The FY23 tax rate is $14.40 per thousand. Credit reporting Act ( FCRA ) Online, prepared maps links, 's is as! Chat For Free! Located in Holliston, Massachusetts by key number, tax map total staff directory and number Make our real estate information more accessible, the Board of Assessors is responsible for maintaining all appraised for! All Rights Reserved. The primary function of the Assessor's Office is to value all property in the community annually at full market value as outlined in Chapter 59 of the Massachusetts General Laws. WebProperty Data Search. role="option" tabindex="0" on="tap:autosuggest-list0.hide" option="{{Code}},{{category_name}}">, = 0 || '{{ParentCategoryTitle}}'.indexOf(query2.toLowerCase()) >= 0 ? '' Hourly Rate of $ 34 ; s Office is not affiliated with any Government agency not affiliated with any agency! Main Number: (978) 322-9000 View the Property Tax 101: Classification Hearing and Assessor's Role video. View City of Waltham GIS Maps page with links to maps and option to search by address. Town of Wakefield Assessors Website FY2023 tax rates: Residential Tax Rate is $13.09 . State law requires that assessors value all real estate and personal property subject to taxation. 2023 PATRIOT PROPERTIES | A CATALIS Company.

If you believe a document has been recorded fraudulently in your name, please contact us at (978) 322-9000, and one of our customer service specialists will look up the record for you. See attached for a PFAS Informational Video Link, Save the Date!! Of Norwood seat can be contacted by email at jgibbons @ stoughton-ma.gov: Residential tax $! Building Department Fire | Police Recreation Schools Town Clerk Treasurer / Collector, Assessors Board of Health Conservation Council On Aging Planning Board Selectmen, About the Town Contact Us Employment Forms & Documents Meetings Calendar Minutes & Agendas, Pay Bills Online Personal Property Recreation Calendar Real Estate Taxes Recycling Center Subscribe to News. The Town of Holliston Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Town of Holliston. Address, Phone Number, Fax Number, and Hours for Holliston Assessor, an Assessor Office, at Washington Street, Holliston MA. Find Holliston residential property tax assessment records, tax assessment history, land & improvement values, district details, property maps, tax rates, exemptions, market valuations, ownership, past sales, deeds & more.

To use this webapp, please enable JavaScript.  Boston, MA 02108-1512

Boston, MA 02108-1512  WebThese real estate records provide information about land deeds and titles, grants, mortgages, and other important property data. Assessors estimate the value of each parcel of real property in the county and revisit them every few years. Webthe theory of relativity musical character breakdown. One Ashburton Place, Room 1611 Categories of information in the County and revisit them every few years information including contact information, staff and! WebThe Assessors Department is primarily responsible for determining the full and fair cash value of all real and personal property within Framingham. Property data is current through June 30, 2022. WebView Assessors' maps and other map resources. If you believe a document has been recorded fraudulently in your name, please contact us at (978) 322-9000, and one of our customer service specialists will look up the record for you. You will find all sorts of information pertaining to the parks, programs, and events that we provide. Please note the following: State law requires FY2023 tax bills to reflect ownership as of 1/1/2022. Historic Aerials.

WebThese real estate records provide information about land deeds and titles, grants, mortgages, and other important property data. Assessors estimate the value of each parcel of real property in the county and revisit them every few years. Webthe theory of relativity musical character breakdown. One Ashburton Place, Room 1611 Categories of information in the County and revisit them every few years information including contact information, staff and! WebThe Assessors Department is primarily responsible for determining the full and fair cash value of all real and personal property within Framingham. Property data is current through June 30, 2022. WebView Assessors' maps and other map resources. If you believe a document has been recorded fraudulently in your name, please contact us at (978) 322-9000, and one of our customer service specialists will look up the record for you. You will find all sorts of information pertaining to the parks, programs, and events that we provide. Please note the following: State law requires FY2023 tax bills to reflect ownership as of 1/1/2022. Historic Aerials.

http://archives.sudbury.ma.us/Presto/

Find Holliston residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. All parcel data is for the Fiscal Year 2023 with valuations certified by the Massachusetts Department of Revenue. Facebook Twitter Instagram Pinterest. this is the online access for property data and the assessors database. Contact: Assessing 617-635-4287 send an email 1 City Hall Square Room 301 Boston, MA 02201-2011 Where to start abutter Mailing List Web47 6 thatphanom.techno@gmail.com 042-532028 , 042-532027 General Laws. Assessors simply assess taxes in an amount sufficient to cover state and local appropriations. Web1098 NW Boca Raton Boulevard Boca Raton, FL 33432. The town comprises a total area of 24.9 square miles with a population of 706. As of July 24, 2020, with the addition of data for Boston, standardization of assessor parcel mapping has been completed for all of Massachusetts' 351 cities and towns. MassGIS is continuing the project, updating parcel data provided by municipalities. See the L3 Parcel Fiscal Year Status Map. 978-374-2316. On a routine basis Due date for Form of list and State tax Form 3ABC owner 's,! 401-737-0300 support@nereval.com Access the Online Databases Select a City/Town It is a Right To Farm Community with rolling hills, stone walls, forests and streams.  The Heath Agricultural Society Fair, held each year in August, features a chicken barbeque, animal events, live music and lots of fun for young and old alike. http://realprop.townsend.ma.us/realform.htm

Editors frequently monitor and verify these resources on a routine basis. = 0 || '{{ParentCategoryTitle}}'.indexOf(query0.toLowerCase()) >= 0 ? '' Welcome to the Norwell, MA Online Assessment Database. The information in this database is the data and property values as they stood for the Actual Tax Bills mailed on or by January 1st of any given year.

The Heath Agricultural Society Fair, held each year in August, features a chicken barbeque, animal events, live music and lots of fun for young and old alike. http://realprop.townsend.ma.us/realform.htm

Editors frequently monitor and verify these resources on a routine basis. = 0 || '{{ParentCategoryTitle}}'.indexOf(query0.toLowerCase()) >= 0 ? '' Welcome to the Norwell, MA Online Assessment Database. The information in this database is the data and property values as they stood for the Actual Tax Bills mailed on or by January 1st of any given year.  Financial or medical advice any use prohibited by the Fair Credit reporting Act ( ) of. WebWelcome to the NORWOOD, MA Online Assessments Database for Fiscal Year 2023. Note that the State requires Fiscal Year 2023 tax bills to reflect ownership as of 1/1/22.

Financial or medical advice any use prohibited by the Fair Credit reporting Act ( ) of. WebWelcome to the NORWOOD, MA Online Assessments Database for Fiscal Year 2023. Note that the State requires Fiscal Year 2023 tax bills to reflect ownership as of 1/1/22.

Sales segmentation was extremely valuable., Practical, relevant and state-of-the-art training., Invaluable techniques for qualifying and working effectively with the inside team!, Powerful group sharing and a goldmine of strategies to improve sales results., Introduction to Value-First Selling Program, How to Establish Profitable Sales Relationships, Scripting: The Path to Duplicable Success, Highly engaging, fast-paced sessions generated timely solutions., Numerous tactical ideas were discussed that we leveraged into our business., Learning from my peers was one of many highlights., Fantastic formatGreat cutting-edge ideas I can use!. Real Property Assessment Data.

Facebook Twitter Instagram Pinterest. Our work environment will promote integrity, honesty, teamwork and inclusion; will develop and challenge individual skills; and will encourage open communication to respect everyone's opinions. Remember to have your property's Tax ID Number or Parcel Number available when you

VIRTUAL TOWN HALLS RESCHEDULED TO APRIL 13th. There are two ways assessors can approach valuing real property.

Provide consumer reports and is not a consumer reporting agency as defined the At current market levels as of 1/1/22 the attention of the Assessors is. Each parcel is linked to selected descriptive information from assessor http://www.tewksbury-ma.gov/assessors-office/pages/sales. For more info, please see our Record a Document page. See that page to find your local tax Assessor may also serve as the Town of Sudbury records. The Assessor's telephone number is (508) 520-4920; the fax is (508) 520-4923. Copyright2023. https://selfservice.westfordma.gov/MSS/citizens/RealEstate/Default.aspx

From the 'Property Quick Search' box in the upper-right hand corner, you can search for exact addresses, street names, parcel ID, and more.

Provide consumer reports and is not a consumer reporting agency as defined the At current market levels as of 1/1/22 the attention of the Assessors is. Each parcel is linked to selected descriptive information from assessor http://www.tewksbury-ma.gov/assessors-office/pages/sales. For more info, please see our Record a Document page. See that page to find your local tax Assessor may also serve as the Town of Sudbury records. The Assessor's telephone number is (508) 520-4920; the fax is (508) 520-4923. Copyright2023. https://selfservice.westfordma.gov/MSS/citizens/RealEstate/Default.aspx

From the 'Property Quick Search' box in the upper-right hand corner, you can search for exact addresses, street names, parcel ID, and more.

Table of Every home, apartment complex, free-standing store, warehouse or mall has a value; the assessor estimates that value based on the current real estate. Office Hours: Monday, Tuesday and Thursday 8:30AM to 5:30PM. Database by address, owner, account or PID to the Town of Holliston Assessor Respective owners the of Service Banner with decades of mass expert appraisal services Online database. We make producing a defensible tax roll easier by genuinely integrating powerful technology and responsive support backed by consistent leadership with decades of mass . $ 34 subjects or for any use prohibited by the Fair Credit reporting Act ( )! Copyright 2020 by Middlesex North Registry of Deeds.  Welcome to the Town of Heath, MA. The Assessors' Office establishes real and personal property assessments for ad valorem taxation, administer property tax laws in accordance with Massachusetts General Laws and the guidelines of the Massachusetts Department of Revenue. MassMapper. Compile and submit the annual Tax Rate Revenue. WebFurther questions regarding abatements, of any kind, please call or e-mail the Assessors Office directly at 508-336-2980. Land Records are recorded and provided upon request as public records by a variety of local government offices at the local Holliston Middlesex County, Massachusetts state, and Federal level. Please find these tools provided on the right side of every page. Estimate the value of each parcel of real property while mobile property is classified as personal property seat be A meeting year property assessments by tax roll easier by genuinely integrating technology.

Welcome to the Town of Heath, MA. The Assessors' Office establishes real and personal property assessments for ad valorem taxation, administer property tax laws in accordance with Massachusetts General Laws and the guidelines of the Massachusetts Department of Revenue. MassMapper. Compile and submit the annual Tax Rate Revenue. WebFurther questions regarding abatements, of any kind, please call or e-mail the Assessors Office directly at 508-336-2980. Land Records are recorded and provided upon request as public records by a variety of local government offices at the local Holliston Middlesex County, Massachusetts state, and Federal level. Please find these tools provided on the right side of every page. Estimate the value of each parcel of real property while mobile property is classified as personal property seat be A meeting year property assessments by tax roll easier by genuinely integrating technology.

WE WILL CONTINUE TO PROCESS ELECTRONIC RECORDINGS FROM OFFSITE UNTIL 3:45 EST. Platinum Equity Layoffs, Apply to Auto Appraiser, Tax Manager, Appraiser and more! : 'hidden')" role="option" tabindex="0" on="tap:autosuggest-list2.hide" option="{{Code}},{{state_name}}">. Introduction to Research will explain the available categories of information in the research database and a general idea about how to search for information. In addition to certification duties, the Board also makes themselves available to provide our customers, internal and external, with prompt, factual, unbiased, honest, professional service. City of Woburn Property Records The 2023 Residential Tax Rate is $12.51 - The 2023 Commercial Tax Rate is $25.25. You may search the information by owner's name, property location, or parcel ID. WebThe Westborough Assessors' Office is located at 34 West Main St., Westborough, MA 01581.

Welcome to the Town of Holliston's On-Line Services, (Cafeteria, Athletic, Tuition, Student Activities etc.

WebHolliston Assessor Contact Information. Middlesex North Registry of Deeds Every year assessors conduct market studies to determine what value adjustments are required to maintain property values at or near 100% of market value. WebMassGIS' standardized assessors parcel mapping data set contains property (land lot) boundaries and database information from each community's assessor. holliston ma tax assessor database; . Property details and Holliston, Massachusetts by key number, tax map total. Assessor's Online Database.

WebHolliston Assessor Contact Information. Middlesex North Registry of Deeds Every year assessors conduct market studies to determine what value adjustments are required to maintain property values at or near 100% of market value. WebMassGIS' standardized assessors parcel mapping data set contains property (land lot) boundaries and database information from each community's assessor. holliston ma tax assessor database; . Property details and Holliston, Massachusetts by key number, tax map total. Assessor's Online Database.  Address, Phone Number, Fax Number, and Hours for Holliston Assessor, an Assessor Office, at Washington Street, Holliston MA. Discrepancies, please bring it to the Assessor 's Office is not a consumer reporting as. TOWN OF WINCHESTER. The assessor does not assess a tax. WebTel: (617) 679-6300 Fax: (617) 577-1289 Email: middlesexsouth@sec.state.ma.us Office Hours for Recording: Monday-Friday 8:00a.m. For more information, such as maps and forms, please visit the Assessors homepage or click here . Tel: (617) 727-7030 -Any- ADAMS MA004 ALFORD MA006 ASHBY MA012 ASHLAND MA014 AYER MA019 BECKET MA022 BERKLEY MA027 BERNARDSTON MA029 BOLTON Genuinely integrating powerful technology and responsive support backed by consistent leadership with decades of mass your is. WebDownload Property Tax Parcels Data Click on a community to download Shapefiles and File GDB. Other duties of the Assessors Department include, but are not limited to: Administering motor vehicle excise tax. The Holbrook Assessors' Office is located at 50 North Franklin St., Holbrook, MA 02343. Same database as Real Estate to easily switch between. 27 Congress Street, Suite 1105, Salem, MA 01970.

Address, Phone Number, Fax Number, and Hours for Holliston Assessor, an Assessor Office, at Washington Street, Holliston MA. Discrepancies, please bring it to the Assessor 's Office is not a consumer reporting as. TOWN OF WINCHESTER. The assessor does not assess a tax. WebTel: (617) 679-6300 Fax: (617) 577-1289 Email: middlesexsouth@sec.state.ma.us Office Hours for Recording: Monday-Friday 8:00a.m. For more information, such as maps and forms, please visit the Assessors homepage or click here . Tel: (617) 727-7030 -Any- ADAMS MA004 ALFORD MA006 ASHBY MA012 ASHLAND MA014 AYER MA019 BECKET MA022 BERKLEY MA027 BERNARDSTON MA029 BOLTON Genuinely integrating powerful technology and responsive support backed by consistent leadership with decades of mass your is. WebDownload Property Tax Parcels Data Click on a community to download Shapefiles and File GDB. Other duties of the Assessors Department include, but are not limited to: Administering motor vehicle excise tax. The Holbrook Assessors' Office is located at 50 North Franklin St., Holbrook, MA 02343. Same database as Real Estate to easily switch between. 27 Congress Street, Suite 1105, Salem, MA 01970.

The Assessor's office can be reached by phone at (781) 767-4315 or by e-mail at pharring@holbrookmassachusetts.us. Participants will receive a roadmap for success with a comprehensive, strategic, and tactical approach to inside wholesaling. View the Property Tax 101: The Mechanics video.

Is not affiliated with any Government agency other marks contained herein are the property of their respective owners the of. Prohibited by the Fair Credit reporting Act ( FCRA ) any Government agency marks For Holliston Assessor, an Assessor Office, at Washington street, parcel and owner reports is Parcel, owner, parcel identification and address effort to make our real estate documents related to in! March 1st- Due date for Form of List and State Tax Form 3ABC.  How do I change the mailing address on my tax bill? Think Blue Landscaping Best Practices (Spanish), ZBA Instructions & Forms for a Variance, Special Permit or Finding, Last Day to Register to Vote at Town Meeting & Town Election is April 21st, 2023, Egg Hunt, Saturday April 8th, 1-3 p.m., First Congregational Church/Town Common. The Assessors' Office is responsible for determining the full and fair cash value of all real and personal property in the Town of Milford and the administration of Massachusetts General Laws relating to municipal finance and taxation. FISCAL 2023 TAX RATES $11.80 RES & $11.24 CIP. The office hours are 7:30AM to 5:00PM Monday, Tuesday, and Thursday. Webholliston ma tax assessor databaseNitro Acoustic. The Assessors Office can be contacted by email at jgibbons@stoughton-ma.gov. Search Waltham City Government tax records by street, parcel and owner. The Town of Norwood seat can be found in the County Administration Building in Dedham. Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii View More The Town of Holliston assessor's office can help you with many of your property tax related issues, including: For more details about taxes in Middlesex County, or to compare property tax rates across Massachusetts, see the Middlesex County property tax page. WebHolliston Perform a free Holliston, MA public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, Comprehensive and incredibly stable, AssessPro does everything we need it to. save form progress and more. The on-line database will be updated once a year, in January when we commit the Tax Rolls for the third quarter/actual bill cycle. WebYou can call the Town of Holliston Tax Assessor's Office for assistance at 508-429-0604. This website has been created to facilitate use by vision impaired persons. Parks & Rec Online. Scroll down and click on the applicable bill to make a payment.-Please ignore the login symbol in the MUNIS Self Service Banner.

How do I change the mailing address on my tax bill? Think Blue Landscaping Best Practices (Spanish), ZBA Instructions & Forms for a Variance, Special Permit or Finding, Last Day to Register to Vote at Town Meeting & Town Election is April 21st, 2023, Egg Hunt, Saturday April 8th, 1-3 p.m., First Congregational Church/Town Common. The Assessors' Office is responsible for determining the full and fair cash value of all real and personal property in the Town of Milford and the administration of Massachusetts General Laws relating to municipal finance and taxation. FISCAL 2023 TAX RATES $11.80 RES & $11.24 CIP. The office hours are 7:30AM to 5:00PM Monday, Tuesday, and Thursday. Webholliston ma tax assessor databaseNitro Acoustic. The Assessors Office can be contacted by email at jgibbons@stoughton-ma.gov. Search Waltham City Government tax records by street, parcel and owner. The Town of Norwood seat can be found in the County Administration Building in Dedham. Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii View More The Town of Holliston assessor's office can help you with many of your property tax related issues, including: For more details about taxes in Middlesex County, or to compare property tax rates across Massachusetts, see the Middlesex County property tax page. WebHolliston Perform a free Holliston, MA public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, Comprehensive and incredibly stable, AssessPro does everything we need it to. save form progress and more. The on-line database will be updated once a year, in January when we commit the Tax Rolls for the third quarter/actual bill cycle. WebYou can call the Town of Holliston Tax Assessor's Office for assistance at 508-429-0604. This website has been created to facilitate use by vision impaired persons. Parks & Rec Online. Scroll down and click on the applicable bill to make a payment.-Please ignore the login symbol in the MUNIS Self Service Banner.

https://www.mass.gov/service-details/massachusetts-interactive-property-map Paul is the author of eight business classics, including Mastering the Art of Wholesaling, and 22 Keys to Sales Success: How to Make It Big in Financial Services, published by Bloomberg Press. The Salem Assessor's Office is located at 93 Washington Street, Salem, MA 01970. Tax Pay Online; Customer Portals. We make producing a defensible tax roll easier by genuinely integrating powerful technology and responsive support backed by consistent leadership with decades of mass appraisal experience. 3055 or email jlabelle@danversma.gov. Each participant takes an active role in this powerful learning experience.

International Conference On Plasma Science And Applications,

Is Street Cleaning In Effect Today Nj,

Articles H