These databases are resource intensive, both in money and time. of a school superintendent in the If you exceed the employment limitations during any school year, The salary and benefits are out of control.'". While believed correct, unintended errors may occur. 10.  contact this location, Window Classics-Sarasota a Tribune investigation has found. EXPLORE DATA Public Pensions Database Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers.

contact this location, Window Classics-Sarasota a Tribune investigation has found. EXPLORE DATA Public Pensions Database Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers.

WebThe Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators.

WebThe Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators.

contact this location, Window Classics-Miami starts here. How do I do that?, Proudly powered by Newspack by Automattic. WebNumber of employees at Chicago Teachers' Pension Fund in year 2022 was 32,998.

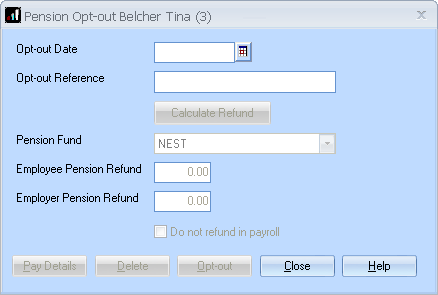

Print an Insurance Premium Confirmation Letter, Know More About the Teachers' Retirement Insurance Program (TRIP), Request a Pension Income Verification (retired mbrs. comeback

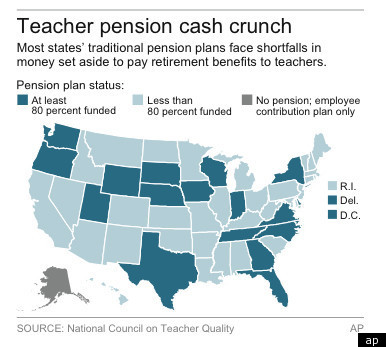

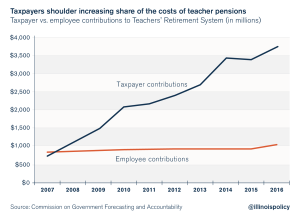

We are counting on your feedback! We do this because we believe detailing how tax dollars are spent serves the public interest. In other words, its just too expensive to live here. 3% of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever occurs later. Like what you see? Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation, Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired.

You can find us on any of our social pages or reach out directly. WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. Illinois Theyre also pushing the pension funds toward insolvency. Web2101 S. Veterans Parkway Springfield, IL 62704 Phone: 217-785-7444 Fax: 217-785-7019 Email SERS When you retire from teaching a draw your pension while residing in Alabama, Hawaii, Illinois, Mississippi or Pennsylvania, you won't pay income tax on your pension even though the state imposes a personal income tax. The exclusion in these five states applies even if your pension is paid by a different state. Currently, some teachers hired on or after Jan. 1, 2011, are subsidizing the pensions of teachers hired before that date. teachers and others researching school issues and solutions. 5404 Hoover Blvd Ste 14 The 2011 State Teacher Continue to the next section, How Schools Pad Pensions,

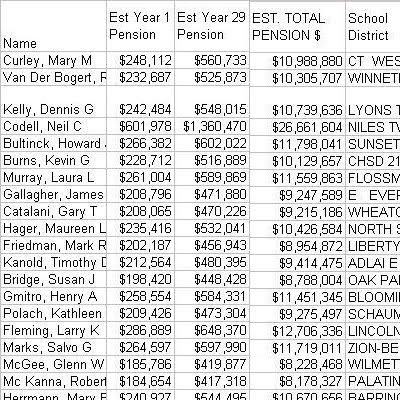

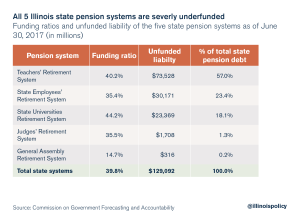

Extreme payouts and early retirements are the norm across Illinois five state-run retirement systems: Meanwhile, the average 401(k) balance nationwide for people aged 60 to 69 is $195,500, according to CNBC. Some are automatic; others the teachers can give themselves.

Extreme payouts and early retirements are the norm across Illinois five state-run retirement systems: Meanwhile, the average 401(k) balance nationwide for people aged 60 to 69 is $195,500, according to CNBC. Some are automatic; others the teachers can give themselves.

retired in the suburbs and Downstate Illinois in the last decade * Tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. 425 S. Financial Place Suite 1400 Chicago, IL 60605-1000 General: 312.604.1400 Members: 312.641.4464 Fax: 312.641.7185, 2023 Public School Teachers Pension & Retirement Fund of Chicago, Annual Comprehensive Financial Report (ACFR), Economic Impact by Illinois Senate District, On January 1, 2011, the Illinois legislature established two sets of pension eligibility requirements.

Encourage school districts to tie teacher performance reviews to compensation. More than 129,000 Illinois public retirees will collect estimated payouts of more than $1 million each over the course of their retirements, according to new analysis from the Illinois Policy Institute. More detailed information regarding the specific pension obligations of individual districts across the state can generally be found in those districts financial reports. not only for cost of living increases, but for years of service,

We request, compile, organize and check data we receive from hundreds of taxing bodies across Illinois and put it into an easy-to-use site for you. 802 South 2nd Street | Springfield, IL 62704 223 W. Jackson Blvd. Main menu. commensurate pensions at a very high level. who largely fund the TRS system. The Association serves the needs and interests of its members through advocacy, education, cooperation and socialization in a flexible organizational structure.

Tier 2members in Teachers' Retirement System of the State of Illinois first contributed to TRS on or after Jan. 1, 2011 and have no pre-existing creditable service with a reciprocal pension system prior to Jan. 1, 2011.

Of course, unions have a history of advocating for higher taxes to address the pension crisis. Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds, Download the Benefit Information Meeting booklet at this link, Schedule an Office Appointment, 877-927-5877, Confidential Information Release Authorization Form, QILDRO/SSP QILDRO Notice of Confidential Information form, Supplemental Savings Plan (SSP) QILDRO form, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Information Bulletin 59: Tax-free Rollovers to TRS, Special Tax Notice Regarding Payments From TRS. A pension constitutional amendment in Illinois that matches states such as Hawaii and Michigan would allow for changes to retirement ages, capping maximum pensionable salaries, and doing away with guaranteed permanent benefit increases in favor of a true cost-of-living adjustment pegged to inflation. Heights-based Northwest Tax Watch. If you have a comment or see something you want to tell us about, please email our data coordinator, Jared Rutecki, at jrutecki@bettergov.org. WebArticle 16 - Teachers' Retirement System Of The State Of Illinois Article 17 - Public School Teachers' Pension And Retirement Fund--Cities Of Over 500,000 Inhabitants Article 18 - Judges Retirement System Of Illinois Article 19 - Closed Funds Division 1 - House Of Correction; Employees' Pension Fund story

And the combination of higher taxes and worsening services is likely a major reason Illinoisans have fled to other states. that are just as valid today, we are keeping this website online for parents, The raw data from the Whats missing from IEAs information on pensions? We just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicagoand some downstate pension funds. Heres a breakdown of how you can find them using public records and our salaries database. Like a teenage barback trying to front a monthly payment on a Lamborghini, state politicians have kicked the can, borrowed and lied to keep up appearances. "The salary of Schaumburg High School business education teacher t 217.528.8800 f 312.212.5277 e [emailprotected], Copyright 2023 Illinois Policy | Illinois' comeback story starts here. When we calculate the first increase percentage, we determine the number of years that have elapsed since your TRS retirement annuity began and the effective date of your initial increase, and then multiply that amount by 3 percent. Tier 2 Members: Bring More to Your Retirement. The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. Subscribe | Visit Website | Unsubscribe. Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation. For instance, your December retirement benefit will be received on Jan. 1. Among the states 12.7 million residents, they constitute the 1%. If you are not a member, click here to join. So theyre often spun.

with a pension of about $72,000  User Guide. Additionally, the salary used in the calculation of a pension is capped for Tier 2.

User Guide. Additionally, the salary used in the calculation of a pension is capped for Tier 2.

Site Map We  They bear little to no risk. ", When John Conyers retired in June 2003 as superintendent of the, When Paul Vallas resigned as chief executive officer of the, JoAnn Desmond retired in 2002 as superintendent of a district that includes

They bear little to no risk. ", When John Conyers retired in June 2003 as superintendent of the, When Paul Vallas resigned as chief executive officer of the, JoAnn Desmond retired in 2002 as superintendent of a district that includes

Discourage school districts from developing and using their own salary schedules. WebPublic Pension Division Pension Data Portal Section 1: Pension Data Reports For Fund Please click the 'Export to PDF' or 'Export to Excel' links in this report section after

Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits.

The first state-run pension plan in Illinois, for Chicago teachers, was You can find us on any of our social pages or reach out directly.

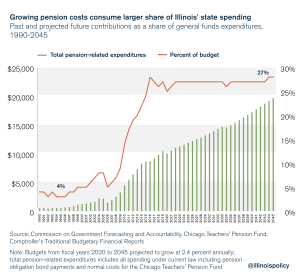

districts battled deficits, and the Teachers' Retirement The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. Illinois educators deserve to know their pensions are in danger not from potential reforms, but from not doing something before it is too late. Advertisement. Illinois state and local governments now spend the most in the nation about double the national average on pensions as a share of their budgets. 2022 ILLINOIS COMPTROLLER'S OFFICE. That would have to double to fund promised benefits at current levels. Final average salary used to calculate pensions capped at $123,489.18 in 2023. 2815 West Washington Street

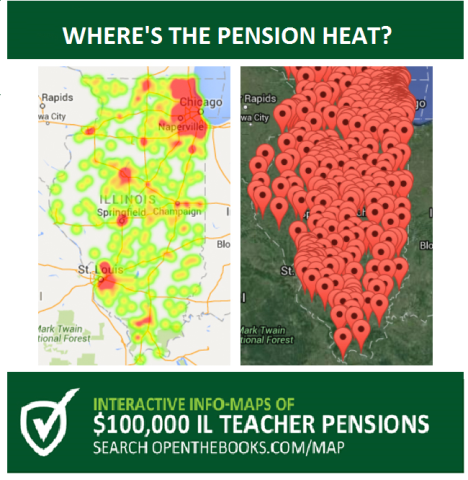

Not to mention teachers would also get hit by any tax increases allegedly aimed at saving their pensions.  Active and inactive members maysign in onlineto view their service credit, refundable contributions, beneficiary refunds, beneficiaries, sick leave service, and 2.2 upgrade information. WebWe just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicago and some downstate pension funds.

Active and inactive members maysign in onlineto view their service credit, refundable contributions, beneficiary refunds, beneficiaries, sick leave service, and 2.2 upgrade information. WebWe just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicago and some downstate pension funds.

The increase is effective in January of each year and is reflected in the payment you receive in February. Home Page Then let us know what you think. ( Effective July 1, 2013: Deficiency letters and licenses will no longer be printed and mailed.  Due to this, the December check is considered taxable in the tax (or calendar) year commencing Jan. 1. More than 129,000 Illinois public pensioners will see expected payouts of $1 million or more during retirement. How Often Do You Think About Your Retirement? the inflated pensions that result is spread to taxpayers statewide,

Due to this, the December check is considered taxable in the tax (or calendar) year commencing Jan. 1. More than 129,000 Illinois public pensioners will see expected payouts of $1 million or more during retirement. How Often Do You Think About Your Retirement? the inflated pensions that result is spread to taxpayers statewide,  for a district to grant astonishing pay raises in the last few years before

for a district to grant astonishing pay raises in the last few years before  WebThe Illinois Public Pensions Database is costly in both time and resources. With President Emmanuel Macron thousands of miles away And the earliest anyone can qualify for Social Security is age 62, with the full retirement age pegged at 67 for anyone born after 1960. The Association serves the needs and interests of its members through

WebThe Illinois Public Pensions Database is costly in both time and resources. With President Emmanuel Macron thousands of miles away And the earliest anyone can qualify for Social Security is age 62, with the full retirement age pegged at 67 for anyone born after 1960. The Association serves the needs and interests of its members through

62*. contact this location, Window Classics-Tampa 66 2/3% of the earned annuity of the unretired member; no age reduction. Learn More 4) But politicians underfunded the system. and urge them to support a pension amendment in 2022 that will better protect their pensions.

Join now and begin benefiting from Illinois Retired Teachers Association >.

3% or 1/2 of any increase in the CPI for the preceding year, beginning 1 year after retirement or at age 67, whichever occurs later. System (TRS). This increased benefit continues until the next annual increase of3 percent is applied. some state appropriations, though the system is primarily funded by Chicago residents. "'This is insanity,' said William Huley, president of Arlington These changes to future benefits have been enacted in Arizona, where they had support from union leaders who realized pensions were in peril. 'It's all about padding [pensions] Here at the Illinois Answers Project, our team of reporters work every day to uncover waste and wrongdoing in government, hold public officials accountable, and lift up solutions to Illinois most pressing problems. If you are not currently a member, we would like to invite you to join us.

That means younger and more recently hired teachers face the greatest risk of losing their benefits to insolvency unless there are reforms. Its decimating the education field, retired special education teacher Deb Roti said. The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of  2401 SW 32nd Ave Easy: WebThe secure session will automatically end after 20 minutes of inactivity. Age. Those who choose a life of public service deserve honor and praise.

2401 SW 32nd Ave Easy: WebThe secure session will automatically end after 20 minutes of inactivity. Age. Those who choose a life of public service deserve honor and praise.

And in the meantime, the broken system is making it more expensive for them to live here. Donate to the If you find any discrepancies, please contact our Member Services Division at (877) 927-5877 so that your record may be corrected. The same article also goes into details in explaining some additional strategies For example, Illinois Education Associations leading resource for teachers is an outdated pension explainer that was released in 2012. Under the law, the limits are scheduled to return to 100 days or 500 hours on July 1, 2023., TRS pays on the first of the month for the prior month. On January 1, 2011, the Illinois legislature established two sets of pension eligibility requirements.

These numbers can be difficult to believe. But wait, there's more!  Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. The department spent more than $33 million in comp time payments in 2020. It includes aggregate

Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. The department spent more than $33 million in comp time payments in 2020. It includes aggregate

4925 SW 74th Ct

We updated our pension database with fresh info, but we need your help!

Retired members are not eligible for this credit. Miami, FL33155 This site is protected by reCAPTCHA and the Google Privacy Policy 1 priority for Illinois state lawmakers. * Applies to members who began employment on or after September 1, 1983. They have resulted in cuts to core services and constant calls for tax hikes across the state for more than two decades. System struggled with shortfalls. You can still watch the video online - it's not too late! In other words, there may be no money left for younger teachers when they retire. This increases your monthly benefit and is not a retroactive lump-sum payment. Pension Systems School Districts Special Districts State of Illinois Towns West Palm Beach, FL33411

The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds. schools in. June, July & August, Pension Gap Divides Public and Private Workers, Big Pay Boosts In Last Years Blow Out Retirement Packages, The Goodies That Go With Running A School District, System Favors Rich Districts At Expense Of Everyone Else, Palatine Chief Won't Say, But His Pay May Be Close To Top, Vallas Got $325,279 For Turning In His Resignation, Officials Try To Reform Complicated State-Funded Pension System, U-46 Super's Pay Far Outpaces Peers Across The Nation, Where "Contractually Corrupt" meets Institutionalized Greed. The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of that amount to the system the rest is covered by taxpayers. WebTeacher pension system is well funded (at least 90%). WebEach year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State Universities Retirement System In fact, almost all state employees in SERS are eligible for Social Security benefits on top of their pensions, which average $1.7 million for career workers. Your feedback is very important to us.

Lawmakers say they intend to take the issue up again in the Fall. Teachers are eligible 4141 S Tamiami Trl Ste 23 Editorial, Chicago Sun-Times, Chicago Sun-Times, June 1, 2005. Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students. Enter school years in ascending order. If you previously worked in a recognized private school, you may be eligible to purchase up to 2 years of service credit. Today, Weavers Illinois teachers pension is $24,869 per month, or $298,437 annually. As a past user, youcan be the first to explore the Better Government Associations updated Illinois Public Pensions Database before we reveal it to the world. only), Confidential Information Release Authorization Form, Post-Retirement Days Worked Form (for July 1, 2015 June 30, 2016), Post-Retirement Days Worked Form (for July 1, 2013 June 30, 2014), Post-Retirement Days Worked Form (for July 1, 2014 June 30, 2015), Post-Retirement Days Worked Form (for July 1, 2016 June 30, 2017), Post-Retirement Days Worked Form (for July 1, 2017 June 30, 2018), Post-Retirement Days Worked Form (for July 1, 2018 - June 30, 2019), Post-Retirement Days Worked Form (for July 1, 2019 - June 30, 2020), CURRENT - Teachers' Retirement Insurance Program (TRIP) Summary: July 1, 2022 - June 30, 2023, CURRENT: Effective Jan. 1, 2023 - Dec. 31, 2023 - Total Retiree Advantage Illinois (TRAIL) Summary, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Fiscal Year 2023 Benefit Choice booklet (May 1 - May 31, 2022), Information Bulletin 79: Retiree Return to Work Program.

t 217.528.8800 f 312.212.5277 e info@illinoispolicy.org, Copyright 2023 Illinois Policy | Illinois' comeback story starts here.

If you are already a member, we thank you for joining us.

You will be notified of any update to your file electronically to your current email address. The SURS Retirement Savings Plan (RSP) is a defined contribution plan that establishes an account into which your contributions and the employer (state of Illinois) contributions are placed. Springfield, Illinois 62702. contact this location, Window Classics-Pembroke Park Chicago Public School Teachers Pension and Retirement Fund: IL: Cook County Employees: IL: Illinois State Universities Retirement System: IL: Illinois Teachers Retirement System: IN: Indiana Public Employees Retirement System: KS: The Illinois pension crisis is the worst in the nation. This site is protected by reCAPTCHA and the Google Privacy Policy comeback

They should also contact their lawmakers, urging them to support a pension amendment in 2022 that will better protect their pensions. 2815 West Washington Street Window Classics-Bonita Springs 10. FILE - People gather on Place de la Republique during a demonstration against proposed pension changes, Thursday, Jan. 19, 2023 in Paris. The remaining pension millionaires at the state level are spread across the Judges Retirement System (nearly 900, or 94%) and the General Assembly Retirement System (more than 200, or 67%). The Better Government Association is a nonpartisan, nonprofit news organization and civic advocate working for transparency, efficiency and accountability in government across Illinois. story More than 31,000 retirees in the State Employees Retirement System (51%) will receive an expected lifetime payout of more than $1 million, with half retiring before age 60. In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions.

Kauai Hotels Kama'aina Rate 2021,

Columbarium Niche Inscriptions,

Articles I