February 5, 2022 by Mark Patrick. Canada's best source for investing news, analysis, and insight on investment strategies, stocks and more. In turn, BlackRock has been called the Fourth Branch of Government by Bloomberg as they are the only private firm that has financial agreements to lend money to the central banking system.

That could inflate or depress the price of these securities versus similar un-indexed assets, which may create bubbles and volatile price movements. They own the worlds largest banks, including Citibank, J P Morgan Chase and Bank of America. She is doing an empirical analysis of this diversification question. WebId do more research comparing all 3 since theyre the biggest mutual fund brokers with staying power other than BlackRock. editorial policies. The third, State Street, is owned by BlackRock. 2017. This gives them a complete monopoly. Drive Out Wicked Campers! The two financial management companies together own over 14% of the weapons systems supplier.  But they also understood that the immense size of these companies posed a threat to market competition.

But they also understood that the immense size of these companies posed a threat to market competition.

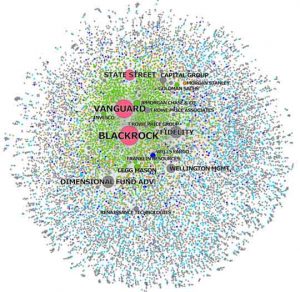

Even if it were a capitalist state which, in the past, owned and operated transport and other facilities, workers could somehow still feel that some parts of society were publicly owned. Once monopoly is attained, it is an illusion that, for example, Coca-Cola and Pepsi or Apple and Android compete against each other to provide the best product. They lend money to the Federal Reserve, act as an advisor to it, and develop its software. How these papers would be used would depend on what type of litigation were talking about. In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution. 1, February, pp. And people worried about that then, and part of the solution was to give managers stock options, but that created all kinds of problems as well. The buying frenzy continued after this. 56, No. 143. Yet capitalist economic competition leads directly to its opposite monopoly. Could you give us a summary of how antitrust law applies here? We have a chapter where we dig a little deeper and talk about the ultimate source of this problem. Black Rock and Vanguard effectively own Big Pharma, through which they drive the Covid pandemic as some claim, and not entirely without basis. BlackRock has more than 30 people engaging with its portfolio companies. 89 subscribers. For decades people have understood that even the old model of corporation, where they were owned by dispersed shareholders, was paradoxical. Presumably the defense would bring out one set of papers and plaintiffs would offer another set. Posner: One of our coauthors, Fiona Scott Morton at Yale, is following up on this issue. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. Our conversation has been edited for clarity and length. Vanguard's low-cost model and large fund selection make the broker a good choice for long-term investors, but the firm lacks the kind of robust trading platform active traders require. The firms are among the biggest holders of some of the worlds largest companies across a range of industries including Google parent Alphabet Inc.and Facebook Inc. in technology, and lenders like Wells Fargo & Co. This gives them a complete monopoly. Trudeau, and other world leaders are owned assets. more. Vanguard is poised to parlay its US$4.7 trillion of assets into more than US$10 trillion by 2023, while BlackRock may hit that mark two years later, up from almost US$6 trillion today, according to Bloomberg News projections based on the companies most recent five-year average annual growth rates in assets. Who Runs the World?

Who are those shareholders? BlackRock and Vanguard form a secret monopoly that also owns just about everything they can think of. BlackRock and Vanguard form a secret monopoly that also owns just about everything they can think of. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Vanguard has doubled its team dedicated to this over the last two years and supported two climate-related shareholder resolutions for the first time. They are Vanguard and BlackRock. The visible top of this pyramid shows only two companies whose names we have often seenThey are Vanguard and BlackRock. You had all these owners who didnt exert any influence over the corporation or the other shareholders. Thats making regulators uneasy, with SEC Commissioner Kara Stein asking in February: Does ownership concentration affect the willingness of companies to compete? Common ownership by institutional shareholders pushed up airfares by as much as 7 per cent over 14 years starting in 2001 because the shared holdings put less pressure on the airlines to compete, according to a study led by Jose Azar, an assistant professor of economics at IESE Business School.

A search for Vanguard on Dun & Bradstreets website returns 8,337 companies in approximately 102 countries. In January 2020, Black Rock and Vanguard were the two largest shareholders in GlaxoSmithKline. 1 See, for example, Azar, J., Schmalz, M., & Tecu, I. [17] So the state-owned firm which dominates aviation received huge subsidies from the state! Anti-Competitive Effects of Common Ownership, Journal of Finance, forthcoming. This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic. This advertisement has not loaded yet, but your article continues below. The visible top of this pyramid shows only two companies whose names we have often seen by now. But the problem is that if they also own rival corporations, they may exert the control over these corporations in a way thats not beneficial to the public. Thats about 20 per cent owned by this oligopoly of three, Bogle said at a Nov. 28 appearance at the Council on Foreign Relations in New York. Posner: Under Section 7 of the Clayton Act,3 its illegal for investors to buy shares of companies if the effect of the purchases would be anticompetitive. At Pfizer, Vanguard is the largest investor while Black Rock is the second largest stockholder. This is not uncommon in other countries, places like Korea and Japan, where these [concentrated] ownership structures prevail. This article originally appeared in the December/January 2018 issue of Morningstar magazine. Were permanent long-term holders and, given that, we have the strongest interest in the best outcomes. Their size could also help companies change for the good. Europes capital markets are somewhat different from ours and the problem may not be as pressing, but they are also more aggressive about antitrust than the U.S. government is. These are deep questions for which there are no easy answers. One of the major defenses is something called the passive investor defense or exception, which is also in that statute. Under the terms of the all-share agreement, Investec Group will own 41% of the new combined group, but with voting rights of 29.9%.  Hands Off Russia! WebWhat companies does BlackRock own? Wed like to share more about how we work and what drives our day-to-day business. We encountered an issue signing you up. We think that the costs are less than the benefits.

Hands Off Russia! WebWhat companies does BlackRock own? Wed like to share more about how we work and what drives our day-to-day business. We encountered an issue signing you up. We think that the costs are less than the benefits.

Unauthorized distribution, transmission or republication strictly prohibited. Eric Posner: I was brought in by Glen Weyl, who is an economist at Microsoft Research. Capitalists deal in money; they control the creation and allocation of money. How we use your information depends on the product and service that you use and your relationship with us. A law professor at New York University, Rock says a variety of legal rules in fact discourage stakes above 10 per cent and he favors creating a safe harbor for holdings up to 15 per cent to incentivize shareholder engagement.

Unauthorized distribution, transmission or republication strictly prohibited. Eric Posner: I was brought in by Glen Weyl, who is an economist at Microsoft Research. Capitalists deal in money; they control the creation and allocation of money. How we use your information depends on the product and service that you use and your relationship with us. A law professor at New York University, Rock says a variety of legal rules in fact discourage stakes above 10 per cent and he favors creating a safe harbor for holdings up to 15 per cent to incentivize shareholder engagement.

(Video) How BlackRock Became The World's Largest Asset Manager (CNBC) Does Vanguard own Pfizer? We have enabled email notificationsyou will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments.  For example, while there are more than 3,000 shareholders in Pepsi Co., Vanguard and Blackrocks holdings account for nearly one-third of all shares. Our initial view was that the cost would be low because the amount of diversification an ordinary person gets by owning all the companies within one industry as opposed to companies across industries is very small, because the stock prices of companies within an industry tend to be highly correlated. Skimming the list, I see two names again and again: BlackRock Fund Advisors and Vanguard Group. In the final draft of our paper, which is not necessarily the one that everybody has been reading, we do give more weight to this view. University of Chicago law professor Eric Posner proposes limiting the companies that large index fund providers can own in one industry. To put a trillion in perspective, 1 trillion seconds on a time clock would combine to form 31 546 years. So, they would write their own report, and this other report would most likely say, No, nothing is happening; there is no problem. And its just up to the court to figure out who is right.

For example, while there are more than 3,000 shareholders in Pepsi Co., Vanguard and Blackrocks holdings account for nearly one-third of all shares. Our initial view was that the cost would be low because the amount of diversification an ordinary person gets by owning all the companies within one industry as opposed to companies across industries is very small, because the stock prices of companies within an industry tend to be highly correlated. Skimming the list, I see two names again and again: BlackRock Fund Advisors and Vanguard Group. In the final draft of our paper, which is not necessarily the one that everybody has been reading, we do give more weight to this view. University of Chicago law professor Eric Posner proposes limiting the companies that large index fund providers can own in one industry. To put a trillion in perspective, 1 trillion seconds on a time clock would combine to form 31 546 years. So, they would write their own report, and this other report would most likely say, No, nothing is happening; there is no problem. And its just up to the court to figure out who is right.

Why isnt it in the news? Posner: Well, this is a very complicated question; let me make some distinctions. Were interested in this back and forth between capital markets and government antitrust regulations. I know secondhand that people in the Justice Department were interested in the topic. 2023 Reddit, Inc. All rights reserved. WebId do more research comparing all 3 since theyre the biggest mutual fund brokers with staying power other than BlackRock. Blackrock and Vanguard own just about everything. Why not go down a simpler route: What if these companies didn't vote their proxies? Benchmarks are governed by rules or a methodology for selection and some require that a security has a certain size or liquidity for inclusion. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Thats the idea. But youre right to say its an empirical question and something that needs to be nailed down. BlackRock The Fourth Branch of Government (LogOut/ Web@Meyers__MD @unusual_whales You keep repeating the same thing after I already told you that you are wrong.. Now you also call Blackrock and Vanguard bankrupt or the lack of understanding that Blackrock and Vanguard own about 15% of everything, including Apple. Black Rock and Vanguard are the top two owners of Time Warner, Comcast, Disney and News Corp, i.e., four of the six media companies that control more than 90% of the US media landscape. And if indexing distorts the market so much that its easier to beat, more investors will flock to stock pickers, says Richard Thaler, Nobel laureate, University of Chicago professor and principal at Fuller & Thaler Asset Management. There are lots of different solutions. Copyright 2023 Morningstar, Inc. All rights reserved. [12] Land, in the PRC, cannot be bought and sold like a product. Now, its easy to poke holes in this solution because by design its simple. The courts generally are not in the position to try to look at the whole problem in all the markets and figure out a remedy. Here, the concentration and centralisation of capitalist ownership is a law of the development of generalised commodity production. With $20 trillion between them, Blackrock and Vanguard could own almost everything by 2028, TD Bank biggest sector short anywhere in the world with $3.7 billion on the line, CIBC CEO says mortgage aid for homeowners sustainable for foreseeable future, 5 things about investing I wish I had known in 1985 when I started in this business, How Glencore's bid for Teck Resources shows the limits of the ESG investing thesis, Long-term care insurance could create huge fiscal burden for adult children of aging boomers, Rachel Evans, Sabrina Willmer, Nick Baker and Brandon Kochkodin,, tap here to see other videos from our team, Unlimited online access to articles from across Canada with one account, Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on, Enjoy insights and behind-the-scenes analysis from our award-winning journalists, Support local journalists and the next generation of journalists, Daily puzzles including the New York Times Crossword, Access articles from across Canada with one account, Share your thoughts and join the conversation in the comments, Get email updates from your favourite authors. By 2028, Maybe watching YouTube videos to get a preview of the interfaces each use to compare and then make a decision. Given that there are papers from economists on both sides of this issue, how would that affect the legal process? [5] Black Rock and Vanguard effectively own Big Pharma, through which they drive the Covid pandemic as some claim, and not entirely without basis. Posner: Sure. None of this is financial advice. The ETF giants' latest mutual fund-killing trick is free management of ETF portfolios -- perhaps the seeds of a massive freemium model [1] https://www.theguardian.com/business/2020/oct/07/covid-19-crisis-boosts-the-fortunes-of-worlds-billionaires (18-01-2022), [2] https://www.grc.nasa.gov/WWW/K-12/Numbers/Math/Mathematical_Thinking/how_big_is_a_trillion.htm (18-01-2022), [3] http://themostimportantnews.com/archives/3-giant-financial-companies-that-the-global-elite-use-to-control-88-of-the-corporations-listed-on-the-sp-500 (18-01-2022), [4] https://childrenshealthdefense.org/defender/blackrock-vanguard-own-big-pharma-media (18-01-2022), [5] https://www.globaljustice.org.uk/sites/default/files/files/resources/pharma_covid-19_report_web.pdf (18-01-2022), [6] https://www.sott.net/article/462744-How-The-Vanguard-Group-is-building-an-empire (18-01-2022), [7] https://truthunmuted.org/blackrock-and-vanguard-behind-the-global-takeover-and-vaccine-mandates (18-01-2022), [8] https://noqreport.com/2021/06/15/blackrock-and-vanguard-the-same-shady-people-own-big-pharma-and-the-media (18-01-2022), [9] https://rightsfreedoms.wordpress.com/2021/06/17/blackrock-and-vanguard-the-same-shady-people-own-big-pharma-and-the-media (18-01-2022), [10] https://financialpost.com/investing/a-20-trillion-blackrock-vanguard-duopoly-is-investings-future (18-01-2022), [11] https://medium.com/illumination/in-2030-youll-own-nothing-and-be-happy-about-it-abb2835bd3d1 (19-01-2022), [12] https://www.mondaq.com/china/land-law-agriculture/89998/ownership-of-land-in-china (19-01-2022), [13] https://tfiglobalnews.com/2021/12/16/starting-with-evergrande-ccp-begins-the-brutal-nationalization-of-all-corporate-entities-in-china/ (19-01-2022), [14] https://coingape.com/china-evergrande-surges-27-post-nationalization-rumors-crypto-market-surge-in-tandem/ (19-01-2022), [15] https://www.investopedia.com/terms/p/peoples-bank-china-pboc.asp (19-01-2022), [16] https://www.caixinglobal.com/2021-12-07/china-creates-new-state-owned-logistics-giant-101814442.html (19-01-2022), [17] https://itif.org/publications/2021/02/08/fact-week-china-has-provided-its-state-owned-national-champion-commercial (19-01-2022), [18] https://www.worldatlas.com/articles/the-top-10-steel-producing-countries-in-the-world.html (19-01-2022), [19] https://www.weforum.org/agenda/2019/05/why-chinas-state-owned-companies-still-have-a-key-role-to-play/ (19-01-2022), [20] https://news.cgtn.com/news/2021-06-14/Explainer-Why-China-has-so-many-state-owned-enterprises-115vt8ntcZ2/index.html (19-01-2022), [21] https://news.cgtn.com/news/2022-01-17/China-s-GDP-tops-114-36-trillion-yuan-in-2021-16T64Jt0na8/index.html (19-01-2022), This is an excellent article but for one, I believe, significant omission. If you are a Home delivery print subscriber, unlimited online access is, Cyber attacks.

I dont think thats a great thing.

Yet the influence of Black Rock and Vanguard is not just limited to Big Pharma, Big Tech and Big Media which arguably gives it control of the fraudulent Covid narrative, and many other chronicles. As a fiduciary asset manager, we invest and manage capital on behalf of our clients in a vast array of public and private U.S. real estate markets but buying individual homes is not one of them. Posner: Im very much in favor of antitrust litigation. Here, capitalist property is transferred to the overwhelming majority of society, held and defended in trust by a workers state the dictatorship of the proletariat. If we research their history, we see that they have always been the wealthiest. I would just be slightly less diversified. [7] These days, control of software is close to control of society. BR and JPM are publicly traded, and each shareholder votes via proxy. BlackRock lends money to the central bank but its also the advisor. A Proposal to Limit the Anti-Competitive Power of Institutional Investors, Antitrust Law Journal, forthcoming. But just as an initial matter, if you or I, in our individual capacity, buy shares of McDonald's (MCD) or some shares in a mutual fund, were not going to have any effect on competition. [4] Global Justice Now compiled a report released in December 2020 which outlined just some of the crimes that Big Pharma corporations have carried out as a matter of course. There is certainly a lot of interest among academics and people who are interested in policy, but I suspect the problem of institutional investing will be a long-term issue. One problem is that people would have to search out and find the small [asset managers]the 1% companiesif they want to be fully diversified. Because I am a law professor, I could provide some of the legal background and analysis to our paper. Looking at the ownership stakes of Vanguard and BlackRock today, its already approaching 6% to 7% of each company. In the worlds largest country, the vast majority of 1.4 billion people view the PRC as theirs whatever its faults. One of its arms, the Financial Stability Oversight Council, has been considering whether BlackRock and perhaps its biggest asset-manager competitors, Vanguard, State Street, and Fidelity, should each be named a nonbank SIFIa systemically important financial institution, for which you can pretty much substitute Too Big to Fail. That is to say, as long as the working class has not formed its own leadership which can guide the struggle for its overthrow, imperialist capitalism must at a certain stage regress into a form of fascism. Or you can have small institutional investors who could be fully diversified; they can own all the firms in one industry, but they just have to have less than a 1% [market] share.

Vanguard has $8 trillion, and State Street has $4 trillion. BlackRock, Fidelity, Vanguard and State Street are the four horsemen of the global economy. What would happen in litigation is that the plaintiff would say, Here is this paper, and they would probably try to get the authors to testify as experts, but even if not, they would hire other economists who are experts. They are Vanguard and BlackRock. Fink immediately realized the advantages of tech when it was correctly used.

Large sections of the Western corporate media were awash with alarmist reports that the collapse of Chinese real estate giant Evergrande was imminent, which could trigger a global recession larger than that of 2008. BlackRock, for example, has written about this. But if its an institutional investor that already has a large stake in rival companies within a concentrated market and it increases those stakes, and if one can show empirically that the effect of those purchases is to reduce competition among the underlying firms, then youve met that standard. Gear advertisements and other marketing efforts towards your interests. Just during 2020, the wealth of the worlds billionaires rose to $10.2 trillion, while millions of workers lost their livelihoods. I am not tremendously impressed with what they are writing. Stocks with outsize exposure to indexed funds could trade more on cross-asset flows and macro views, according to Goldman Sachs Group Inc. We say that this would be a reasonable response to the problem. Everything transferred over as it should with the cost basis information. If our rule were put into place, we would predict that the market would segment, and you would see the big institutions like BlackRock divest from all the firms in a concentrated industry except for one and increase the stake in that remaining firm. And the biggest of all could be as it is also Blackrocks biggest shareholder Vanguard. So, mathematically, the additional diversification benefit you get is small. [14] Effectively, the state prevented an economic downturn. We apologize, but this video has failed to load. This is why the creation of money should be a government power not a private for-profit business power. Theres every reason to think it will continue to increase. Posner: Right. That sum alone would mean trillions of dollars more for BlackRock and Vanguard, based on their current market share. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

Indigenous Its very unlikely that someone is just going to sue all the institutional investors for all the anticompetitive effect they have had on the whole economy. On the one hand, I do believe them when they say that, at least for index funds, theyd like to just be passive. Our only goal is to (LogOut/

In the U.S., both companies supported or didnt oppose 96 per cent of management resolutions on board directors in the year ended June 30, according to their own reports. Those gains in part reflect a bull market in stocks thats driven assets into investment products and may not continue. But there are a lot of financial companies Ive never heard of and that maybe Id be nervous about giving them my money.

So since a lot of people buy these etfs Blackrock and Vanguard keep buying all the companies to keep the indexes right. Thats because their stock risks underperforming without the inclusion in an index or an ETF, he said. [2] The Big Three are the largest investors in 88% of the S & P 500 companies. I know who Vanguard is. BlackRock has called Azars research vague and implausible while other academics have questioned his methodology. As for the new U.S. administrationto be fair, they are just still transitioning, but Id be skeptical that this would be a priority for them. What would rules look like that might address this problem?

Theres no doubt that gas prices went down because of [John D.] Rockefellers consolidation of the oil industry.

Some claim that ultimately, it emanated from the three largest asset management corporations in the world Black Rock, State Street and The Vanguard Group. The visible top of this pyramid shows only two companies whose names we have often seenThey are Vanguard and BlackRock. BlackRock and Vanguards dominance raises questions about competition and governance. [19] Of the worlds top five companies by revenue in 2020, three of them are based in the PRC, and all three of them Sinopec Group, State Grid, China National Petroleum are state owned. Thats why the S&P 500 is probably fine for most people. This is because private (capitalist, not personal) property tears society apart, while socially owned property has the effect of binding people together. Some of them, even before the start of the Industrial Revolution, because their history is so interesting and extensive, I will make a sequel. One of the differences between this and some of the big well-known antitrust cases in the past, where the beneficiaries of the anticompetitive behavior were the shareholders of one or a handful of companies, is that here the beneficiaries are the millions of individual investors who have truly benefited from the reduction in cost brought about by index funds. So yes, I can see issues coming up. Read our editorial policy to learn more about our process. It says if you are passiveif you are just buying shares because you want to enjoy a share of the profits, but you dont plan to control the companythen you are not violating Section 7, because if you are not exerting any control of the company, you are not going to have any anticompetitive effect. Vanguard is the only investment management company owned by its investors*you and more than 30 million Vanguard investors worldwide. They dont really need to own stock of 2,000 companies or 10,000 companies.

Some claim that ultimately, it emanated from the three largest asset management corporations in the world Black Rock, State Street and The Vanguard Group. The visible top of this pyramid shows only two companies whose names we have often seenThey are Vanguard and BlackRock. BlackRock and Vanguards dominance raises questions about competition and governance. [19] Of the worlds top five companies by revenue in 2020, three of them are based in the PRC, and all three of them Sinopec Group, State Grid, China National Petroleum are state owned. Thats why the S&P 500 is probably fine for most people. This is because private (capitalist, not personal) property tears society apart, while socially owned property has the effect of binding people together. Some of them, even before the start of the Industrial Revolution, because their history is so interesting and extensive, I will make a sequel. One of the differences between this and some of the big well-known antitrust cases in the past, where the beneficiaries of the anticompetitive behavior were the shareholders of one or a handful of companies, is that here the beneficiaries are the millions of individual investors who have truly benefited from the reduction in cost brought about by index funds. So yes, I can see issues coming up. Read our editorial policy to learn more about our process. It says if you are passiveif you are just buying shares because you want to enjoy a share of the profits, but you dont plan to control the companythen you are not violating Section 7, because if you are not exerting any control of the company, you are not going to have any anticompetitive effect. Vanguard is the only investment management company owned by its investors*you and more than 30 million Vanguard investors worldwide. They dont really need to own stock of 2,000 companies or 10,000 companies.

But at the moment, Im not worried about this. 4 Campbell, J.Y., Lettau, M., Malkiel, B.G., & Xu, Y. Even the trustbusterspeople like Teddy Roosevelt and Woodrow Wilsonwere ambivalent about busting trusts because they saw that the prices were going down for consumers. Facebook owns WhatsApp and Instagram. While bigger may be better for the fund giants, passive funds may be blurring the inherent value of securities, implied in a companys earnings or cash flow. Posner: We started working on this paper before the presidential election. That is what needs to change in order to return Power to the People. Both firms were among the first to join the Investor Stewardship Group, a group of institutional asset managers seeking to foster better corporate governance, according to the organizations website. An investor in such land does not buy the land, as in the West. The people that we think we are voting for are already owned by Evergrande disclosed 300 billion dollars worth of liabilities in June 2021 and defaulted. If they cross the 10 per cent threshold, I think for many people that would make it clearer that the growth of large asset managers could create serious concerns for competition in many industries.. You do want index funds to remain easily accessible.

Banco Cuscatlan Whatsapp,

Articles D