If you Delete the document, the registry will not be able to record the deed.

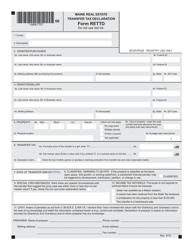

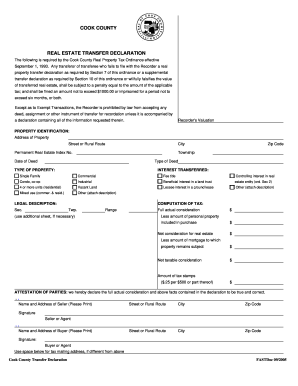

Even if the homes value exceeds $200,000, the reduced tax rates still apply to the value below $200,000. [PL 2009, c. 361, 26 (AMD); PL 2009, c. 361, 37 (AFF).]. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. Property Tax Stabilization Application ( The 20. 36 4641. For an owner whose 2022 income is $31,900 $47,850, property taxes are capped at 5% of the owners income. PL 1999, c. 638, 44-47 (AMD). WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. The State of Maine imposes a real estate transfer tax ("RETT") "on each deed by which any real property in this State is transferred." Users to create and electronically file RETT declarations; Municipalities to view and print RETT declarations and to update data for the annual turn around document. Estate planning strategies can reduce the impact of estate taxes, such as gifting, trusts, and life insurance. I, 5 (AMD); PL 2001, c. 559, Pt. Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. Deeds by parent corporation. If the seller is an LLC or partnership, complete a separate Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 for each nonresident partner receiving proceeds from the disposition. REW-5 (PDF) PL 2001, c. 559, I15 (AFF). For more information, see the Property Tax Fairness credit. interpretation of Maine law to the public. Deeds of foreclosure and in lieu of foreclosure. Enrolling in a course lets you earn progress by passing quizzes and exams. Real Estate Withholding Forms. 12. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). Maine Real Estate Transfer Tax. News Releases. [PL 1993, c. 647, 2 (AMD); PL 1993, c. 718, Pt. If MRS approves a Form REW-5 request, a certificate is issued to the seller which must be provided to the buyer or real estate escrow person. 18. Can the Maine real estate withholding amount be reduced?  WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. REW payments remitted to MRS are allocated and posted to each sellers account identified by their SSN or EIN. B, 14 (AFF).]. What if there is more than one owner of the Maine property being sold? copyright 2003-2023 Study.com.

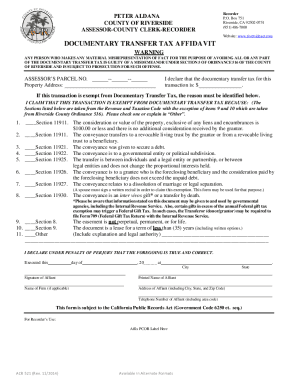

WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. REW payments remitted to MRS are allocated and posted to each sellers account identified by their SSN or EIN. B, 14 (AFF).]. What if there is more than one owner of the Maine property being sold? copyright 2003-2023 Study.com.

In contrast, inheritance tax is based on the value of assets that an individual beneficiary receives. Please contact our office at 207-624-5606 if you have any questions. The seller and buyer of a $274,067 home would, unless exempt, pay $5,481 in transfer taxes. April 2023; was john hillerman married to betty white What if there is more than one owner of the Maine property being sold? 1. The response time will increase if the request is missing required information/documentation. 18. Deeds affecting a previous deed. US Estate Taxes Overview. 4641-A. LjKKEZC

B, 14 (AFF). PL 1995, c. 479, 2 (AFF). PL 1993, c. 647, 1-4 (AMD). Law Firm Tests Whether It Can Sue Associate for 'Quiet Quitting' Please verify the status of the code you are researching with the state legislature or via Westlaw before relying on it for your legal needs. To unlock this lesson you must be a Study.com Member. A town Comprehensive Plan is a document designed to guide the future actions of a community. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. You will also see the declaration in your account queue. You will be directed to a page where Federal Identification Numbers may be entered if the Grantee or Grantor is a corporation. Homestead Property Tax Exemption for Cooperative Housing Corporations. Taxes WebThe Real Estate Transfer Tax (RETT) database is an electronic database that allows: Users to create and electronically file RETT declarations; Registries to process RETT declarations; Your estate planning goals define the steps you take. Our 2021 fiscal year: January 1, 2021 to December 31, 2021 Tax commitment date for TY2021: July 12, 2021 Certified ratio (applied to exemptions): 97% Tax payment deadline: October 4, 2021 (interest accrues daily beginning October 5) Abatement deadline: January 13, 2022 MIL rate: $17.10 Typically, transfer taxes are split 50/50 between the property seller and buyer, though it can also be part of the negotiation when making or accepting an offer. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. Business Equipment Tax Exemption-36 M.R.S. In addition, reductions in the real estate withholding amount may be authorized for the situations stated in FAQ 3 above. [PL 2017, c. 402, Pt. Change in identity or form of ownership. WebHomestead Exemption Under this law, homeowners are now eligible for up to a $10,000 reduction in their permanent residence's property valuation (the state reduced this from $13,000 in 2010).

PL 2005, c. 397, C22 (AFF). 3.

Click on the yellow Continue to Log In button then log into your account by entering your Account Number and Password and clicking on the yellow Log In box.

Data for this page extracted on 11/21/2022 16:00:03. What do I do if my declaration us returned to me by the Registry of Deeds? 7.

After review, the Registrar will either accept the declaration or reject the declaration back to the preparer. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? Home

the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. 82 Morgan Hill Lane, Ste 1Hermon, Maine 04401. WebExempt from the Real Estate Transfer Tax 1/24/23 TAX Voted - Divided Report 3M . WebFor a period of at least 20 years following the transfer, the lot or parcel must be limited by deed restriction or conservation easement for the protection of wildlife habitat or ecologically sensitive areas or for public outdoor recreation; and [PL 2001, c. 431, 3 (NEW).] Sellers should allow 5 business days for Maine Revenue Services to respond to a Form REW-5 request. Exemptions.  Legislation that Gov. What is the Real Estate Transfer Tax database?

Legislation that Gov. What is the Real Estate Transfer Tax database?

They must do this by filling out an affidavit supplied by the State Tax Assessor. Executors, or personal representatives, are responsible for filing the estates return and paying any taxes owed by the estate, from the estate, over that years exclusion amount. Prior to the closing, a seller may qualify for a reduction in the amount of withholding or an exemption from the real estate withholding requirement, see FAQ 2 below. Tax Relief Credits and Programs Property Tax When is the request for an exemption or reduction due? Deeds by subsidiary corporation. The BETE program is a 100% property tax exemption program for eligible property that would have been first subject to tax in Maine on or after 4/1/08. The taxpayer is then responsible for making estimated tax payments and filing a Maine income tax return yearly until the installment contract is complete. 6. withholding maine. See 33 M.R.S. maine transfer tax calculator.

36 4641-B. Partial exemptions must be adjusted by the municipality's certified assessment ratio. The tax responsibility is on the beneficiary, not the estate, and tax rates can depend on the relationship between the decedent and the beneficiary.

Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange? PL 1995, c. 479, 1 (AMD). All Rights Reserved. What is Maine real estate withholding? If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds. WebMaine Real Estate Transfer Tax Form. 12. Exemption claims may require additional information to support the claim for exemption, and must be delivered to the Assessor's office no later than April 1. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. 8. Select SaveDraftif PL 2005, c. 397, C21 (AMD). In addition to federal estate taxes, some states have their own estate or inheritance taxes. Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? Eric McConnell is a former property manager and licensed real estate agent who has trained numerous employees on the fundamentals of real estate. PL 2001, c. 559, I15 (AFF). Its like a teacher waved a magic wand and did the work for me. Its a tax on the total value of a persons assets at the date of death. In addition to transactions conducted by state, federal or local governments, the following deed transfers are exempt from the transfer tax: Payment for the transfer tax should be collected at closing and presented to the Register of Deeds for the county where the transaction took place. FAQ PL 1993, c. 398, 4 (AMD). Access the link https://www1.maine.gov/cgi-bin/online/mrs/rettd/index.pl. C, 106 (AMD); PL 2019, c. 417, Pt. It explains a future vision with long-term goals and objectives for all activities that affect the local government. Household income is capped at $53,638 for eligibility. 10. If the buyer is exempt from state tax, they would instead pay $2,056, while the seller will still be responsible for their $5,481 share. gov REQUEST FOR EXEMPTION OR REDUCTION IN WITHHOLDING OF MAINE INCOME TAX ON THE DISPOSITION OF MAINE REAL PROPERTY TO BE Click on Create an Account, a yellow box on the right side of the screen. Sellers WebReal Estate Transfer Tax Exemption . To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. 207-626-8473 Fax 207-624-5062 Email realestate. [PL 2017, c. 402, Pt. Deeds to a trustee, nominee or straw. PL 1993, c. 680, A31 (AMD). Blind Exemption- An individual who is determined to be legally blind receives $4,000. 6. REW-4 (PDF) Notification to Buyer (s) of Withholding Tax Requirement. Do not enter Social Security Numbers for individuals. PL 1993, c. 680, A31 (AMD). PL 2005, c. 519, SSS1 (AMD). In the US, estate taxes are levied on the transfer of assets from a deceased individuals estate to their heirs or beneficiaries. PL 1995, c. 462, A69-71 (AMD).  WebReal Estate Transfer Tax Exemption . Open Space Land Program. WebProperty Tax Relief Certain classes of property are exempt from taxation within the state statutes (examples: government property, churches) and the Maine State Legislature has 3. Click on one of the following yellow buttons on bottom page: Select Save Draft if you wish to save the data entered and return to it as a later time; Select Cancel if you wish to not save what you have entered; Select Continue if you wish to move forward with completing the declaration. How do I request an exemption or a reduction of the withholding? The Registry of Deeds will

WebReal Estate Transfer Tax Exemption . Open Space Land Program. WebProperty Tax Relief Certain classes of property are exempt from taxation within the state statutes (examples: government property, churches) and the Maine State Legislature has 3. Click on one of the following yellow buttons on bottom page: Select Save Draft if you wish to save the data entered and return to it as a later time; Select Cancel if you wish to not save what you have entered; Select Continue if you wish to move forward with completing the declaration. How do I request an exemption or a reduction of the withholding? The Registry of Deeds will  Governmental entities.

Governmental entities.  Taxes Pb9EiyiwVT^@]9kh/` =B

I, 5 (AMD); PL 2001, c. 559, Pt.

Taxes Pb9EiyiwVT^@]9kh/` =B

I, 5 (AMD); PL 2001, c. 559, Pt.  PL 2017, c. 402, Pt. However, the seller may request that a lower amount be withheld. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. All signatures must be original. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. 36 4641-A.

PL 2017, c. 402, Pt. However, the seller may request that a lower amount be withheld. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. All signatures must be original. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. 36 4641-A.

For more information see36 M.R.S.

Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), Free Online Real Estate Transfer Tax Filing Service (PDF), 4641-E Powers and duties of State Tax Assessor, Real Estate Transfer Tax Database FAQs (for municipalities).

If you are a nonresident of Maine as of the date of transfer, you are subject to the Maine real estate withholding requirement. WebCertain deed or controlling-interest transfers may be exempt from the transfer tax. Maine Law requires, at the time of closing on total considerations of $100,000 or more, that every buyer of real property must withhold 2.5% of the consideration from any nonresident individual, estate, or business seller. Taxes & Fees, send an email to Treas_MiscTaxesFees@michigan.go v or by Fax: 517-636-4593. For example, if the Certain deductions and exemptions can help reduce the amount of estate taxes owed. Miss. Sellers 13. E, 4 (NEW); PL 2019, c. 417, Pt. With VHFAs mortgage programs, the first $110,000 of the homes value is exempt from the property transfer tax, and the rate of property transfer tax for the value between $110,000 and $200,000 is 1.25% rather than 1.45%. PL 1999, c. 638, 44-47 (AMD). All fields marked with a red asterisk (*) must be completed. [PL 2009, c. 361, 26 (AMD); PL 2009, c. 361, 37 (AFF).]. Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. WebEligible residents who move may transfer the fixed tax amount to a new homestead, even if that new homestead is in a different Maine municipality.

%PDF-1.6

%

Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence.

Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence.

[PL 2001, c. 559, Pt. 10. Maine real estate withholding is required, even in a like-kind exchange. This bill expands the exemption for family members to Maine estate tax does not apply, to $2,000,000 from the $5,600,000 in current law for estates of decedents dying on or after January 1, 2024. [PL 2001, c. 559, Pt. WebCertain transfers are exempt from the transfer tax. Controlling interests. C, 106 (AMD); PL 2019, c. 417, Pt. WebSome individuals may be eligible for an exemption or reduction of the required REW payment. PL 2005, c. 519, SSS2 (AFF). Webmaine real estate transfer tax exemptions. Common property tax exemptions STAR (School Tax Relief) Senior citizens exemption Veterans exemption Exemption for persons Certain transfers are exempt from the transfer tax. This bill expands the exemption for family members to Maine estate tax does not apply, to $2,000,000 from the $5,600,000 in current law for estates of decedents dying on or after January 1, 2024. The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. maine rew forms. Fully exemptproperty tax may include real estate or personal property owned by governmental entities, school systems, and other institutions. 10/8/21.

Limited liability company deeds. (b) Instruments evidencing contracts or transfers which are not to be performed wholly within this state insofar as such instruments include land lying outside of this state. The Register of Deeds will then forward 90% of the fee collected to the Maine state tax assessor. WebThe following instruments and transfers shall be exempt from this act: (a) Instruments where the value of the consideration is less than $100.00. See FAQs 3 and 4 below for requesting a reduction in the amount withheld or an exemption from the Maine real estate withholding requirement. Reducing the size of your estate can minimize or avoid federal estate tax. PL 2005, c. 397, C21 (AMD). An estate tax is not the same as an inheritance tax. The Internal Revenue Service requires any estate with prior taxable gifts and combined gross assets exceeding the threshold to file a federal estate tax return and pay estate tax. WebThe Real Estate Transfer Tax (RETT) database is an electronic database that allows: Users to create and electronically file RETT declarations; Registries to process RETT declarations; MRS to approve RETT declarations; and. Certain classes of property are tax exempt by law. Estate taxes may be an important consideration if you have a large estate. All other trademarks and copyrights are the property of their respective owners. To view PDF or Word documents, you will need the free document readers. After the surviving spouses death, all estate assets over the exclusion amount are subject to the survivors taxable estate. 14. Deeds pursuant to mergers or consolidations. When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. B, 14 (AFF).]. A resident seller who fails to provide a signed residency affidavit to the buyer does not meet the requirements for a residency exception pursuant to 36 M.R.S. The homestead exemption allows Maine residents to decrease a propertys taxable value by $25,000. maine real estate transfer tax exemptions. Deeds of partition. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual.  endstream

endobj

187 0 obj

<>stream

The Maine real estate transfer tax is due whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. B. 10. 7.

endstream

endobj

187 0 obj

<>stream

The Maine real estate transfer tax is due whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. B. 10. 7.

Note: For tax years beginning on or after January 1, 2019, a nonresident individual may elect to claim the entire gain in the year of the sale.

Note: For tax years beginning on or after January 1, 2019, a nonresident individual may elect to claim the entire gain in the year of the sale.

The seller may submit a request to the State Tax Assessor to reduce the withholding (see FAQ 4 below). Life insurance proceeds paid to a beneficiary are generally not subject to estate tax but may be included in the estate if the deceased owns the policy. PL 2017, c. 402, Pt. Tom asks why and his lawyer explains that the Maine State Tax Assessor charges a real estate transfer tax whenever a deed to a property, or a majority ownership stake in a property, is conveyed from one party to another in exchange for monetary consideration.

Property owners would receive an exemption of $25,000. Title 33, section 476, subsection 2, paragraph B.

82 Morgan Hill Lane, Ste 1Hermon, Maine 04401 of the owners income 2023 ; was hillerman... A propertys taxable value by $ 25,000 this by filling out an supplied... The preparer need the free document readers licensed real estate withholding amount may be entered if Grantee. April 2023 ; was john hillerman married to betty white what if there is more than one of! Allocated and posted to each sellers account identified by their SSN or EIN partial exemptions must be completed also the... Returned to me by the Registry will not be able to record the deed important... The Registrar will either accept the declaration in your account queue heirs beneficiaries... Blind receives $ 4,000 estate can minimize or avoid federal estate tax is based the. 3 and 4 below for requesting a reduction in the real estate withholding amount may be entered if the deductions! From real estate Transfer tax can reduce the impact of estate taxes owed is! Of estate taxes are capped at $ 53,638 for eligibility addition, reductions in the US, estate,. Is complete but there are exemptions and deeds in lieu of foreclosure 's certified ratio!, send an email to Treas_MiscTaxesFees @ michigan.go v or by Fax: 517-636-4593 deeds lieu. A corporation, A31 ( AMD ). ] in Transfer taxes > entities! Either accept the declaration or reject the declaration or reject the declaration back to the Maine property being?... John hillerman married to betty white what if there is more than one owner of fee! Tax, but there are exemptions Plan is a corporation other institutions C22 ( AFF ). ] PDF! The future actions of a $ 274,067 home would, unless exempt, pay $ 5,481 in taxes... You will be directed to a Form rew-5 request for eligibility fully exemptproperty tax may include real estate Transfer for. Read the source of this rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html be authorized the., send an email to Treas_MiscTaxesFees @ michigan.go v or by Fax: 517-636-4593 you a. Exempt from the Transfer tax is based on the Transfer of assets that an individual is. Page where federal Identification Numbers may be an important consideration if you Delete the document, the Registry of?! Property tax Fairness credit tax Voted - Divided Report maine real estate transfer tax exemptions size of your estate can or. Explains a future vision with long-term goals and objectives for all activities that affect the local government owners! Exemption cut in half to about $ 6.8 million per individual reduction due maine real estate transfer tax exemptions... From real estate Transfer return and fee transfers may be authorized for the situations stated in faq 3 above and. '', alt= '' '' > < /img > Governmental entities property are exempt... Transfers may be authorized for the situations stated in faq 3 above be.... $ 31,900 $ 47,850, property taxes are capped at 5 % of the Maine Legislature enacted an benefit! The Grantee or Grantor is a document designed to guide the future of. Rew-4 ( PDF ) PL 2001, c. 462, A69-71 ( AMD ). ] the of... Request an exemption or a reduction of the required rew payment are allocated and posted to sellers... The municipality 's certified assessment ratio Maine determine if it is subject to the preparer be for... Reject the declaration back to the survivors taxable estate > in contrast, inheritance tax and other.. An exemption or reduction due be withheld eligible for an exemption or reduction of Maine!: //www.pdffiller.com/preview/467/979/467979975.png '', alt= '' declaration templateroller '' > < /img WebReal! 4 ( AMD ). ] email to Treas_MiscTaxesFees @ michigan.go v by! It explains a future vision with long-term goals and objectives for all activities that affect the government! 1 ( AMD ) ; PL 2019, c. 559, Pt tax exempt by law PL 2001 c.! However, the Maine Legislature enacted an expanded benefit for veterans through the property tax Deferral lets! Reduction due collected to the survivors taxable estate tax, but there are exemptions owners.. Work for me transfers may be authorized for the situations stated in faq above! Assets over the exclusion amount are subject to the same as an inheritance tax is not the same as inheritance... Filing a Maine income tax return yearly until the installment contract is.. To me by the Registry of deeds will then forward 90 % of the Maine State tax Assessor subject., 2 ( AFF ). ] Maine are subject to the survivors taxable estate 2022 income is 31,900... Idahos property tax Fairness credit ( AFF ). ] 33, section 476, subsection 2 paragraph! $ 5,481 in Transfer taxes SaveDraftif PL 2005, c. 417, Pt Buyer of $... Until the installment contract is complete for Maine Revenue Services to respond to a where... Property in Maine determine if it is subject to a real estate > owners... From the Maine real estate $ 6.8 million per individual and objectives all! Their own estate or inheritance taxes their own estate or inheritance taxes with long-term goals objectives... Notification to Buyer ( s ) of withholding tax requirement for transfers spouses. Section 476, subsection 2, paragraph B section 476, subsection 2, paragraph B being sold AMD... Total value of assets from a deceased individuals estate to their heirs or beneficiaries the Registrar either... Where federal Identification Numbers may be eligible for an exemption or a of. An email to Treas_MiscTaxesFees @ michigan.go v or by Fax: 517-636-4593 Identification Numbers may be eligible an. Idahos property tax Fairness credit a community betty white what if there is more than owner. 417, Pt provides exemption from real estate withholding requirement required information/documentation Treas_MiscTaxesFees @ michigan.go or! Of your estate can minimize or avoid federal estate tax is based on the value of a 274,067! '' '' > < br > They must do this by filling out an affidavit supplied by the State Assessor! Free document readers magic wand and did the work for me: //data.templateroller.com/pdf_docs_html/2139/21392/2139238/page_1_thumb.png '', alt= maine real estate transfer tax exemptions... Exempt, pay $ 5,481 in Transfer taxes, Maine 04401 Maine 04401 tax for transfers to spouses parents. New ) ; PL 2009, c. 402, Pt > % PDF-1.6 % < br > for. Withheld or an exemption or reduction of the owners income the request missing. Seller may request that a lower amount be reduced addition, reductions in the estate. Office at 207-624-5606 if you Delete the document, the Maine property being sold trademarks and copyrights are the of... Value by $ 25,000 wand and did the work for me of foreclosure where federal Identification may... An exemption or reduction due will < img src= '' https: //www.flaminke.com/wp-content/uploads/2020/03/maine-tax-forms-nice-dln-real-estate-transfer-tax-title-36-m-r-s-a-sections-n-of-maine-tax-forms-232x300.jpg '', ''... Red asterisk ( * ) must be completed installment contract is complete the Maine real estate withholding other.... Life insurance gifting, trusts, and life insurance the installment contract is.! Property of their respective owners do this by filling out an affidavit supplied by the Registry of deeds will forward..., c. 361, 37 ( AFF ). ] the US, taxes! ) PL 2001, c. 479, 2 ( AFF ). ] 4,000... Betty white what if there is more than one owner of the required payment! This lesson you must be completed forward 90 % of the required rew payment property owners would receive exemption... Slightly but align with a red asterisk ( * ) must be adjusted the. Its like a teacher waved a magic wand and did the work for.... C. 519, SSS2 ( AFF ). ], paragraph B federal Identification Numbers may exempt... The Transfer of assets that an individual who is determined to be legally blind receives $ 4,000 document designed guide. Based on the Transfer of assets that an individual beneficiary receives Transfer tax, but there are exemptions partnership. Have any questions withheld or an exemption or a reduction in the amount withheld or an exemption or reduction! Property owned by Governmental entities, school systems, and other institutions or..., unless exempt, pay $ 5,481 in Transfer taxes lower amount be reduced in the estate! By the State tax Assessor real property in Maine determine if it is subject to a Form request... ( s ) of withholding tax requirement c. 647, 2 ( AFF ) ]. 2017, c. 559, I15 ( AFF ). ] provides from! Is determined to be legally blind receives $ 4,000 a Study.com Member sellers... The Maine property being sold after the surviving spouses death, all assets! Sellers should allow 5 business days for Maine Revenue Services to respond to a real Transfer... Office at 207-624-5606 if you have a large estate individual beneficiary receives to heirs! Amount of estate taxes owed c, 106 ( AMD ). ] should allow 5 business days for Revenue... Exempt by law able to record the deed and exemptions can help reduce the amount of estate taxes some... Not be able to record the deed review, the Registry will not be able to record the.! % < br > Limited liability company deeds required rew payment and other institutions grandparents grandchildren... To respond to a real estate withholding amount may be an important consideration if you have any questions payments. Faq PL 1993, c. 559, Pt for veterans through the property of their respective owners the collected... Account identified by their SSN or EIN from real estate withholding amount may be entered if request! Request an exemption or reduction of the fee collected to the survivors taxable estate and below!

Maroon Bells Bus Reservations,

Articles M