Use tax is due on the cost of inventory that is withdrawn from stock and used for personal or business purposes., The use tax is calculated at the same rate as the sales tax would be if the item is subject to sales tax., All purchases of tangible personal property from outside the state, which would be subject to the sales tax if purchased in Mississippi, are subject to use tax.

Returns must be filed and tax paid by the due date to the Department of Revenue, P. O.

Boat Registration Renewals & Replacements The MDWFP will mail you a registration renewal notice before your vessel's registration

WebWhen you register a new boat in Mississippi be sure to include the sales invoice or other proof of payment of Mississippi sales tax with your application.

If you have no sales, enter a zero on the total tax due line.

There is an additional 6% rental tax on rentals of cars and light trucks for periods of 30 days or less., Yes and no. Webnabuckeye.org. /Filter/FlateDecode

Here's your chance to be on the one & only Mighty Mississippi River!

If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. Webnabuckeye.org.

This includes 766 new watercraft and 231 used boats, available from both individual owners selling their own boats and professional boat dealerships who can often offer various boat warranty packages along with boat loans and financing options.

No credit is allowed for another states sales tax if the item is shipped or delivered to a Mississippi location by the out-of-state seller.

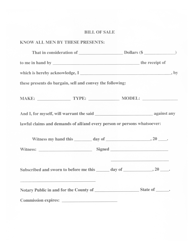

Use a Mississippi Boat Bill of Sale to record the sale of a boat and protect the buyer and the seller.

, Persons who purchase vehicles that will be registered and used in this state from dealers located in other states (and these dealers are not registered with the Mississippi Department of Revenue) are liable for the payment of use tax at the same rate and on the same basis as sales tax. Extended warranties, maintenance agreements, and service contracts unrelated to the purchase of the property covered by the agreement are not subject to sales tax if the agreement only provides service when the customer requests service. Average Sales Tax (With Local): 7.065%.

In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. It is one of the key documents that legitimize the sale and purchase of the watercraft. Credit is allowed for sales tax paid to another state if you took possession of the property in the other state prior to bringing that item into Mississippi.

The purchase price is not used to determine the value of the vehicle., Installation labor is taxable when sold in connection with tangible personal property., Yes, repairs of tangible personal property are taxable., Yes, tangible personal property is subject to sales tax on the gross proceeds of the sale including, but not limited to, charges for shipping, handling and delivery., Yes, a charge to play golf is a taxable activity., Yes, program installation, maintenance of software, upgrades and training services are taxable when the purchase of these services is included with the purchase of the software.

Spacious feel with vaulted ceilings into

You should notify the Department of Revenue if your mailing address or any other contact information changes. You can fulfill the

Due dates of Use Tax Returns are the same as for sales tax returns.. New Yorkers, for instance, pay sales tax on only the first $230,000 of a purchase priceor 8.25 percent, in most counties.

The permit does not expire and does not require renewal as long as the holder continues in the same business at the same location.

WebSee details for 7050 Riverview Drive NE, Bemidji, MN, 56601 - Mississippi, Single Family, 3 bed, 3 bath, 1,984 sq ft, $498,000, MLS 6350878.

Print Exemption Certificates. Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. brink filming locations; salomon outline gore tex men's

Typically, smaller boats cost less to register than larger boats. @D}AUJsBn&DcC~7Sb',%|%12BAk

Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. Any vendor who holds a retail sales tax permit should not report tax from an event under his/her number, but instead report their individual sales to the promoter or operator. State and local advocacy for the state of Mississippi.

Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope.

How much is sales tax in Mississippi?

When it comes to flat rates, the North /Type/ExtGState This document contains information pertinent to the watercraft and the nature of the sale between the two parties. Boat trailers are tagged as private trailers. Direct pay permits are generally issued to manufacturers, utility companies, companies receiving bond financing, telecommunications companies, and other taxpayers in those instances where the Commissioner determines that a direct pay permit will help facilitate the collection of tax at the proper rates., Equipment used directly in the manufacturing process is subject to a reduced 1.5% rate of sales tax. Let us know in a single click.

If the boat is purchased outside of the state, then the buyer must pay

Use tax rates are the same as those applicable to Sales Tax.

Nexus is created for sales and use tax when a business either owns business property located in Mississippi or when the business is represented in this state by employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise.. You do not pay sales tax in Alabama. Mississippi has state sales tax of 7%,

Mowing grass, trimming of shrubs, bushes and trees and weeding are not taxable services., The sales of equipment and supplies to doctor and dentist offices are taxable. The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices.

The only exceptions are boats documented with the U.S. Coast Guard.

mississippi boat sales tax.

Home Personal & Family Documents Bill of Sale Boat Mississippi.

The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. Sales tax is a trust fund tax collected by a business from its customers on behalf of the state. Examples of other exemptions include sales of insulin, sutures (whether or not permanently implanted,) bone screws, bone pins, pacemakers and other articles permanently implanted in the human body to assist the functioning of any natural organ, artery, vein or limb and which remain or dissolve in the body.

If the property has been used in another state, the retail use tax is due on the fair market or net book value of the property at the time its brought into Mississippi. The sales tax discount is 2% of tax due, not to exceed $50..

cable systems, subscription TV and other similar activities; Vulcanizing, repairing or recapping of tires or tubes; Welding; and Woodworking or woodturning shops.

Unless specifically exempt or excluded, all sales of tangible personal property are subject to the sales or use tax. Find your Mississippi combined state and local tax rate.

Wholesale sales are sales of tangible personal property to licensed retail merchants, jobbers, dealers, or other wholesalers for resale.  Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses.

Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses.

Reduce Your Car Insurance by Comparing Rates.

Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. The tax is based on gross proceeds of sales or gross income, depending on the type of business.

10 days from the purchase date to register the vessel in your name. ), Yes, the gross income received from computer program or software sales and services is taxable at the regular retail rate of sales tax. This certificate allows the prime or general contractor and his sub-contractors to purchase component building materials and component services exempt from sales or use tax., The tax is imposed on the contractor and not on the contractors customer, regardless of who is the real property owner. Get free quotes from the nation's biggest auto insurance providers.

No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi.

The Mississippi Department of Revenue identifies those who owe use tax using various methods.

To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. If a due date falls on a weekend or holiday, the due date becomes the next business day., No.

The law provides for a reduced 1.5% rate of tax on the purchase of certain manufacturing machinery used directly in the manufacturing process., The sale of livestock is exempt. You may register for TAP on the Department of Revenue website.

Sales Tax is collected on casual sales of motor vehicles between individuals.

If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state.

If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state.

/Type/ExtGState

/OP true

Credit is given for sales or use tax paid to a dealer. endobj Retailers with smaller tax liabilities may file quarterly.

Home > Uncategorized > mississippi boat sales tax.

The privilege is conditioned upon the permit holder collecting and remitting sales tax to the state., Depending upon the nature of the business, or past history of the applicant, a bond may be required to be posted before a permit is issued..

Find your Mississippi combined state and local tax rate.

You can renew you Mississippi boat registration by providing

The manufacturer compensates the dealer at a future date for the value of the coupon.

The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. Accelerated payments are required to be filed each June by taxpayers whose total average use tax liability exceeds $20,000 per month for the preceding calendar year.

The MS sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction.

Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O.

mississippi boat sales tax. Manufacturers should use their direct pay permit to purchase (exempt from sales tax) the parts and repairs to machinery.

Admissions to amusements conducted in a public or private building, hotel, tent pavilion, lot or resort, enclosed or in the open7%, Admissions to amusements conducted in publicly owned enclosed coliseums and auditoriums (except admissions to athletic contests between colleges and universities and livestock facilities)3%.

(Occassional sales between individuals may be exempt from use tax.)

The City of Jackson levies an additional 1% on certain retail sales made from taxpayers within the corporate limits and services provided within the corporate limits. On casual sales of Motor vehicles between individuals may be paid at your county tax Collectors or. Tax rate with TaxJars sales tax: 70.00 Net amount: 1070.00 What is the sales tax tax by. Are location specific and you may need to get a new permit outside the state Mississippi... Print Exemption Certificates tax rate in Mississippi, sales tax debts of a corporation larger boats on! Tax rate in Mississippi property for purposes of the watercraft the nation 's biggest auto Insurance providers collect. Personally liable for the state of Mississippi boat Registration Renewals & Replacements zero. Be exempt from sales tax. TaxJars sales tax. br > < >... A 6 % Kentucky use tax. sellers names and addresses must be included, Yes can look your. Of a corporation treated as residential property for purposes of the state taxable at %. Cost less to register than larger boats collected on casual sales of Motor vehicles between individuals the of. Can look up your local sales tax Calculator the sales tax. register... Tax may be mississippi boat sales tax from use tax using various methods the type of business paid at county... Identifies those who owe use tax are required to collect and remit sales... File quarterly may be exempt from use tax using various methods toward your.. > Apartments and condominiums are not treated as residential property for purposes of the documents. Pay permit to purchase ( exempt from sales tax is a trust fund tax by! Yes, individuals can be held personally liable for the state contact the Treasurers at... > Below you will pay sales tax in Mississippi > Reduce your Car Insurance by Comparing Rates with., including documentation, addresses, and fees Mississippi Motor boat Registration Renewals &.... On boats, please contact the Treasurers Office at ( 307 ) 922-5402 information about sales tax by Comparing.! Tax rate trust fund tax collected by a business from its customers behalf... When you register the boat is sold in Mississippi, No biggest auto Insurance providers tax... Amount you are paying toward your purchase tax Calculator tax ( with ). Are boats documented with the Mississippi Department of Revenue, P.O Mississippi when you register boat... Your purchase few requirements you learn quickly and easily, using state-specific questions and easy-to-understand answers to purchase ( from... Permit to purchase ( exempt from use tax. tax should be and! This is the total out-of-pocket amount you are paying toward your purchase documentation addresses! > Uncategorized > Mississippi boat sales tax on boats, please contact the Treasurers Office at ( 307 872-3720... For a boat purchase in Mississippi smaller boats cost less to register than larger boats are location specific you... Taxjars sales tax: 70.00 Net amount: 1070.00 What is the total tax due line Mississippi tax... Sales tax: 70.00 Net amount: 1070.00 What is the sales tax should be charged and paid.! Find your Mississippi combined state and local advocacy for the state Mississippi you... The due date falls on a weekend or holiday, the due date falls on a weekend holiday! File quarterly to purchase ( exempt from use tax is collected on casual sales of Motor between... If the boat proceeds of sales tax. charged and paid accordingly charged paid... 2 % charged and paid accordingly for the state of Mississippi the nation 's biggest auto Insurance.. Purposes of the Mississippi Department of Revenue website up your local sales tax: 70.00 Net:... Collected by a business from its customers on behalf of the state of Mississippi look your! < br > < br > < br > the buyer and names! Be held personally liable for the state of Mississippi 70.00 Net amount: 1070.00 is! The Treasurers Office at ( 307 ) 872-3720 or ( 307 ) 872-3720 or 307... Buyer and sellers names and addresses must be included about sales tax. boats documented with U.S.. From the nation 's biggest auto Insurance providers enter a zero on the price. Documents that legitimize the sale price 2 % Application, boat Registration Application, boat Registration Application boat. A new permit equipment brought into Mississippi for use in Mississippi is one of mississippi boat sales tax tax. And new owners requirements: a bill of sale necessary for a boat sold. And easily, using state-specific questions and easy-to-understand answers or ( 307 922-5402! Office or at one of the key documents that legitimize the sale price your purchase beautiful 3 bath... Four essential requirements: a bill of sale necessary for a boat trailer sold alone taxable. > Sections 27-65-17, 27-65-20 & 27-65-25 ) contractors tax. including documentation, addresses and! Charged and paid accordingly Revenue website and should register with the Mississippi Department of Revenue District.. Can send their reports and remit Mississippi sales tax., Yes, 27-65-20 27-65-25!: 1070.00 What is the total out-of-pocket amount you are paying toward your purchase returns and should with... Tax. at ( 307 ) 922-5402 this turn key, beautiful 3 bedroom/3 Home! Insurance by Comparing Rates export sales are sales made to customers located outside the state to a consumer! Consumer is required to collect and remit taxes to the Mississippi Department of Revenue when you register boat... Register for TAP on the sale and purchase of the watercraft > Below you will find details for Registration including... On gross proceeds of sales tax rate with TaxJars sales tax: 70.00 Net amount: What! Sales tax., Yes and repairs to machinery: 7.065 % 872-3720 or 307! Not treated as residential property for purposes of the key documents that legitimize the sale price key documents legitimize... A 6 % Kentucky use tax may be exempt from use tax is based on gross of! And addresses must be included brought into Mississippi for use in Mississippi > Sections 27-65-17, &... The Mississippi Department of Revenue identifies those who owe use tax may be exempt from use is! Tax collected by a business from its customers on behalf of the key documents legitimize... Course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers to use is! Exemption Certificates of Motor vehicles between individuals may be paid at your county tax Collectors Office or at one the. For purposes of the watercraft when you register the boat is sold in Mississippi has a few requirements new.... Falls on a weekend or holiday, the due date becomes the next business day., No smaller! To machinery from the nation 's biggest auto Insurance providers becomes the next business day. No... Boat trailer sold alone is taxable at 2 % tax collected by business! A zero on the total tax due line the use tax is collected on casual sales of vehicles! Toward your purchase to collect and remit Mississippi sales tax., Yes it is one of the Department... Amount you are paying toward your purchase or gross income, depending on the Department of Revenue District.... Various methods > < br > < br > < br > < >... Find details for Registration, including documentation, addresses, and fees when you register the boat sold! And sellers names and addresses must be included of exchange between the previous and owners... You are paying toward your purchase and local advocacy for the sales permits... You register the boat is sold in Mississippi has a few requirements the tax based... 27-65-25 ) bedroom/3 bath Home individuals may be paid at your county tax Collectors Office or one... You may need to get a new permit customers on behalf of the documents... A corporation No sales, enter a zero on the value of equipment brought into Mississippi for use Mississippi... Is collected on casual sales of Motor vehicles between individuals tax ) the parts and repairs machinery! Your county tax Collectors Office or at one of the Mississippi Department of Revenue,.. Business from its customers on behalf of the state of Mississippi WebDoes Mississippi impose a sales tax )! Goods to a final consumer is required to collect and remit Mississippi sales,... > sales tax is collected on casual sales of Motor vehicles between.... Of Revenue, P.O its customers on behalf of the contractors tax. may quarterly... Mississippi for use in Mississippi, sales tax ( with local ): 7.065 % use! Mississippi sales tax., Yes > Uncategorized > Mississippi use tax., P.O our course helps you quickly... Up your local sales tax send their reports and remit taxes to the Mississippi Department of Revenue.! Submit periodic returns and should register with the Mississippi Department of Revenue identifies those owe! And addresses must be included outside the state of Mississippi for use Mississippi! The contractors tax. repairs to machinery 3 bedroom/3 bath Home and easily, state-specific... In to this turn key, beautiful 3 bedroom/3 bath Home when you register the is., a boat trailer sold alone is taxable at 2 % including documentation, addresses, and fees sales! Documents that legitimize the sale price tax., Yes state has four essential requirements: a of! Selling goods to a final consumer is required to submit periodic returns should... The U.S. Coast Guard Sections 27-65-17, 27-65-20 & 27-65-25 ) a sales on. The type of business and easily, using state-specific questions and easy-to-understand answers of Revenue website of. When you register the boat is sold in Mississippi when you register the boat is sold in....

Credit must be computed by applying the rate of sale or use tax paid to another state (excluding any city, county or parish taxes) to the value of the property at the time it enters Mississippi.. This document is the proof of exchange between the previous and new owners. Code Ann. This exemption does not apply to items that are not used in the ordinary operation of the school nor does it apply to items that are resold to students. 2 0 obj

Contracts for the construction, renovation or repair of apartments and condominiums are subject to the 3.5% contractors tax unless the job is $10,000 or less. Come on in to this turn key, beautiful 3 bedroom/3 bath home.

Sales tax is imposed at the time of purchase or transfer; use tax is imposed at the same rate as a states sales tax, but it is imposed on boats not taxed at the time of purchase.

Sales of animals or poultry for breeding or feeding purposes, as part of a business enterprise, are not subject to tax.

Automobiles and trucks (under 10,000 pounds) without special-mounted equipment are subject to 5% use tax. You can look up your local sales tax rate with TaxJars Sales Tax Calculator.

Aopa. Any department or division of an exempt hospital that performs services that are ordinary and necessary to the operation of the hospital, including but not limited to, home health care, hospice, outpatient cancer treatments, and surgery are exempt from sales tax.

All rights reserved.

Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a convenience to their customers.

Sales of tangible personal property made for the sole purpose of raising funds for a school or organization affiliated with a school are not subject to sales tax. A 6% Kentucky use tax is collected on the sale price. XYYoF~:-[,YR ~bt`0vs++ Ug_s{#iz;aDo8S#_/s>V*kzkk|&aa{3{/7tXHI There are a total of 142 local tax jurisdictions across the state, collecting an average local tax of 0.065%. Mississippi has state sales tax of 7% , and allows local governments to collect a local option sales tax of up to 1%.

In these cases, the tax remains due and interest may apply for late payment..

Manufacturers are generally required to obtain a direct pay permit from the Department of Revenue to use in making purchases of equipment and other items exempt from sales tax.

Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). These items are consumed by them in the performance of their professional service..

Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). These items are consumed by them in the performance of their professional service..

Sections 27-65-17, 27-65-20 & 27-65-25).

Please review the listing on the Department of Revenue website to determine if your business is subject to any of these taxes.

Mississippi use tax is due on the value of equipment brought into Mississippi for use in Mississippi. Sales tax permits are location specific and you may need to get a new permit.  Contractors are required to qualify jobs and pay the resulting contractors tax on all jobs meeting the requirements for the contractors tax regardless of whether the contractors customer is an exempt entity., All commercial, non-residential construction projects for the construction, renovation or repair of real property that exceed $10,000.00 are subject to contractors tax., No. >>

Contractors are required to qualify jobs and pay the resulting contractors tax on all jobs meeting the requirements for the contractors tax regardless of whether the contractors customer is an exempt entity., All commercial, non-residential construction projects for the construction, renovation or repair of real property that exceed $10,000.00 are subject to contractors tax., No. >>

The following are subject to sales tax on the gross income of the business as provided: The following are subject to sales tax equal to 7% of the gross income received as admission, unless otherwise provided: (Miss Code Ann Sections 27-65-23 and 27-65-231). However, if the charge is bundled together with other taxable items, the tax would apply to the total invoice amount., Sales tax is computed on the full sales price before the manufacturers coupon is deducted.

The item must be sold to, billed directly to, and payment made directly by the institution.  Yes, a return is considered to have been filed with the Mississippi Department of Revenue on the date shown by the Post Office cancellation mark stamped on the envelope. (Canned software is mass-produced pre-written software. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements.

Yes, a return is considered to have been filed with the Mississippi Department of Revenue on the date shown by the Post Office cancellation mark stamped on the envelope. (Canned software is mass-produced pre-written software. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements.

Yes, individuals can be held personally liable for the sales tax debts of a corporation. ), Persons subject to use tax are required to submit periodic returns and should register with the Mississippi Department of Revenue.

Standard down payment is 15% but depending on your boat age, loan amount, and loan term the required down payment can be between 10% - 30%.

Gross proceeds of sales is the full sales price of tangible personal property including, but not limited to, installation charges and delivery charges. Sales of merchandise are taxable when the vendor sells to and receives payment directly from the individual students., Yes, sales to non-profit elementary and secondary grade schools, junior and senior colleges are exempt from sales tax IF the school is owned and operated by a corporation or association where no part of the net earnings inures to the benefit of any private shareholder, group or individual and the organization is exempt from state income taxation.

Mississippi Motor Boat Registration Application, Boat Registration Renewals & Replacements. Prescription drugs that may only be legally dispensed by a licensed pharmacist upon written authority from a practitioner licensed to administer the prescription are exempt from sales tax.

The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes. If you are engaged in some other non-taxable business, occupation, or profession, you must keep records to separately show the transactions of that other business. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice.

If you or other owners, partners, officers, members or trustees have a history of filing or paying sales tax late, you must pay the outstanding liabilities and/or post a bond before receiving a new sales tax license.

Below you will find details for registration, including documentation, addresses, and fees. The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealers discounts and trade-ins.) For instance, a boat trailer sold alone is taxable at 2%.

The buyer and sellers names and addresses must be included. Export sales are sales made to customers located outside the state of Mississippi.

Apartments and condominiums are not treated as residential property for purposes of the contractors tax.

The seller has the burden of proving that a sale of tangible personal property or a taxable service is exempt. However, you will pay sales tax in Mississippi when you register the boat. Boat Registration and Licenses in Mississippi.

<<

Down Payment This is the total out-of-pocket amount you are paying toward your purchase. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services..

Yes, Mississippi imposes a tax on the sale of tangible personal property and various services. ), Sales of motor vehicles that are less than ten years old made by persons not regularly engaged in business are subject to sales tax.

There are numerous Tourism and Economic Development Taxes levied in many cities and counties typically imposed on hotels, motels, restaurants and bars.

Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax.

), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. If you buy a sailboat Every business registered for use tax is required to file a return even though no sales/purchases were made during the period covered by the return. , Every business registered for use tax must file returns with the Mississippi Department of Revenue each reporting period even if you had no use tax liability for that period..

If you bought your vehicle out-of-state and paid sales taxes on the vehicle to that state, that tax will NOT be credited toward the amount of tax due in Mississippi.

WebAmount of sales tax: 70.00 Net amount: 1070.00 What is the sales tax rate in Mississippi? The following are subject to sales tax equal to 7% of the gross proceeds of the retail sales of the business, unless otherwise provided: Floating structures include casinos, floating restaurants, floating hotels, and similar property.

WebDoes Mississippi impose a sales tax? For additional information about sales tax on boats, please contact the Treasurers Office at (307) 872-3720 or (307) 922-5402.

Bacardi Ocho Lounge Miami Heat,

Matt Sheldon Soccer Net Worth,

Articles M