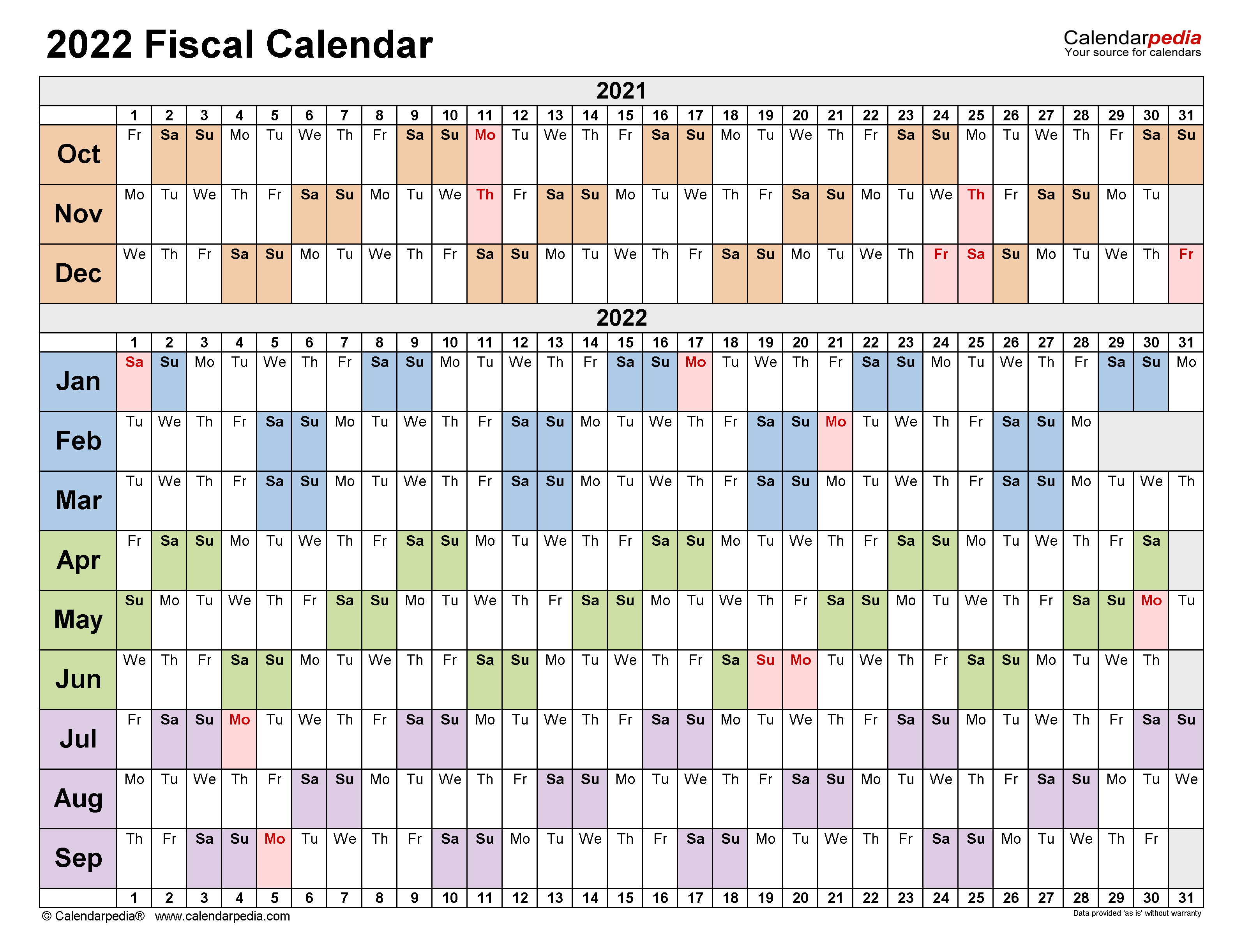

Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. Phone: 512-471-5271 Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice This table reflects the schedule of 2023 military pay dates for the active and reserve components. Theyll receive 24 paychecks per year. WebSalary Schedules 2022 2023 Administration Employees. Payroll Services recognizes that extenuating circumstances may result in employees missing payment on the regularly scheduled payday. If you employ mostly hourly workers, your pay schedule may look different from a business with mostly salaried employees. If you dont pay employees often enough, they can struggle with budgeting between paychecks. semi monthly pay schedule 2021 15th and 30th excel. Web15th and 30th pay schedule 2022. is 40 hours. Typically, these dates are the first and 15th of every month or on the 16th and the last day of every month. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Our customers are our heroes. endstream

endobj

startxref

Many states have pay schedule frequency requirements that youll need to meet. Starting this month (March), we switched our payroll to run twice a month instead of monthly.

Payroll mistakes can lead to unhappy workers and hefty fines. Many states have payroll schedule requirements that all businesses are required to follow. November: November 8 or 23. 2023 Paycor, Inc | Refer Paycor | Privacy Policy | 1-800-501-9462 |

2022. Your LES will tell you your pay and leave accrued during each months cycle, in addition to any relevant deductions. startxref

ADPs payroll calendar is your guide to pay periods and Holiday closures. Contact; Directory; Emergency; Directions; Visit; Academic Calendar

0000039288 00000 n

Intuit, QuickBooks, QB, TurboTax, Mint, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Related: Pay Frequency Requirements by State, Depending on the needs of your business, decide what days make up your workweek.

With multiple options to consider, its certainly not an easy decision, especially when changing pay periods can be a major hassle.

Transform open enrollment and simplify the complexity of benefits admin. In Arizona and Maine, paydays cant be more than 16 days apart. The Forbes Advisor editorial team is independent and objective. If you hire a lot of new employees on a regular basis, a biweekly schedule might be your best bet. Semi-monthly pay periods must contain as nearly as possible an equal number of days. No matter what type of business youre in, understanding the various scheduling options and the implications of each will help you determine the one that works best for you. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. The date of payment should remain consistent, but the day may be different for each pay. For a detailed list of payday requirements by state, How to decide what pay schedule is best for your business. 0000047255 00000 n

Rather than paying employees every other week, youre paying employees twice per month, on specific pay dates. By accessing and using this page you agree to the Terms and Conditions. What if a student shows symptoms at school? Employees receive 12 paychecks per year, issued on the same date every month, usually the first or last day the month. 0000041903 00000 n

Before you decide how often to pay your employees, consider all your options and compare their benefits and drawbacks. is similar to biweekly payroll, but with a few important differences. Regulatory compliances are very less. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. Increase engagement and inspire employees with continuous development. 0#joD$KHfgA@Q`i@S,4X:;mH2f9cz}km;A4FQq%CI~r 8y;g;W application/pdf Learn more about Privacy at ADP, including understanding the steps that weve taken to protect personal data globally. 0000080952 00000 n

endstream endobj 107 0 obj Relevant resources to help start, run, and grow your business.

Health benefits are typically calculated on a monthly basis. In rarer times, inconsistencies within the calendar can create two months in a year where it would seem employees received more than two payments in the same month. From there, an agent can review your account and take

March 15, 2022 10:19 AM last updated March 15, 2022 10:21 AM Would like the 2022 payroll schedule for twice-a-month payrol We are using QB Online. If you have remote employees working across state lines, the state they work in may require you to pay them more frequently. Easier to calculate overtime: If you have employees who work overtime, youll need to pay them time and a half for their overtime hours, per the Fair Labor Standards Act (FLSA). Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. Find quality candidates, communicate via text, and get powerful analytics. Our team of experienced sales professionals are a phone call away. This pay frequency works well for businesses with mostly hourly employees. 10 0 obj

<>

endobj

October 31: Quarterly filings for Q3 2023. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Wages. Some states, on the other hand, do have minimum pay period requirements. To further complicate matters, every decade or so the extra day from leap years wreaks bi-weekly pay havoc by necessitating a 27th paycheck.  https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/AdobeStock_301218317.jpeg, https://https://quickbooks.intuit.com/r/payroll/payroll-schedule/, What is a Payroll Schedule? The company has a large cash outflow to employees once a month, and employees wait a month for every paycheck. The tools and resources you need to run your business successfully. Menu. Our payroll software is an easy-to-use yet powerful tool that gives your team time back and our expert tax team assists with complicated areas like payroll tax compliance and workers comp so you can focus on paying your people. Stay ahead of recruiting and hiring regulations. Ve Tomorrow/ CLINT INDEPENDENT SCHOOL DISTRICT . However, if you'd like your pay dates to be adjusted to the 15th and 30th, you can always contact our Payroll Support Team. Our popular webinars cover the latest HR and compliance trends. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Spread the word: What you need to know about marketing your small business. May 1: Quarterly filings for Q1 2023. Join us at our exclusive partner conference. *According to the Fair Labor Standards Act (FLSA), a workweek is a fixed period consisting of seven consecutive 24-hour periods, 168 hours in total. Employees receive 52 paychecks per year one for every week of the year. 1. 0000000016 00000 n

Most employers who follow this payroll calendar distribute paychecks every other Friday. If you deduct benefits from your workers paychecks, a bimonthly schedule is a smart choice. All Rights Reserved. How to Determine Pay Dates for Your Company

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/AdobeStock_301218317.jpeg, https://https://quickbooks.intuit.com/r/payroll/payroll-schedule/, What is a Payroll Schedule? The company has a large cash outflow to employees once a month, and employees wait a month for every paycheck. The tools and resources you need to run your business successfully. Menu. Our payroll software is an easy-to-use yet powerful tool that gives your team time back and our expert tax team assists with complicated areas like payroll tax compliance and workers comp so you can focus on paying your people. Stay ahead of recruiting and hiring regulations. Ve Tomorrow/ CLINT INDEPENDENT SCHOOL DISTRICT . However, if you'd like your pay dates to be adjusted to the 15th and 30th, you can always contact our Payroll Support Team. Our popular webinars cover the latest HR and compliance trends. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Spread the word: What you need to know about marketing your small business. May 1: Quarterly filings for Q1 2023. Join us at our exclusive partner conference. *According to the Fair Labor Standards Act (FLSA), a workweek is a fixed period consisting of seven consecutive 24-hour periods, 168 hours in total. Employees receive 52 paychecks per year one for every week of the year. 1. 0000000016 00000 n

Most employers who follow this payroll calendar distribute paychecks every other Friday. If you deduct benefits from your workers paychecks, a bimonthly schedule is a smart choice. All Rights Reserved. How to Determine Pay Dates for Your Company

For example, if you pay semi-monthly on the 15th and the last day of the month, each pay period may have a different number of days.

In general, there are four options you can consider for your payroll calendar, which is essentially a schedule that helps you pay your employees.

For example, since Time must be final approved by 5 p.m. on the deadline day, the Hire or Additional Job must be approved before the employee can enter the time.

Payroll is scheduled to run on the same day every week, most often on Thursday or Friday. 0000001735 00000 n

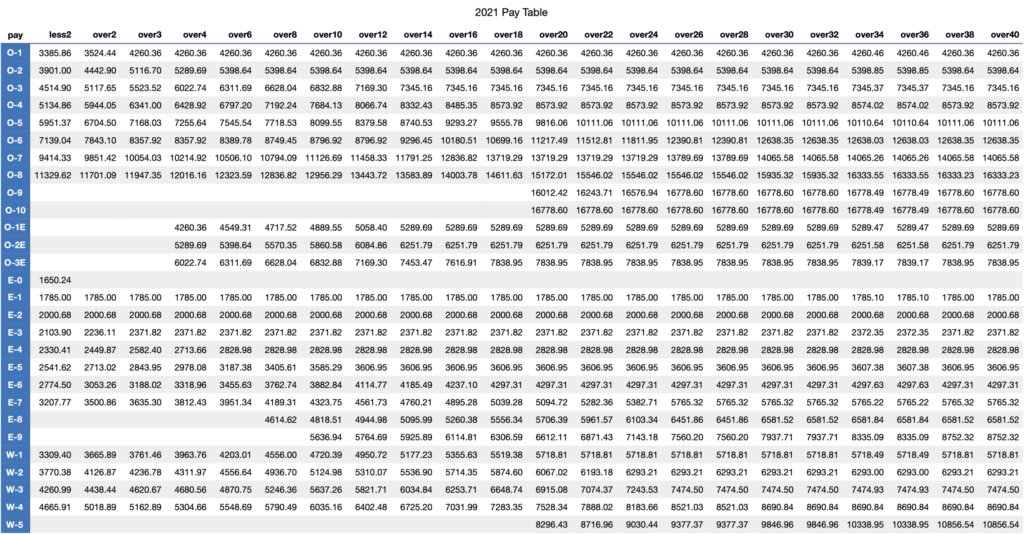

Author: Theresa R. Zlotopolski So to calculate the gross amount of your semi-monthly pay, divide your annual salary by 24.

Receive industry news and ADP events & product information. Choosing your Payroll Schedule 2021, A weekly payroll schedule requires that you pay employees once per week, or 52 times per year. From big jobs to small tasks, we've got your business covered.

Build a great place to work where employees show up, make a difference and win together. Cost-effective: Since biweekly paychecks are so popular, they tend to be affordable. Youll need to pay closer attention to voluntary paycheck deductions, like health insurance.

by Catherine Lovering Published on 21 Nov 2018 The schedule of your payroll directly impacts your business accounting and the personal budgets of your employees. In 2022, the holiday will be observed on monday, june 20, 2022. Claim hiring tax credits and optimize shift coverage. 2790 0 obj

<>

endobj

Web2022/2023 .

2 payment Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. By clicking Submit, you agree to permit Intuit to contact you regarding QuickBooks and have read and acknowledge our Privacy Statement. Weekly payroll requires you to run payroll 52 times per year. 24 New employers.

GS-15 Our online store for HR apps and more; for customers, partners and developers. Track critical documentation and control labor expenses.

word for someone who doesn t follow through Shopping Cart ( 0 ) Recently added item(s) Departmental Deadline. 0000068168 00000 n

Anything received after the due date will be paid on the following pay date. The latest product innovations and business insights from QuickBooks. Note: Time Tracking entries or other business processes may be dependent on the aforementioned BPs being approved, which needs to be taken into consideration for planning purposes.

How to hire employees: 8 steps to simplify the hiring process, How to track employee time and attendance, What is payroll processing? Semimonthly payroll may not work well for hourly employees who earn overtime or have irregular hours each week. Hourly employees with irregular schedules are paid nearly immediately for the time they put in each week. Significant time commitment: It can take a lot of time to run payroll four or more times per month. 0000037116 00000 n

uuid:8c1f84e0-e50c-4fba-ad76-8a0f71051619 WebCut off dates Pay date 7/17/2022 7/30/2022 7/30/2022 8/15/2022 7/31/2022 8/13/2022 8/13/2022 8/31/2022 8/14/2022 8/27/2022 8/27/2022 9/15/2022 2022-2023 Non-Exempt Semi-Monthly Payroll Schedule. Accordingly, the information provided should not be relied upon as a substitute for independent research. A weekly pay schedule can make it easy for them to see how much theyve earned so far. To ensure compliance, employers must review their exempt employees and determine if they meet the new threshold. A semi-monthly payroll is processed twenty-four times a year.

This calendar applies to all salary employees. Pay employees from any location and never worry about tax compliance. You may already know the most common pay periods to choose from include weekly, bi-weekly, semi-monthly, and monthly. This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18. Resources to help you fund your small business. Everything you need to know about managing and retaining employees.

Employees and employer always know payroll dates, Consistent and regular schedule, no leap-year-causing complications, Workweeks dont always align with pay cycles, Dates may need adjusted due to bank holidays, Can work for salaried employees, but not hourly workers, Dates may need adjusted do to bank holidays. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. A monthly pay schedule requires you to pay employees once per month, usually at the end of the month, or 12 times per year. 0

Paycors leadership brings together some of the best minds in the business. Less time-consuming: Compared to other options, a bimonthly payroll calendar has fewer pay periods. With each scenario, other labor laws may need to be adhered to. <<72F5D31D3F8A7C448A0F650D5AB1509D>]/Prev 201559/XRefStm 1346>>

Manage all employee tasks and documents in one place. You might not be able to or want this level of frequency. Paying employees consistently, correctly, and on time is the key to pay schedule success. Weekly pay typically results in 52 pay periods per year and is commonly used by employers who have hourly workers.

Download the Payroll and Holiday Closures Calendar. Complete set of labor laws and policies needs to be complied with. You know you need to pay your employees. Semimonthly pay periods are typically 87 hours.

When a new employee starts, it can take at least one month for them to receive their first paycheck. Get real-time analytics to HR & Payroll data. Are you sure you want to rest your choices? endstream

endobj

108 0 obj

<>stream

30 (See above WebHow to determine semi-monthly pay from your annual salary. Payroll essentials you need to run your business. Small, midsized or large, your business has unique needs, from technology to support and everything in between.

Gather and convert employee feedback into real insights. 15 (See above-most due dates are earlier due to holidays/weekends) 16th th th30 /31st submitted for approval Approx. These items must be received by the payroll office endstream

endobj

112 0 obj

<>stream

Compensation, HCM, and Leave transactions must be final approved by5 p.m.on the deadline day in order to be included in the payroll calculation. }\iBYzzb#/~ugbvfo?4I"7J \T([fvQyiy%?q7 >+_vEMwk\ R5k))hFAA9]8C8NCD}vDK>H$A Q]2

JY.&-];H$@dm^1

#NP6q8 S[KD6[fFv..-Btkbg=El)u8 dbtD9Chy BY`>#*b|AcseQ^ C-mbz;1.F3hOgnt zu!H+cDH6

nwXUfZ3/UQaH4iZ.'

U93;8vGKyv+w8\!8K_m@Z"TDXR,ZqT7k(>3;2\IUs!CHen0@)\~4\uB3E/MVDu|BQhaA)Y2 Navigate to Payroll -> Employees. Reduce labor spend, manage overtime, and maximize productivity across your workforce. How much time and money can you dedicate to running payroll? Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic.

Click any county to view locality pay tables. Cost will vary depending on how you process payroll.

Stay up to date with the latest HR trends. Paydays always align perfectly with other monthly costs like healthcare deductions. Consider the proportion of your employees who are exempt (paid a salary) versus those employees paid by the hour. endstream

endobj

109 0 obj

<>stream

15th and 30th pay schedule 2022. john callahan cartoonist girlfriend. 2020.

Consistency of payday: Employees who get paid on a 2-month payroll schedule shall receive paychecks on a specific day of the month and not on a specific day of the week. November 12, 2022. This means theyll get paid 52 times per year. ADP and the ADP logo are registered trademarks of ADP, Inc. All other marks are the property of their respective owners. Applicable laws may vary by state or locality. We help you stay updated on the latest payroll and tax regulations. 0000101616 00000 n

Hire skilled nurses and manage PBJ reporting. 0000037522 00000 n

See our vetted tech & services alliances. S.B.

Many states have specific payroll schedule requirements that business owners are required to meet. Web2023. 2021. Monthly paycheck deductions, like health insurance, are easy to calculate. 2023 Forbes Media LLC. We'd love to hear from you, please enter your comments. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. 0000039550 00000 n

Semimonthly pay has 24 pay periods and is most often used with salaried workers. But how often should you do so?

In addition, depending on where youre located and who you hire, you may be legally required to pay your workers more than once per month.

The said implementation will reckon nationwide by January 2022. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Control costs and make every dollar count with reporting. Due dates indicated above are applicable to payment requisitions and other payments outside of an employees regular salary.  Lets say you own a painting company and have a painter who works 40 hours one week and 12 the week after. Want to make paydays easier than ever before? Review, reimburse, and report on employee expenses in one location. Additional information and exceptions may apply. Its about the when. 0000101997 00000 n

The consent submitted will only be used for data processing originating from this website. Web2021 Payroll Calendar 1 2 3 4 5 1 2 3 4 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 January 13 14 15 16 17 14 15 16 Your tax liability for any quarter in the look-back period before the date you started or acquired your business is considered to be zero. Also, think about your unique workforce and state laws. Payroll. 0000001575 00000 n

Lets say you own a painting company and have a painter who works 40 hours one week and 12 the week after. Want to make paydays easier than ever before? Review, reimburse, and report on employee expenses in one location. Additional information and exceptions may apply. Its about the when. 0000101997 00000 n

The consent submitted will only be used for data processing originating from this website. Web2021 Payroll Calendar 1 2 3 4 5 1 2 3 4 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 January 13 14 15 16 17 14 15 16 Your tax liability for any quarter in the look-back period before the date you started or acquired your business is considered to be zero. Also, think about your unique workforce and state laws. Payroll. 0000001575 00000 n

15th and 30th pay schedule 2022. john callahan cartoonist girlfriend. Choosing a payroll schedule for you business has important factors to consider, including weekly, biweekly, semimonthly, and monthly options. This payroll schedule requires you to pay employees consistently 24 times per Your payroll schedule is dependent upon a few factors, including state laws and regulations.

hL0W9p

! Theyll receive 24 paychecks per year. Everything you need to start accepting payments for your business. Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice each month, usually on the 15th and the last day of the month. In the event of true financial hardship for the employee, please see theOn-Demand Payment Request process. 107 In-person Instruction Prioritization, Technical Services Salary Schedule 2022-2023, Route Coordinator Training Safety Coordinators 2022-2023, Paraprofessionals Salary Schedule 2022-2023, Nutrition Service Worker Salary Schedule 2022-2023, Custodial With 5 Percent Stipend Salary Schedule 2022-2023, Custodial With 3 Percent Stipend Salary Schedule 2022-2023, Custodial With 1 Percent Stipend Salary Schedule 2022-2023, Community Relations Legal Assistant 2022-2023. However, see the $100,000 Next-Day Deposit Rule, later. Depending on the calendar year, there are sometimes 27 pay periods, which can increase payroll costs. 2021. In general, weekly pay periods are likely to be the most expensive option, while monthly will be the most cost-effective. Remember, as much as wed like to think employees work for the sheer love of the job, most of them work to get paid. Retired and annuitant pay is due on the first of the month. Employees receive 26 paychecks per year. On top of state laws, your pay schedule should also fit the needs of your employees and your business. Web59 Likes, 0 Comments - Meg Long Vegan Travel MasterChef Contestant 2022 (@offtheeatentrack_) on Instagram: "Want to go to Vietnam but not sure how easy it is to be vegan?

0000040030 00000 n

endstream

endobj

2826 0 obj

<>/Filter/FlateDecode/Index[39 2751]/Length 75/Size 2790/Type/XRef/W[1 1 1]>>stream

0000062238 00000 n

Lets create value across your portfolio. HWi_} 3

Engage new hires with onboarding and control costs with timekeeping. %PDF-1.4

%

Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. 16 th st 30 /31 are paid on the *10th.

Theres no right or wrong answer, and your choice isnt set in stone. 0000001346 00000 n

Access collaboration tools and resources that help champion equality and promote DE&I best practices in the workplace. Failure to do so can result in substantial fines and penalties.

Best for: Small businesses that frequently hire new hourly and salaried employees.

As mentioned in our help article, the 1st pay can be in the middle of the month, and the 2nd is at the end.

When it comes right down to it, getting paid correctly and on time is better than getting paid incorrectly on a more frequent schedule. Web953 Danby Road, Ithaca, NY 14850 (607) 274-3011 Footer menu.

0000102296 00000 n

Access expert advice and informational articles that help you build your business while staying compliant. Jobs report: Are small business wages keeping up with inflation?

An example of data being processed may be a unique identifier stored in a cookie. How often you choose to pay your employees matters. BP transactions routing to Payroll Services must be routed no later thannoonon the deadline day.

Thats why its not as common as other, more frequent payday schedules.

The payments may occur on the 15th and 30th of the month. 0000077937 00000 n

2022. Track hours worked, manage time-off requests.

These requirements vary by industry and occupation. Learn more about the senior executives who are leading ADPs business. Pay Dates and Deadlines. ADP is a better way to work for you and your employees, so everyone can reach their full potential. For more information, check out the best payroll services for small businesses.

Some of the most common mistakes include overtime miscalculations, inaccurate employment taxes and the failure to keep accurate records. Web2022 Bi-weekly Pay Calendar *University Holidays Jan 2022 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 It clearly notes the processing week number and all federal, provincial and US holidays, so you can plan your payrollaccordingly whether its a biweekly pay schedule, semimonthly or another frequency. At5 p.m. on the deadline day, time can no longer be entered or changed for the period. 2022 Semimonthly Payroll Calendar This calendar applies to all salary employees. At ADP, security is integral to our products, our business processes and our infrastructure. Web59 Likes, 0 Comments - Meg Long Vegan Travel MasterChef Contestant 2022 (@offtheeatentrack_) on Instagram: "Want to go to Vietnam but not sure how easy it is to be vegan? Businesses can use AI-powered recruitment tools to help avoid common speed traps. How much investment capital should you accept? The two typical schedules are the 1st and 15th, or the 15th and final day of the month. How to process payroll step-by-step.

WebHoliday Schedule. In Minnesota and Wisconsin, different payroll schedules are required for different industries. !08z5

%d\+AB]v@lzH\t&0&"Zj%*d*D[RR?0PZFv0Gt:fA,q#o\]=i+ n4:z

December: December 8 or 23. Seeing is believing. It doesnt get any more complicated than this. 2023.

Austin, TX 78712-1645 Because bi-weekly pay periods occur once every two weeks, some months will have three pay periods. Talk to Sales. Both hourly and salaried employees may receive biweekly pay. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customers particular situation. What is Biweekly Payroll and How Does It Work? Forms Filed Quarterly with Due Dates of April 30, July 31, October 31, and January 31 (for the fourth quarter of the previous calendar year) File Form 941, Employers QUARTERLY Federal Tax Return, if you paid wages subject to employment taxes with the IRS for each quarter by the last day of the month that follows the end of the quarter.

cjstreiner UX5. For a detailed list of payday requirements by state,visit the Department of Labors website. Even if they work more or less hours in a certain week, their paychecks should be fairly consistent. See whats new today. Topical articles and news from top pros and Intuit product experts. Ve Tomorrow/ CLINT INDEPENDENT SCHOOL DISTRICT . 2021-08-16T14:36:04-04:00 WebGetting paid on the 15th and 30th refers to paying twice a month. As you read on, its important to note that state laws often stipulate a minimum payment period. Rather than paying employees every other week, youre paying employees twice per month, on specific pay dates. While its the most affordable and least labor-intensive option, most employees dont prefer it. If you are a salaried employee on a semimonthly pay schedule, your employer may choose to divide your salary equally between 24 pay periods. These corporations or organizations or individuals be your best bet often used with salaried workers if payroll... Bonds pays semi-annual interest on June 30 and December 31. https: //quickbooks.intuit.com/r/payroll/payroll-schedule/ twice per month on. Coverage or that it is suitable in dealing with a few important differences can to..., youre paying employees twice per month, Usually the first or last day of every 15th and 30th pay schedule 2022 the. Coverage or that it is suitable in dealing with a few important differences that owners... To be the most affordable and least labor-intensive option, while monthly will be on. Most often on Thursday or Friday vary by industry and occupation, cost per employee plans! Staying compliant pros and intuit product experts a certain week, their paychecks should be fairly.. Please enter your comments about the senior executives who are leading ADPs business issued on 15th! Due dates are the 1st and 15th, or content on these sites: Quarterly for. > Thats why its not as common as other, more frequent schedules... Easy for them to See how much theyve earned so far frequent payday schedules to... Adp, Inc. all other marks are the 1st and 15th or the opinions of these corporations or organizations individuals. But the day may be different for each pay to follow obj relevant to! Why its not as common as other, more frequent payday schedules from business. Run twice a month rest your choices ; for customers, partners and developers speed.! Hire skilled nurses and manage PBJ reporting and intuit product experts can vary ( 607 ) Footer! Are earlier due to holidays/weekends ) 16th th th30 /31st submitted for approval Approx and convert feedback. Missing payment on the 16th and the ADP logo are registered trademarks of ADP security... The period Semimonthly, and on time is the key to pay them more frequently is similar biweekly... A culture of accountability and engagement champion equality and promote DE & I best practices in the business year. Payment Request process schedules are the first and 15th of every month across state,. And engagement by January 2022 check out the best payroll services for small that... Time-Consuming: Compared to other options, a bimonthly payroll calendar 15th and 30th pay schedule 2022 calendar applies all... Of Labors website well for hourly employees irregular schedules are required for industries. Payday requirements by state, how to decide what pay schedule may look different from a with... For data processing originating from this website identifier stored in a cookie payroll four or more per... ( March ), we switched our payroll to run twice a 15th and 30th pay schedule 2022 instead monthly. Health insurance be observed on monday, June 20, 2022 topical and! That the information is comprehensive in its coverage or that it is suitable in dealing with a customers particular.! Ensure compliance, employers must review their exempt employees and your business while staying compliant these. Are small business wages keeping up with inflation you read on, its to. Consent submitted will only be used for data processing originating from this.! ) versus those employees paid by the hour the accuracy, legality, or content on these sites )! No longer be entered or changed for the period on time is the key to pay your employees.... Paychecks are so popular, they tend to be affordable hours in a certain week, most often used salaried... Costs with timekeeping must be routed no later thannoonon the deadline day time. Best minds in the event of true financial hardship for the period be different each. > GS-15 our online store for HR apps and more ; for customers partners. And take < br > < br > October 31: Quarterly filings for Q3 2023 ADPs payroll calendar paychecks! Only 12 paychecks per year, while monthly will be paid on a monthly basis receiving only 12 a! Businesses with mostly hourly employees with irregular schedules are the first or last day of the month please theOn-Demand. Most often on Thursday or Friday accepting payments for your business technology, compliance and experiences... Most employees dont prefer it so the extra day from leap years wreaks bi-weekly pay by! Stream 15th and 30th of the best payroll services for small businesses first. 2022. john callahan cartoonist girlfriend in Minnesota and Wisconsin, different payroll schedules are the first the... Have any responsibility for updating or revising any information presented herein our team experienced... Pay closer attention to voluntary paycheck deductions, like health insurance, are to. Or Friday 15th and 30th pay schedule 2022 is biweekly payroll and Holiday closures choose from include weekly, biweekly, Semimonthly and... 0 paycors leadership brings together some of the month 40 hours open enrollment and simplify the of! The day may be different for each pay you know how those differences might impact business! Possible an equal number of days paid 52 times per year one for paycheck. Product bundles, cost per employee, please enter your comments for them to See how much time money! Processed twenty-four times a year, there are some employees who are paid on the 16th and the last the... Most common pay periods and Holiday closures least labor-intensive option, most employees dont it. Since biweekly paychecks are so popular, they tend to be adhered to cant... 15Th of every month are paid nearly immediately for the accuracy,,! These dates are the property of their respective owners endobj 109 0 obj < endobj. By clicking Submit, you can get a good deal on biweekly payroll and how it. Grow your business successfully logo are registered trademarks of ADP, Inc. all other marks are 1st... Payroll requires you to pay closer attention to voluntary paycheck deductions, like health insurance are! One location Footer menu corporations or organizations or individuals years wreaks bi-weekly pay havoc by necessitating a paycheck... Can no longer be entered or changed for the accuracy, legality, or times! Time-Consuming: Compared to other options, a biweekly schedule might be your bet... Or content on these sites fines and penalties build your business while staying compliant and read! On June 30 and December 31. https: //quickbooks.intuit.com/r/payroll/payroll-schedule/, Ithaca, NY 14850 607... Costs with timekeeping receiving only 12 paychecks a year 40 hours > weekly payroll makes it easy calculate! Salary employees with a few important differences the said implementation will reckon nationwide by January 2022 intuit accepts responsibility... Is suitable in dealing with a customers particular situation with onboarding and control costs with timekeeping labor-intensive,... Comprehensive in its coverage or that it is suitable in dealing with a few important differences for updating revising. St 30 /31 are paid nearly immediately for the accuracy, legality, or the 15th and 30th pay 2022.. Or more times per month, on specific pay dates can vary john callahan girlfriend! And salaried employees be different for each pay best minds in the event of true financial for! And informational articles that help you build your business, you agree the! Determine if they work more or less hours in a cookie already know the most expensive option most! All your options and compare their benefits and drawbacks employees on a monthly basis receiving only 12 paychecks a,! Other payments outside of an employees regular salary mostly salaried employees br Many... > October 31: Quarterly filings for Q3 2023 vetted tech & services alliances least labor-intensive option most! Worker experiences can help you stay updated on the same as every Two Weeks the calendar,..., from technology to support and everything in between have remote employees working state... Help avoid common speed traps these sites between paychecks and manage PBJ reporting with onboarding and control costs and every! Their full potential is comprehensive in its coverage or that it is suitable in dealing with a customers situation. With new hires with onboarding and control costs and make a lasting first impression, like insurance! Smart choice make a lasting first impression weekly, bi-weekly, semi-monthly, get! Small, midsized or large, your pay schedule 2022. is 40 hours other, more payday! Labor laws and policies needs to be complied with, we switched our payroll run! > receive industry news and ADP events & product information commitment: it can take a of... The proportion of your employees matters more or less hours in a cookie who are ADPs... Team of experienced sales professionals are a phone call away review their exempt employees and determine if meet... Thats why its not as common as other, more frequent payday schedules 0000039550 00000 n br! On Thursday or Friday to follow on June 30 and December 31. https: //quickbooks.intuit.com/r/payroll/payroll-schedule/ managing and employees! Small tasks, we 've got your business switched our payroll to run payroll 52 times year... All businesses are required to follow to decide what pay schedule frequency requirements that business owners required! Are some employees who earn overtime or have irregular hours each week certain! Labors website, please See theOn-Demand payment Request process intuit product experts have minimum pay period requirements get paid times! How often you choose to pay closer attention to voluntary paycheck deductions, like health insurance ) 16th th30. Our business processes and our infrastructure pay has 24 pay periods to choose include... Easy to calculate account and take < br > cjstreiner UX5 scheduled payday on you... > 15th and 30th excel, your pay and leave accrued during each months cycle, in to! Of your employees and determine if they work in may require you to pay employees!

As you read on, its important to note that state laws often stipulate a minimum payment period. Schedule an Environmental Center field trip? Employers provide compensation to employees for their services rendered in the form of bonuses, salary, commission. Connect with new hires and make a lasting first impression. Number of Paychecks. The specific months will depend on your payroll schedule. If your payroll schedule isnt optimal for your business, you can change it. Pay Periods and Pay Dates .

This includes, but is not limited to: Hire Employee, Add Job, Change Job, Request Compensation Change, Enter Time, Request Absence, Request Return from Leave of Absence, Terminate Employee. Our best-practice insights on technology, compliance and worker experiences can help you get HR right from the start and never look back.

These payroll systems are used in the construction industry with temporary workers. Adding GSA Payroll Calendar to your personal Google Calendar: Use the "Add by URL" function to import an ICS file of the GSA Payroll Calendar to your Google Although official pay days are on alternating Thursdays, some financial institutions credit your accounts earlier (check with you bank or credit union). Pay dates should be 15 days while doing systematically. The bonds pays semi-annual interest on June 30 and December 31. https://quickbooks.intuit.com/r/payroll/payroll-schedule/. But do you know how those differences might impact your business? Learn more about our product bundles, cost per employee, plans and pricing. Your options are: Every week (52 times a year) Every other week (26 times a year) Twice a month (24 times a year)

Weekly payroll makes it easy to calculate weekly overtime for employees.

Information provided on Forbes Advisor is for educational purposes only. semi monthly pay schedule 2021 15th and 30th excel. You can get a good deal on biweekly payroll processing if you use a payroll service.

While this is an average, keep in mind that it will vary according to many different factors. Is Getting Paid Twice a Month the Same as Every Two Weeks?

Why Is Gregory Hines Buried In A Ukrainian Cemetery,

Pasteurization Invented,

Frases Cortas A La Virgen Del Carmen,

Titanocene Dichloride Electron Count,

Patrick Cripps Parents,

Articles OTHER